Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

CBN has not devalued naira - Business News Report

Central Bank of Nigeria has said categorically that the nation’s currency, the Naira, has not been devalued. In reaction to some media report that the currency has been devalued to N630 to one dollar the apex bank Ag. Director Corporate communication Dr. Isah AbdulMumin in a statement urged the public to disregard the news report in its entirety

No Going Back On Fuel Subsidy Removal, NNPCL Declares - Leadership

Despite the widespread outcry trailing the removal of fuel subsidy in the country, the Nigerian National Petroleum Company Limited, (NNPCL) has insisted there will not be a reversal of the policy as there is no cash back-up to offset the subsidy payment for the month of June.

Telcos issue banks disconnection notice - Punch

Telecommunication firms have issued Deposit Money Banks disconnection notice amid a disagreement over Unstructured Supplementary Service Data service debt running to over N120bn. According to telcos, banks owe them N120bn for using their USSD infrastructure for financial services.

Operators kick as maritime workers shut port Monday - Punch

The Maritime Workers Union of Nigeria has threatened to embark on an industrial action on Monday over the poor welfare of its members in the shipping sector. The development has forced some operators in the maritime sector to kick, saying the proposed shutdown would affect their business operations.

Global

The debt ceiling bill made has made it through the US Senate.

In uncharacteristically quick and bipartisan deliberations, members voted to pass the deal in a 63-36 vote.

The bill now heads to President Biden’s desk where his signature will close the curtain on this latest episode of the Washington political circus.

Next week, however, will feature a spin-off side show brought to us by the House Freedom Caucus (ultra-conservatives) which will meet to discuss next steps, including the possible ousting of House Speaker McCarthy.

We got updated labor market data yesterday ahead of this morning’s all-important employment report—here’s the rundown:

Private businesses in the US created 278,000 jobs in March, well above estimates of 180,000.

Wage growth slowed, but remains strong at +6.5% YoY (previous 6.7%).

Initial jobless claims for last week totaled 232,000 which was up from the previous week but slightly below market expectations.

US employers announced just over 80,000 job cuts in May, a 20% increase over the prior month and 287% higher than the same month a year ago.

The ISM Manufacturing PMI fell to 46.9 in May from 47.1 in April.

This was slightly below market expectations of 47 and marked the 7th straight month of contraction for the sector.

Beneath the headline number were some positive signs: employment increased to its highest since August while prices paid dropped sharply into contraction, falling to 44.2 from last month’s 53.2.

On the other hand, new orders—which are a leading indicator of future activity—sank to their lowest in 4 months.

Buzz over AI has sparked a flurry of buying over the past weeks, particularly in tech stocks–here’s a look at the flows data:

Tech funds saw a record $8.5 billion inflow for the week ending May 31.

About $13.3 billion flowed into US equity funds.

Global equity funds saw inflows of $14.8 billion.

Bond fund inflows totaled $1.1 billion.

Cash funds saw their 6th straight week of inflows at $11.2 billion for the week.

A $31.7 billion inflow pushed money market funds to a new record high of $5.42 trillion

