Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Manufactured exports decline by 40% – NBS– Punch

The National Bureau of Statistics’ Foreign Trade Statistics report, released on Monday, indicates a significant 40 per cent decrease in the value of traded manufactured goods in Q1 2023, which declined from N219bn in the corresponding quarter of the previous year to N131.1bn.Naira Falls 1.02% After Closing Steady For 7 Days At Official Market - Leadership

Nigeria’s currency yesterday depreciated by 1.02 per cent (N4.83/$1) at the Investors and Exporters (I&E) forex window, Nigeria’s official foreign exchange (FX) market. After trading on Thursday the dollar was quoted at N469.50 compared to N464.67 quoted since May 31, 2023, I&E window, data from the FMDQ indicated.

Israel to Partner Nigeria on Job Creation through Digital Economy – This Day

The Ambassador of Israel to Nigeria, Michael Freeman has disclosed the readiness of his country to partner with Nigeria towards realisation of the policy on creation of one million jobs through digital economy.

Net Forex inflows rises 22% to $5.15bn in 2 months - Vanguard

The net foreign exchange inflows through the economy rose year-on-year (YoY) by 22 percent to $5.15 billion in the first two months of 2023 (2m’23) from $4.22 billion in the corresponding period of 2022. Data from the Central Bank of Nigeria, CBN, Monthly Economic Report for February 2023 show aggregate forex inflow rose YoY by 1.7 percent to $10.94 billion in 2m’23 from $10.75 billion in 2m’22.

Global economy to slow in 2023, Nigeria’s growth expected at 2.8% – World Bank

The World Bank has recently disclosed its projections for Nigeria’s economic growth, estimating it at 2.8% in 2023 with a slight revision since January and a marginal increase to 3.0% in 2024.The World Bank warns of obstacles such as foreign exchange restrictions, high living costs, security challenges, and limited fiscal space, which are expected to hinder Nigeria’s growth momentum.

Global

A rally in technology stocks resumed Thursday, pushing the S&P 500’s gains since an October low past 20%, the marker of a bull market - Bloomberg

A jump in jobless claims to the highest since October 2021 delivered a boost to the tech sector, which had been flagging under speculation the Federal Reserve will keep interest rates higher for longer

Donald Trump has been indicted by a federal grand jury for his handling of classified documents.

Until yesterday, no former president had ever faced charges brought by the federal government.

Among the seven counts Trump is charged with are violations of the Espionage Act, obstruction of justice, and false statements.

He has been summoned to appear in a federal court in Miami, FL on Tuesday.

While a criminal conviction would disqualify Trump from running for president (again), it would presumably present a major obstacle in his route (back) to the White House.

US household net worth rose by more than $3 trillion in the first quarter.

This was the largest increase since Q4 2021.

The rise was due largely to an increase in the value of equity holdings, which rose ~$2.4 trillion over the period.

Those gains more than offset a ~$617 billion drop in real estate values.

Consumer credit, meanwhile, rose at the slowest pace in 2 years, rising by an annualized 4.3%.

