Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

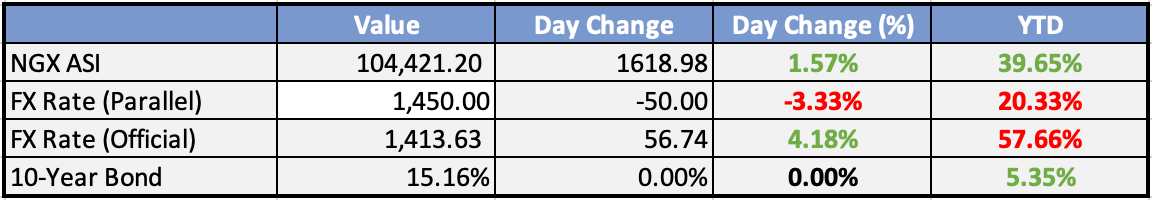

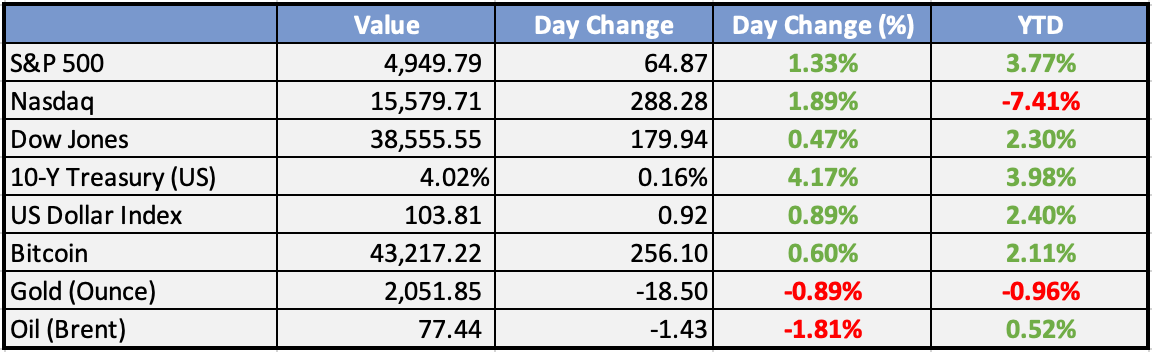

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

FG, NICA to develop consumer credit framework - Punch

The Federal Government is working with the National Institute of Credit Administration to develop a framework for consumer credit in Nigeria.

Airtel Africa plans $100 million share buyback as FX crises weigh on results - The Guardian

Airtel Africa has revealed plans to launch a share buyback worth up to $100 million after posting a strong underlying performance in the results for nine months ending December 31, 2023.

Naira rebounds as banks offload excess dollars - Punch

Ahead of the midnight February 1, 2024 deadline given by the Central Bank of Nigeria to commercial banks to sell all excess foreign exchange holdings, Deposit Money Banks on Thursday made frantic efforts to offload their surplus dollar stocks.

Burkina Faso, Mali, Niger May Close Airspace against Nigerian Flights, Aviation Stakeholders Warn - This Day

Following the official resignation of Burkina Faso, Mali and Niger from the Economic Community of West African States (ECOWAS), after alleging marginalisation from Nigeria’s President who is the Chairman of ECOWAS Bloc, stakeholders in the aviation industry have warned that the three countries may close their airspace against flights emanating from Nigeria.

CBN sets $1m as capital requirement for International Money Transfer Operators - Business Day

This significant development was outlined in the revised guidelines for the operation of IMTOs, which were officially released on January 31, 2024.x

Global

Intel Delays $20 Billion Ohio Project, Citing Slow Chip Market - WSJ

Intel delays Ohio chip factory construction due to market challenges and slow federal funding, pushing completion from 2025 to late 2026. Stock price dips 1.5%. This follows Intel's revenue forecast miss due to uncertain demand in traditional chip markets, as rivals focus on AI and data servers.

Market Commentary:

Asia and Australia:

Indian shares rose on Friday amid signs of a cooling U.S. economy, impacting bond yields and raising expectations of potential Federal Reserve rate cuts.

Economists expect the U.S. central bank to lower rates eventually, despite the current hawkish tone.

CME Group's FedWatch Tool shows a 37.5% chance of a March rate cut and nearly 100% likelihood of lower rates by early May.

Investors reacted positively to India's Modi government's interim budget, which outlined plans to narrow the fiscal deficit in fiscal 2025.

S&P BSE Sensex rose 0.61% to 72,085.63, anticipating the U.S. jobs report, expected to show slower job growth. NSE Nifty settled 0.72% higher at 21,853.80.

NTPC, Adani Ports, ONGC, and Power Grid Corp rallied 3-5%, while Hindustan Unilever, HDFC Bank, HDFC Life, Axis Bank, and Eicher Motors fell 1-2%.

Oil marketing companies surged as crude prices headed for their biggest weekly loss since early November.

BPCL jumped 9.6%, IOC surged 9%, and HPCL climbed 5.1%.

Paytm shares hit the 20% lower circuit limit for a second day after RBI imposed restrictions on its subsidiary Paytm Payments Bank.

Europe, Middle East, and Africa:

European stocks saw modest gains after the Bank of England signaled a likely reduction in borrowing costs in 2020.

France's industrial production growth more than doubled in December, rising 1.1% on a monthly basis.

