Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

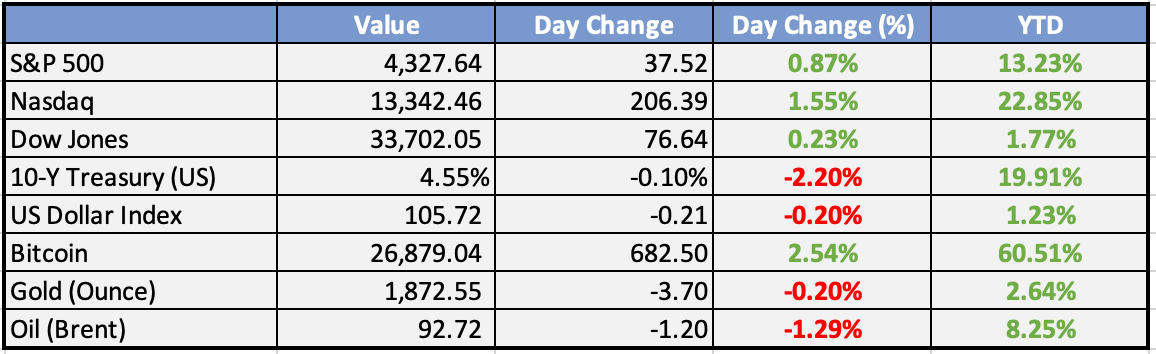

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

CBN will spend $3bn loan to stabilise economy – NEC - Punch

The National Economic Council on Thursday affirmed that the $3bn emergency loan-for-crude oil the Federal Government secured in August would be deployed to stabilise the naira, whose value has continued to fluctuate in the Investors & Exporters’ window and worsened in the parallel market, hitting N1000/$ earlier this month.

Telcos plan different tariffs for calls, data in states - Punch

Nigerians may soon be paying different prices in different states for calls, data, SMS, and other telecommunication services, telecommunication firms have said. According to the telcos, this measure is to mitigate against multiple taxation and business environments across different states.

FG targets wealthy Nigerians in new tax drive - Punch

The move — part of President Bola Tinubu’s reforms to overhaul the beleaguered economy – aims to lift the country’s tax take to 18 per cent of Gross Domestic Product within three years from 11 per cent now, according to a Bloomberg report.

AfDB unveils climate funding guidelines for Nigeria, others - Punch

This was revealed in a statement by the development bank on Thursday. The reports were launched ahead of the 28th United Nations Conference on Climate Change.

Global

US consumer spending rises in August; underlying inflation slows - Reuters

U.S. consumer spending increased in August, but underlying inflation moderated, with the year-on-year rise in prices excluding food and energy slowing to below 4.0%.

European markets higher as euro zone inflation falls; Commerzbank up 12% - CNBC

European investors analyzed this month's euro zone inflation, which fell to its lowest level since October 2021.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities closed higher on Friday, with the Hang Seng in Hong Kong outperforming due to a rally in tech stocks. The Nikkei remained flat, while the ASX (Australian Stock Exchange) logged slight gains. Many mainland Chinese and other Asian markets were offline for the Golden Week holiday.

Tokyo’s core CPI (Consumer Price Index) rose by 2.5% year-on-year in September, slightly below the consensus of 2.6%. This follows a 2.5% increase in the previous month. Excluding fresh food and energy, inflation also softened to 3.8% from 4.0%.

Japan’s industrial production remained unchanged in August, defying expectations of a 0.8% decline. This followed a 1.8% drop in the previous month.

Japanese Government Bonds (JGBs) are experiencing their worst quarterly sell-off since 1998, losing approximately 3% during this quarter.

Over the weekend, official NBS Chinese PMI (Purchasing Managers’ Index) data and the Caixin PMI data were released, both of which are important data points to monitor.

Europe, Middle East, Africa:

European equity markets closed higher, following firmer levels in Asia.

The final UK GDP (Gross Domestic Product) growth rate for the quarter came in at 0.2% quarter-on-quarter, in line with consensus. Year-on-year GDP growth stood at 0.6%, surpassing the consensus of 0.4%.

German retail sales in August missed expectations with a 1.2% month-on-month decline, compared to the consensus for a 0.5% expansion. This followed a previous reading of 0%, which was revised up from the initially reported 0.8% drop.

UK business confidence dipped lower in September, with the UK Lloyds business barometer falling by five points to 36% after reaching an 18-month high of 41% in August.

The Americas:

The final GDP growth data for Q2 remained unchanged at an annualized rate of +2.1%. However, consumption growth was notably adjusted downward to +0.8%, both falling short of expectations. The report was largely positive and led to a more robust multi-year GDP trend and an enhanced multi-year and recent trend for gross domestic income.

Initial jobless claims for the week ending September 23 came in at 204,000, beating the consensus of 215,000. Last week’s figures were revised up by 1,000 to 202,000. Continuing claims for the week ending September 16 were 1.67 million, below the consensus of 1.675 million, with last week’s data revised to 1.658 million from 1.662 million.

A new law in New York City mandates that Uber, Grubhub, and Doordash must pay delivery drivers a minimum of $18 per hour.

The UAW (United Auto Workers) is now targeting a 30% wage increase, down from its initial demand of 40%.

With a government shutdown looming, GOP hardliners are attempting to remove Kevin McCarthy from the speakership as early as next week.

The Week Ahead:

Monday:

Tuesday:

US CB Consumer Confidence declines to 103.00 in September

Wednesday:

Thursday:

Final GDP q/q (US) 2.1%

Unemployment Claims (US) 204,000

Friday:

Core PCE Price Index m/m (US) 0.1%

Revised UoM Consumer Sentiment (US) 68.1

Investment Tip of The Day

Monitor Currency Exposure: If you invest in international assets, keep an eye on currency exchange rates. Fluctuations in exchange rates can impact the value of your investments. Consider currency-hedged options if you want to minimize this risk.