Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

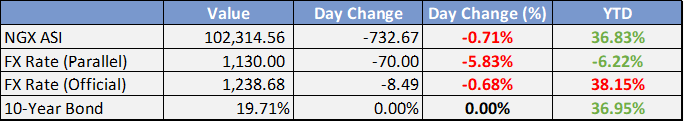

Local

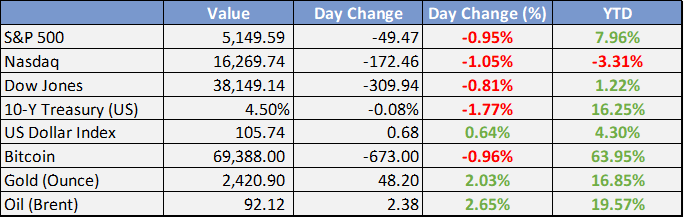

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

The US dollar index remained steady on the day, earlier hitting a five-month peak. The EUR oscillated between 1.0699 and 1.0757 as signals from the ECB suggested a likely rate cut in June. The USD/JPY fluctuated between 152.76 and 153.32, reaching a 34-year high.

The ECB maintained its rates (deposit rate at 4.00%, main refinancing rate at 4.50%), indicating an easing bias but remained non-committal. Their statement suggested that rates will stay high as necessary and only decrease if confidence in achieving inflation targets strengthens.

In the US, the Producer Price Index (PPI) for March was slightly lower than expected at 0.2% month-on-month, with the annual rate at 2.1%. The core measure, excluding food and energy, matched expectations at 0.3% month-on-month and 2.4% year-on-year. Jobless claims data indicated strong labor market conditions, with initial claims at 211k and continuing claims at 1.817m.

FOMC member Williams remarked on the substantial progress towards balancing inflation and employment goals, suggesting no immediate rate cuts. Collins noted the recent data does not urgently change the economic outlook but highlighted the need for patience, suggesting fewer rate cuts this year than previously anticipated.

Interest Rates:

The US 2-year Treasury yield oscillated between 4.92% and 5.00%, settling at 4.94%, while the 10-year yield moved between 4.51% and 4.59%, ending at 4.57%. Markets currently anticipate the Fed funds rate, set at 5.375% (mid), to remain unchanged at the upcoming meeting on May 2, with a 60% probability of a rate cut by July.

In credit indices, Itraxx Europe expanded slightly by 1.3 bps to 56.4 bps, with Santander and Generali showing strong performance, whereas Lufthansa and Volkswagen were underperformers. The CDX IG index slightly tightened by 0.3 bps to 52.8 bps; notable performers included Paramount Global and Freeport, while D.R. Horton and General Motors lagged. Cash bonds across the board tightened by 1.6 bps to 118.6, with utilities and industrials leading the gains, and financial sectors, both senior and subordinated, performing the poorest.

Commodities:

Crude markets remained static as traders balanced concerns between a significant rise in U.S. crude inventories and the potential for drone or missile attacks by Iran or its proxies on Israel. The May WTI contract fell by 1.38% to $85.02, and the June Brent contract decreased by 0.29% to $90.22. Factors such as overbought conditions, a strengthening U.S. dollar, and the diminished likelihood of rate cuts following unexpectedly strong CPI data have tempered market optimism. Nonetheless, forecasts by Rystad suggest a tight supply-demand balance this summer, potentially driving oil prices to $100.

However, Macquarie expressed skepticism about sustaining Brent above $90 into the second half of 2024 without actual supply disruptions caused by geopolitical events. OPEC's monthly report highlighted a "robust oil demand" expected in the summer, projecting global oil demand growth of 2.2mbpd year-over-year in Q2 and 2.7mbpd in Q3, emphasizing the need for "careful market monitoring" amid ongoing uncertainties to ensure a stable market balance. In the gas sector, Russian attacks on Ukraine's underground gas storage facilities have driven up gas prices in Europe, with the May TTF contract surging by 8%. Despite the attacks, Naftogaz Ukrainy reported that the facilities continued to operate.

Investment Tip of The Day

Stay up-to-date with regulatory changes that might affect your investments. Changes in laws, regulations, or tax policies can significantly impact your investment strategy and financial planning. By staying informed and possibly consulting with a financial advisor, you can adjust your strategy in a timely manner to comply with new rules and take advantage of potential benefits.