Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

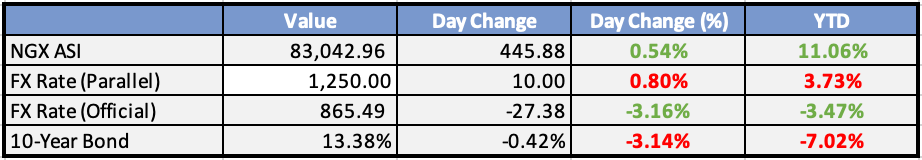

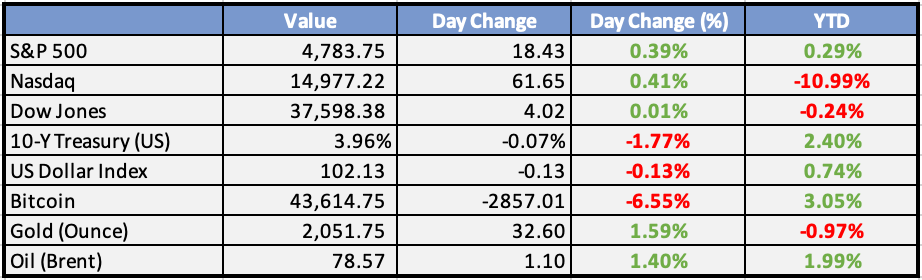

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

International Breweries plans rights - Punch

The Board of Directors of International Breweries Plc is set to consider a Rights Issue as well as an increase in its share capital. According to a corporate update filed with the Nigerian Exchange Limited, the directors of the brewer will meet on Friday for an emergency board meeting to consider the proposals.

Ghana hopes to agree official creditor debt relief terms by Friday – Bloomberg News - BusinessNewsReport

Ghana hopes to finish by Friday reviewing a draft term sheet on debt relief from its official creditors to restructure $5.4 billion of debt, Bloomberg News reported on Thursday

Trapped $700m: Foreign airlines threatening to exit Nigeria soon, AFARN warns - TheSun

The Association of Foreign Airlines and Representatives in Nigeria (AFARN), raised the alarm yesterday, even as it described the $61 million released as “a drop in the ocean,” which will not resolve the pending issues.

Global

Citi to cut 20,000 jobs through 2026, swings to $1.8 billion loss - Reuters

Jan 12 - Citigroup will cut 20,000 jobs over the next two years, the bank said on Friday, after reporting a $1.8 billion quarterly loss driven by a string of one-off charges.Shares of the bank - which has rolled out a multi-year effort to cut bureaucracy, increase profits and boost a stock that has lagged peers - fell more than 1%.

US producer prices unexpectedly fall; goods deflation seen persisting - Reuters

WASHINGTON, Jan 12 (Reuters) - U.S. producer prices unexpectedly fell in December amid declining costs for goods such as diesel fuel and food, suggesting inflation would continue to subside and allow the Federal Reserve to start cutting interest rates this year.

Morning Bid: Crude shrugs at Yemen strikes, banks report - Reuters

Much like the slightly peculiar debt market nonchalance after December's sticky inflation readout, world markets have remained calm and oil steady after U.S. and UK air strikes in Yemen aimed at protecting Red Sea shipping routes.

Market Commentary:

Asia and Australia

Indian shares surged, driven by a rally in IT stocks with positive reports from Infosys and TCS. The S&P BSE Sensex hit a record high, despite concerns about oil prices and reduced expectations for a Fed rate cut in March.

Asian stocks mostly ended lower due to strong U.S. inflation data and escalating tensions in the Red Sea region, causing a more than 2 percent jump in crude prices after Iran's navy captured an oil tanker.

Asian stock markets mostly traded higher, responding to mixed cues from Wall Street and strength in the Japanese market. Asian markets had ended mostly higher on the preceding Thursday.

Europe, the Middle East, and Africa:

European stocks closed higher on Friday due to robust UK economic growth data and dovish comments from ECB President Christine Lagarde, indicating potential rate cuts once inflation aligns with the 2% goal.

Switzerland's market weakened, in line with broader European markets, as higher-than-expected U.S. consumer price inflation data tempered expectations for an early rate cut.

The Americas:

Major averages are down but off their worst levels, with the Dow at 37,564.29 (-0.4%), Nasdaq at 14,918.70 (-0.3%), and S&P 500 at 4,767.05 (-0.3%).

Core consumer prices, excluding food and energy, rose 0.3% in December, aligning with both November and economist estimates.

Software stocks led, propelling the Dow Jones U.S. Software Index up 1.6% to a record closing high.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Thursday:

US Core CPI m/m increased to 0.3%

US Unemployment Claims came in at 202,000, a decrease of 1,000 from the previous week's revised level.

Friday:

UK GDP m/m increased to 0.3%

US Core PPI m/m stayed at 0.0%

Investment Tip of The Day

The Association of Foreign Airlines and Representatives in Nigeria (AFARN), raised the alarm yesterday, even as it described the $61 million released as “a drop in the ocean,” which will not resolve the pending issues.