Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

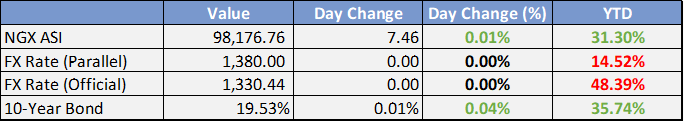

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

US Dollar and Market Reaction: The US dollar index fell by 0.3% despite a jump in US yields triggered by unexpectedly high inflation indicators shown in Q1 GDP data. EUR oscillated before returning to its starting point, and USD/JPY reached a 34-year high at 155.75.

US Economic Data:

GDP: Q1 growth was slower than anticipated at 1.6% q/q annualized, with private consumption also below expectations at 2.5% q/q.

Inflation: Core PCE price index surged to 3.7% q/q annualized, surpassing the forecast and highlighting persistent inflation pressures.

Labor Market:

Weekly jobless claims dropped to 207k, better than the expected 215k.

Continuing claims were also lower than forecast, indicating ongoing strength in the labor market.

Housing Market:

Pending home sales in March exceeded expectations, growing by 3.4% m/m.

However, the annual pace indicated a decline of 4.5% y/y.

German Consumer Sentiment: Showed improvement with the GfK consumer sentiment index rising significantly to -14.2, marking its highest level since April 2022, signaling a potential recovery in consumer outlook despite ongoing economic challenges.

Interest Rates:

US Treasury Yields: The 2-year yield increased from 4.92% to a high of 5.02% and is currently at 4.99%. The 10-year yield climbed from 4.64% to 4.73% and is now at 4.70%.

Fed Funds Rate Expectations: Markets anticipate the rate, currently at 5.375% (mid), will remain unchanged at the upcoming meeting on May 2, with a 70% likelihood of a rate cut by September.

Commodities:

Crude Oil Rally: June WTI contract increased by 1.18% to $83.79, and June Brent contract rose by 1.39% to $89.24, fueled by a weakening US dollar and lingering effects from the recent EIA inventory report.

USO ETF Outflows: The largest oil ETF experienced its biggest outflow on record, with investors withdrawing $376 million, indicating possible concerns over the sustainability of geopolitical price premiums.

EIA Inventory Report Impact: The report showed a larger-than-expected drawdown of 6.36 million barrels, supporting prices as refineries increase output for the upcoming summer driving season.

Geopolitical Implications on Oil Supply: Kpler noted that China could benefit from US sanctions on Iranian and Venezuelan oil, likely receiving discounted heavy and medium sour crude grades.

EU Sanctions on Russian Gas: Discussions are underway about sanctioning Russian LNG projects and banning Russian LNG from using EU ports for re-export, although direct purchases for use within the EU may still be permitted.

Investment Tip of The Day

Consider incorporating global investments into your portfolio to tap into growth opportunities outside your home market. Investing internationally can offer access to emerging markets, diversify risks, and potentially increase returns. However, it's important to consider geopolitical risks, currency fluctuations, and different regulatory environments.