Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

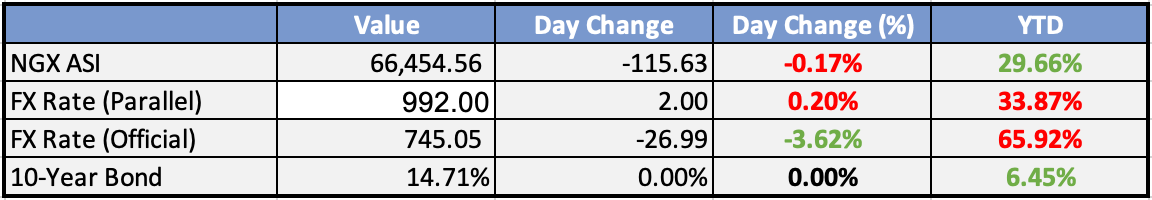

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Kerosene prices rise by 57.18% in August — NBS - Punch

In August, kerosene prices in Nigeria surged by 57.18%, reaching alarming levels as reported by the National Bureau of Statistics. This substantial increase adds to the cost of living for many Nigerians, especially those who rely on kerosene for cooking and lighting.

Capital importation falls 9% to $1.03 bn - Punch

In September 2023, Nigeria recorded a 9% decrease in capital importation, totaling $1.03 billion. This decline is attributed to a variety of factors, including global economic uncertainties and policy shifts. Despite the decrease, Nigeria remains an attractive investment destination for foreign investors.

Global

Mortgage rates hit 7.49%, highest since 2000 - WSJ

The average 30-year U.S. mortgage rate surged to 7.49%, the highest since December 2000. This rate increase is making homeownership less affordable, with high rates adding significant costs for borrowers. The 15-year fixed-rate mortgage also rose to 6.78%. The combination of elevated rates and low home inventory has contributed to keeping home prices near all-time highs.

ChatGPT owner OpenAI is exploring making its own chips - Reuters

OpenAI is exploring the development of its own artificial intelligence chips due to the scarcity and high costs of AI chips it relies on. Options include building its own AI chip, working more closely with chipmakers like Nvidia, and diversifying suppliers. CEO Sam Altman has prioritized acquiring more AI chips to tackle these challenges.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities showed mixed performance on Friday. The Hang Seng outperformed with strong gains in property and tech stocks, while mainland China remained closed. The Nikkei logged mild losses, and the ASX and South Korea recorded moderate gains. Taiwan was higher, while Southeast Asia displayed mixed results. India’s trading session ended on a positive note.

The Reserve Bank of India (RBI) left its interest rate unchanged at 6.5% and its Cash Reserve Ratio at 4.5%. RBI Governor Shaktikanta Das emphasized that the monetary policy focus remains on aligning inflation with the 4% target.

Important data was released from Japan, including real wages and household consumption, which are closely monitored by the Bank of Japan (BoJ) for potential monetary policy revisions. Nominal average wages rose by 1.1% YoY in August, falling short of the consensus of 1.5% and remaining unchanged from the revised 1.1% in the previous month. Real wages continued to decline, falling by 2.5%, a minor change from the revised 2.7% decline in July, marking the 17th consecutive month of negative growth.

August household spending in Japan fell by 2.5% YoY, surpassing expectations of a 3.9% decline and improving from the prior month’s 5.0% drop.

Several US banks, including Citigroup and JPMorgan, raised their China GDP growth projections to 5% for this year. This upward revision follows a series of downgrades and is based on recent stronger economic data.

Europe, Middle East, Africa:

European equity markets displayed firmer performance, with financials leading the gains across the board, including banks, financial services, and insurers. However, the food & beverage sector faced pressure, with the downside attributed to changing food consumption patterns due to the use of anti-obesity drugs like Wegovy, as flagged by Walmart in the US earlier in the week.

Banque de France chief Villeroy, a moderate dove on the ECB Governing Council, expressed the view that good inflation figures and a sharp rise in long-term borrowing costs suggest no need for further rate hikes at present.

In Germany, factory orders rebounded in August by 3.9% MoM, surpassing consensus expectations for a 1.8% increase after a prior drop of -11.3%. This positive outcome was driven by a strong increase in incoming orders in data processing equipment, electronic and optical products (+37.9% compared to the previous month). There were also increases in orders in the manufacture of electrical equipment (+8.7%) and in the pharmaceutical industry (+4.0%).

UK Halifax house price data indicated a 0.4% MoM decline in August, which was better than the consensus expectation of a 0.8% drop. The prior month’s 1.8% fall was revised up from the initially reported 1.9%. On a YoY basis, prices were down 4.7%, better than the consensus of a 5.0% drop, and the prior month’s 4.5% decline was revised up from 4.6%. Official mortgage rates from the UK were expected to be released, with rates having been steadily rising and the last reading at 7.93%.

The Americas:

Tesla reduced the price of some Model 3 and Model Y versions in the U.S. following third-quarter deliveries that missed market expectations. The starting price for the Model 3 was listed at $38,990 on Tesla’s website, down from $40,240 previously.

TSMC (Taiwan Semiconductor Manufacturing Company) reported a revenue decline of 11%, which was less than projected. This drop in revenue was partly offset by increased demand for AI chips, compensating for sagging sales in smartphone and laptop chips.

The SEC (U.S. Securities and Exchange Commission) is looking to compel Elon Musk to testify in its probe of his Twitter stock purchases.

The Week Ahead:

Monday: US ISM Manufacturing PMI rose to 49 in September of 2023 from 47.6 in the previous month

Tuesday:

Wednesday:

US private payrolls up 89,000 in September

US ISM Services PMI is at a current level of 54.50, up from 52.70 last month

Thursday:

US Unemployment Claims totaled a seasonally adjusted 207,000 for the week ended Sept. 30, below the estimate for 210,000.

Friday:

US nonfarm payrolls increased by 336K in September 2023, well above an upwardly revised 227K in August

Unemployment Rate

Investment Tip of The Day

Manage Sequencing Risk: Sequencing risk refers to the risk of experiencing poor investment returns early in retirement. Consider strategies like the bucket approach, which segments your portfolio into different time horizons to mitigate this risk.