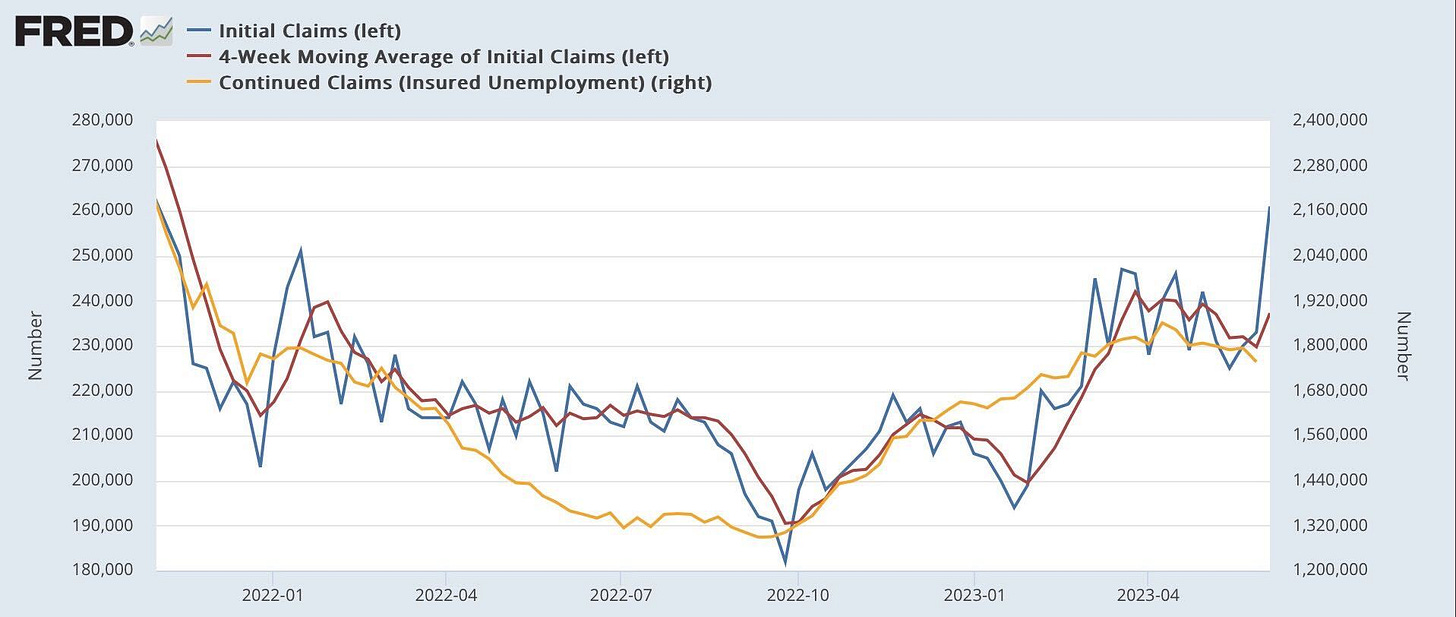

Applications for unemployment benefits surged by the most in nearly 2 years last week, rising to the highest level since October 2021.

Initial claims jumped to 261,000, well above the 235,000 consensus forecast.

One data point does not a trend make, but the new figure broke out of the clear downtrend in place since mid-March.

While the weekly data is very volatile, it suggests strength in the labor market may be waning.

Investors of both the retail and institutional variety are getting more bullish on stocks.

Individual investor sentiment—as measured by the AAII bull-bear spread—reached its highest level since November 2021 as bulls outnumbered bears for the first time in 4 months.

Active portfolio managers, meanwhile, piled into stocks last week at the fastest pace since April 2021.

According to the NAAIM Exposure Index (chart), active manager exposure to equities is at its highest since November 2021.

Market breadth also looks to be improving: the S&P 500 equal weight ETF $RSP is on track for its biggest inflow ever this week

Oil prices fell yesterday after news of talks between the US and Iran regarding a temporary nuclear deal.

The alleged deal would involve Iran reducing its uranium enrichment activities in exchange for some relief from sanctions that would allow it to export more crude.

It would also grant Tehran access to its income and frozen funds abroad.

However, prices partially recovered after both countries denied the reports

Weekly Investment Watchlist

Market Commentary

Asia and Australia

International investors are reducing positions in China's State-Owned Enterprises (SOEs) due to disappointing losses. The Hang Seng China Central SOE's Index lost 9.9% from May 8 to the end of the month.

Japan's Q1 Ministry of Finance (MOF) corporate survey shows capital spending growing 11.0% year-on-year (y/y), indicating a positive influence on future GDP revisions.

South Korea's manufacturing output continues to decline, but a slowed pace suggests the worst of the slowdown might be over.

May PMIs reveal contraction in North Asia while South Asia expands, with conditions notably deteriorating in Taiwan and slightly improving in South Korea?

RBA rate hike probabilities firm up due to data exceeding expectations, with futures now indicating a 100% chance of a rate increase by August.

India's Q4 y/y GDP growth accelerates to 6.1%, bolstered by government and private spending, and manufacturing.

Japan's Nikkei 225 outperforms major global benchmarks in May, primarily driven by semiconductors and related stocks.

China's factory gate prices decline at the fastest pace in seven years, allowing for potential rate cuts to stimulate the economy.

Europe, Middle East, and Africa

Paribas BNP predicts market liquidity decline impacting risk assets while driving bond yields and the US dollar higher.

The majority of economists in a Reuters poll expect the ECB to conclude its rate hiking cycle at 3.75%.

The British Chamber of Commerce (BCC) upgrades its UK growth forecast but warns of low activity throughout the year.

Analysts offer differing outlooks for EUR/USD after a significant recovery since May 13th, reflecting a general decline in the US dollar rather than unique Euro strength.

The Americas

Binance is increasingly being isolated from the US banking system as regulatory scrutiny heats up

Expectations for Fed tightening increase as unexpected rate hikes by RBA and BOC suggest a potentially longer tightening cycle, but the Fed is still not expected to hike next week.

The US economy is defying pessimistic predictions, allowing the Fed more room to execute a soft landing.

US senators propose bipartisan Artificial Intelligence (AI) bills to address growing concerns surrounding the technology.

Blinken may visit Beijing soon, while Biden and UK PM Sunak announce an "Atlantic declaration" to fortify economic ties between their countries.

The Week Ahead:

Monday: US May ISM Services index comes in at 50.3; est 51.8.

Tuesday: IBD/TIPP economic optimism, API crude oil stock change

Wednesday: US trade deficit, EIA stocks change, consumer credit change

Thursday: Initial jobless claims, wholesale inventories

Friday: WASDE report

Investment Tip of The Day

Stay disciplined during market volatility. Market volatility can be unsettling, but it's essential to stay disciplined and avoid making impulsive decisions. Stick to your long-term investment plan and avoid knee-jerk reactions based on short-term market fluctuations.