The pan-European STOXX 600 rose 0.5% to 486.34. The German DAX climbed 0.8%, France's CAC 40, and the U.K.'s FTSE were up around 0.5%.

Electrolux slumped 4.5% after its net loss tripled in 2023, while Husqvarna rallied 2.4% after a smaller-than-expected Q4 loss.

Vinci SA gained about 1%, with its unit Nuvia securing a six-year contract from Vattenfall to dismantle units 1 and 2 of the Ringhals nuclear power plant.

Adidas shares were up 1.4%, intending to sell the remaining stock of Yeezy sneakers from its discontinued collaboration with Kanye West.

Wizz Air Holdings shares soared more than 8%, reporting higher passenger numbers for January compared to the same period last year.

The Americas:

Stocks moved mostly higher, with the Nasdaq up 1.1% at 15,530.66, and the S&P 500 reaching a new record intraday high at 4,936.08.

The Dow, however, was down 0.1% at 38,475.65, with declines by Walgreens, Intel, and Home Depot.

The Nasdaq rallied due to positive earnings from Meta Platforms (META) and Amazon (AMZN), with Meta spiking by 20.8%, and Amazon surging by 7.3%.

The Labor Department reported stronger-than-expected job growth in January, with non-farm payroll employment spiking by 353,000 jobs.

The unemployment rate in January remained unchanged at 3.7%, reducing the chances of an interest rate cut in March.

Larry Tentarelli, Chief Technical Strategist, Blue Chip Daily Trend Report, views a strong jobs market as a "net positive for both the economy and the stock market.

The Week Ahead:

Monday:

Tuesday:

US CB Consumer Confidence rose in January to 114.8

US JOLTS Job Openings surged by 101,000 from the previous month to 9.026 million

Wednesday:

US ADP Non-Farm Employment Change increased by 107,000 jobs in January

Employment Cost Index q/q increased 0.9 percent

US Federal Funds Rate remain steady at 5.25%-5.50%

Thursday:

US initial jobless claims up by 9,000 to 224,000

US ISM Manufacturing PMI rises to 49.1% in January

US job cuts up at 82,307 in January

Friday:

US Average Hourly Earnings m/m rose to 0.6%

US nonfarm payrolls up by 353,000 in January

US Unemployment Rate remained at 3.7 percent

US Revised UoM Consumer Sentiment came in at 79.0 vs 78.8 preliminary

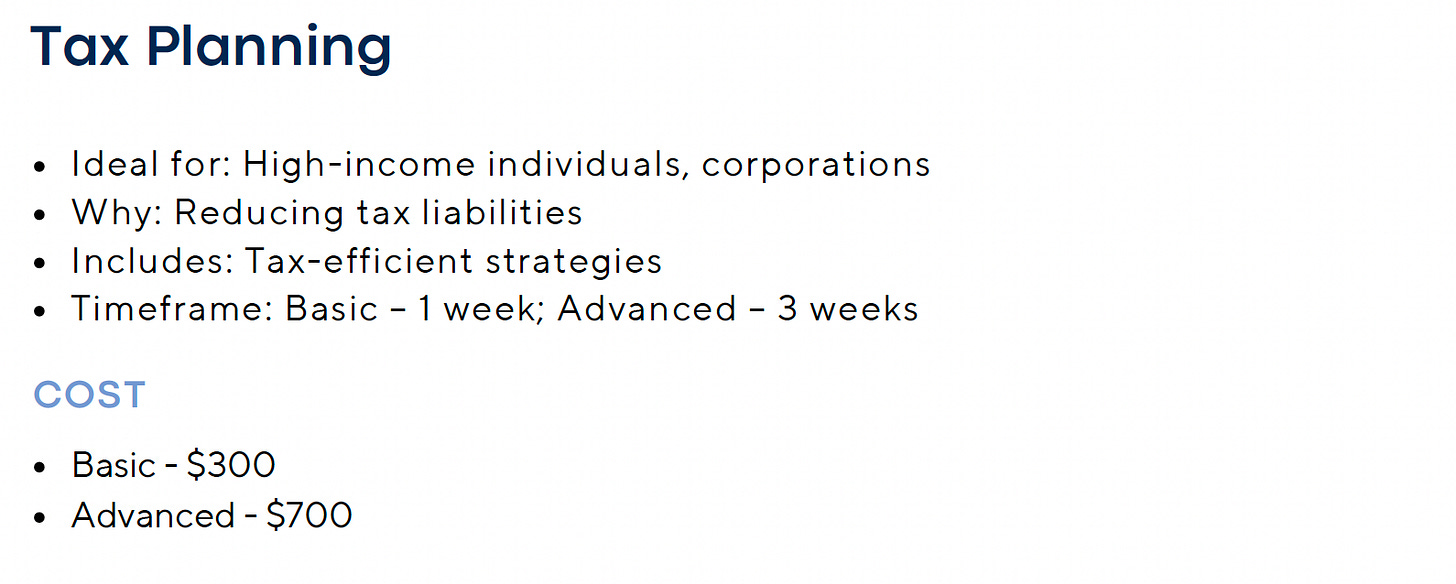

Investment Tip of The Day

Stay Informed About Corporate Tax Planning: Changes in corporate tax laws can impact company earnings. Stay informed about corporate tax planning and its potential effects on your investments.