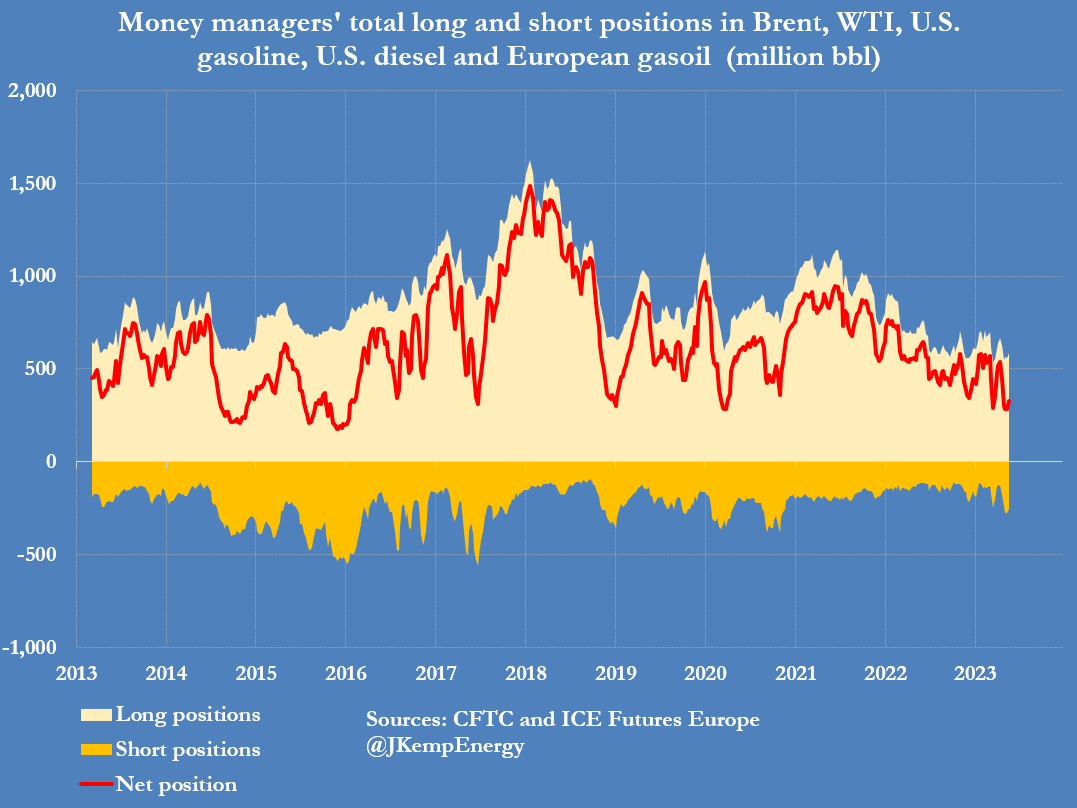

As the OPEC+ meeting draws closer, experts are not expecting the group to cut production levels.

What they are expecting, however, is the potential for cuts in the second half of the year should prices remain below $80 per barrel.

In the meantime, money managers are continuing to bet on lower prices.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

South Korea consumer prices rose 3.3% y/y in May versus April's 3.7%, slowing for fourth straight month.

Australian minimum wage to rise by 5.75%, economists revise up RBA peak rate forecasts.

China Evergrande Unit Misses Payments on Wealth Management Products.

China is considering a new range of stimulus packages to bolster their real estate sector.

Japan equity inflows reinforce renewed foreign interest; TSE data showed foreigners were net buyers for a ninth straight week.

Europe, Middle East, Africa

All eyes are on the OPEC+ meeting due to take place on Sunday in Vienna.

Attention is on French debt sustainability with S&P to provide a ratings update on France after the close. The rating agency is due to issue its credit rating on Friday evening, a month after a first warning from its competitor Fitch. A further downgrading for France would cast doubt on the government's ability to reform in a tense social climate.

Automakers have been pushing for a delay in post-Brexit trade rules, which could result in new levies from next year.

UK pension lifeboat fund will cut exposure to equities by one-third due to high inflation

The Americas

Fed’s Harker says official should at least skip June hike

Debt ceiling deal eliminates possibility of Biden campaign promises like tax increases on the wealthy and corporations

ISM report suggests companies may be "hoarding" workers in anticipation of a 2H pickup

Companies may be correcting overpaying wages in recent years with reductions in force

The Week Ahead:

Monday: Fed talk - Bullard, Barkin, Bostic, Daly

Tuesday: US Manufacturing PMI comes in at 48.5; est: 50.2, US new homes sales come in at 683k; est: 663k.

Wednesday: FOMC minutes

Thursday: ADP monthly employment change comes in at 278k; est 170k, US initial jobless claims come in at 232k; est 235k, Payrolls rose 339,000 in May, beating expectations of 180,000.

Friday: Core PCE, personal income & spending, durable goods orders, Michigan consumer sentiment

Investment Tip of The Day

Seek professional advice when needed. Consider consulting with a qualified financial advisor or investment professional when making complex investment decisions. Their expertise can provide valuable guidance tailored to your specific needs.