Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

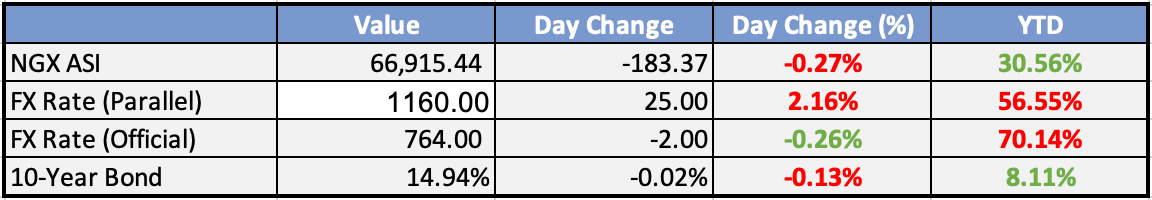

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Nigeria, Chinese firms sign $2bn MoUs, Lekki Deep Blue Seaport contract - Daily Trust

The National Agency for Science and Engineering Infrastructure (NASENI) and three Chinese partners have signed a Memoranda of Understanding (MoU) for new projects valued at $2 billion.

FG partner European Union on development projects worth over €900mn - Businessday

The federal government of Nigeria on Thursday signed a financial agreement with the European Union on development projects worth over €900million. The agreement is in furtherance of the EU- Nigeria corporation to drive the nation’s digital inclusion, green economy and global gateway.

AfDB, AGF approve $1.2bn loan for women-led businesses - Punch

The African Guarantee Fund in collaboration with the African Development Bank Group has approved $1.2bn loan to empower women-led enterprises across Africa.

Global

Home Sales Slide to Lowest Pace Since 2010 as High Rates Squeeze Market - Wall Street Journal

Sales of previously owned homes declined 2% in September from the prior month, as high mortgage rates squeeze the market.

Israel levels Gaza district, hits Orthodox church as invasion looms - Reuters

Israel levelled a northern Gaza district on Friday after giving families a half-hour warning to escape, and hit an Orthodox Christian church where others had been sheltering, as it made clear that a command to invade Gaza was expected soon.

Bitcoin hits two-month high above $30,000 in volatile week - Reuters

Bitcoin jumped on Friday above $30,000 for first time since July , taking gains for the week past 10%, against a backdrop of volatile trading across cryptocurrencies.

Harvard’s $51 Billion Fund Beats Yale in Hard Year for Endowments - Bloomberg

Harvard University’s endowment earned an investment return of 2.9% during the latest fiscal year, beating rival Yale University and most other Ivy League peers but lagging far behind plain old US stocks.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia

Asian equities ended significantly lower on Thursday, with the MSCI Asia ex-Japan index down 1.5%. Hang Seng experienced steep declines, and mainland China benchmarks also fell across the board.

Bank of Korea maintained its benchmark 7D repo rate at 3.5% and announced it would maintain a restrictive policy stance for a considerable time.

Indonesia's central bank (BI) surprised markets by raising its 7D reverse repo rate by 25 bps to 6.0%, aiming to stabilize the sinking rupiah currency.

China's new house prices fell 0.2% m/m in September, extending declines for the third consecutive month.

Australia's job growth slowed in September, with headline employment rising by 6.7K m/m, below the consensus of 20K.

Japan's trade data showed mixed results, with export volumes turning positive, rising 4.3% y/y in September, above the consensus of 3.1%.

Europe, the Middle East, and Africa

European equity markets experienced a decline, with healthcare, auto stocks, real estate, and energy leading the losses.

The Americas

Tesla's Q3 revenue missed expectations by 3%, with automotive GM metrics at 16.3%, down from 18.1% in the prior quarter.

Netflix's Q3 revenue was largely in line with expectations, while EPS beat estimates by approximately 5.5%. The company reported 8.8M net additions, exceeding the consensus of 5.5 M. Netflix guided for Q4 net additions similar to Q3, which would put them above the consensus of 7.7M.

The Week Ahead:

Monday:

Empire State manufacturing index dropped -6.5 points to -4.6 in October

Tuesday:

US retail sales up 0.7% in September

Wednesday:

UK Consumer Price Index YoY is at 6.70%

Thursday:

Unemployment Claims (US) 198,000

Friday:

Retail Sales m/m (UK) -0.9%

Investment Tip of The Day

Understand investment fees and charges. Take the time to understand the fees and charges associated with your investments. Compare different investment options and choose those that offer competitive fees without compromising on quality and performance.