Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

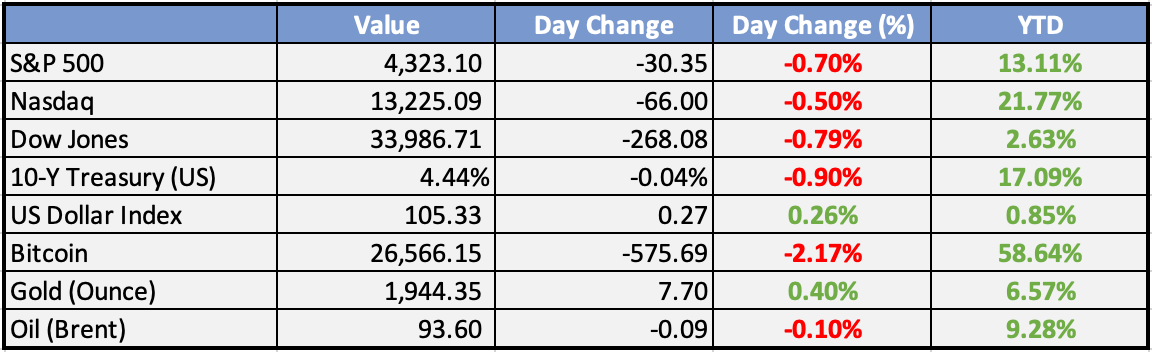

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

234 crude theft incidents were recorded in one week – NNPCL - Naira Metrics

In one week, NNPC Logistics and Supply Co., a subsidiary of the Nigerian National Petroleum Corporation (NNPC), recorded 234 incidents of crude oil theft. These thefts pose significant challenges to the country's oil industry and revenue generation.

CBN Postpones MPC Meeting Indefinitely - Leadership

The Central Bank of Nigeria (CBN) has indefinitely postponed its Monetary Policy Committee (MPC) meeting. The MPC meeting, which was scheduled for September 25 and 26, 2023, has been postponed due to unforeseen circumstances.

NNPC Limited joins UN’s global compact programme - The Sun

NNPC Limited, the Nigerian National Petroleum Corporation's upstream subsidiary, has joined the United Nations Global Compact initiative. This move aligns with NNPC's commitment to sustainability and responsible business practices, focusing on areas such as human rights, labor, environment, and anti-corruption.

Global

Shutdown looms as US House Republicans again block own spending bill - Reuters

House Speaker Kevin McCarthy's attempt to advance defense spending failed as Republicans for a third time blocked a procedural vote on the $886 billion defense appropriations bill, raising the risk of a government shutdown. The House of Representatives voted 216-212 against beginning debate on the bill, with some conservative Republicans joining Democrats to oppose it.

India Suspends Visas, Canada Pulls Diplomats Amid Tensions - Bloomberg

The Indian visa processing centre in Canada suspended services due to a growing rift between the two countries following Canadian Prime Minister Justin Trudeau's statement that India may have been involved in the killing of a Canadian Sikh leader.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities showed mixed results on Friday. Japan’s Nikkei and Topix both ended lower but rebounded from intraday lows following the Bank of Japan (BOJ) meeting. Greater China stocks rebounded and outperformed the region, while South Korea saw declines and Taiwan experienced gains. The Australian ASX index closed relatively flat.

In Japan, inflation remained broadly steady, with service prices consolidating at 2% for the first time in three decades. Core CPI rose 3.1% year-on-year in August, slightly surpassing the consensus estimate of 3.0% and matching the previous month’s 3.1%.

Japan’s Flash manufacturing PMI for September was 48.6, down from 49.6 in the previous month. This marks the fourth consecutive month of contraction and the weakest level in seven months.

Qualcomm is reducing its workforce in China and Taiwan, signaling a longer-than-expected industry downturn and a slow recovery.

In China, yields on shorter-term Chinese government bonds are rising despite two recent LPR (Loan Prime Rate) cuts this year. Tightening capital supply is undermining the easing efforts of the People’s Bank of China (PBOC). While long-term yields have fallen, yields on five-year and shorter maturities have risen, causing a flattening of the yield curve.

Europe, Middle East, Africa:

European equity markets mostly experienced declines. The Basic Resources and Oil & Gas sectors outperformed, boosted by higher commodity prices and rising hopes of additional stimulus measures from China.

Despite the policy statement leaving the door open to further tightening if necessary, the probability of a November Bank of England (BoE) rate hike is perceived to be less than 50% by the markets.

UK retail sales remained subdued in August, with a 0.4% increase compared to the consensus estimate of 0.5% and a 1.1% drop in the previous month. Food sales and clothing had strong months, but internet sales declined, and fuel sales dropped due to increased prices affecting demand.

UK GfK consumer confidence reached a 20-month high in September at -21, compared to the previous reading of -25. This was the strongest level since January 2022, just before Russia’s invasion of Ukraine.

The Americas:

Flow dynamics are in focus as the higher-for-longer theme exerts upward pressure on rates and weighs on risk sentiment. A recent report from Bank of America noted that global equity funds saw outflows of $16.9 billion in the week ending September 20, the most significant outflows since December 2022. US equity funds also experienced outflows of $17.9 billion, the most significant outflows since last December.

Morgan Stanley indicated that absent a rebound in the spot market, CTA (Commodity Trading Advisor) models are likely to turn sellers over the next few days. Nomura recently estimated that a drop below 4,409 on the S&P 500 would trigger selling by CTAs, with an estimated $12.3 billion worth of equity futures to be sold in aggregate.

The United Auto Workers (UAW) targeted work stoppages against major Detroit automakers are expected to expand today due to few signs of progress in wage and benefit negotiations.

The Week Ahead:

Monday:

Tuesday:

Harmonized Index of Consumer Prices (MoM) (EA)

Wednesday:

PBoC Interest Rate Decision (CN)

UK Consumer Price Index YoY is at 6.80%, compared to 7.90% last month and 10.10% last year.

The Federal Reserve kept the target range for the federal funds rate at a 22-year high of 5.25%-5.5%

Thursday:

Initial Jobless Claims (US)

US Existing Home Sales MoM is at -2.16%, compared to -3.26% last month and -4.87% last year.

Friday:

The GfK Consumer Confidence indicator in the United Kingdom rose to -21 in September 2023 from -25 in August

UK Retail Sales MoM is at -1.20%, compared to 0.60% last month and 0.40% last year.

The HCOB Eurozone Composite PMI rose to 47.1 in September 2023, a marginal increase from August's 34-month low

The S&P Global US Services PMI fell to 50.2 in September 2023 from 50.5 in August

Investment Tip of The Day

Conduct Stress Testing: Simulate how your portfolio might perform under different economic scenarios. Stress testing helps you identify vulnerabilities and adjust your investments to better withstand adverse conditions.