Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

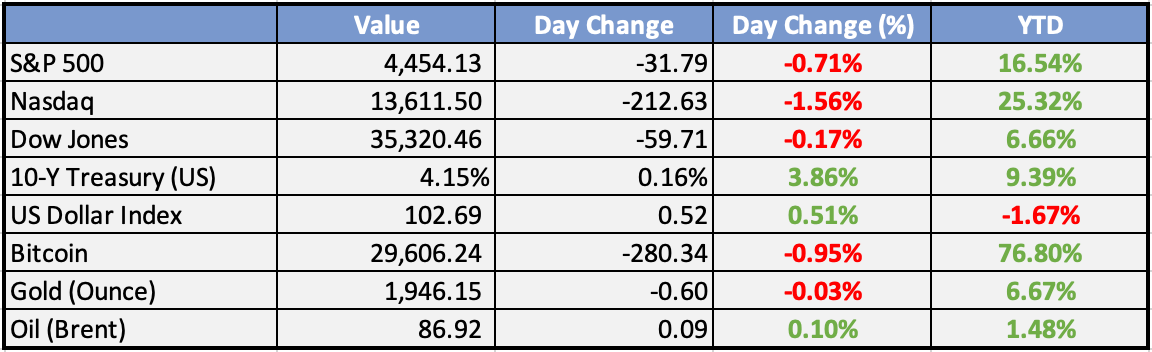

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

NGX partners CSCS, Euroclear on dollar settlement platform - Punch

Nigerian Exchange Limited collaborates with Central Securities Clearing System and Euroclear to establish dollar settlement platform for tech startups' capital raising. Aim is to address challenges of public markets and offer domestic investors access to shares, boosting capital formation and economic growth.Nigeria’s oil production declines 13.6% to 1.08mbpd - Vanguard

In July 2023, Nigeria's oil production plunged by 13.6% to 1.08 million barrels per day compared to June, below both its government target and OPEC quota. Blended and unblended condensate oil contributed 38,258 and 174,509 barrels respectively to a total average daily production of 1.29 million barrels, down 12.8% from June.

Fuel price may go up, say marketers - Punch

The weakening naira against the US dollar and the recent surge in global oil prices are causing concerns about potential petrol price increases in Nigeria. Despite no official announcements, factors like foreign exchange scarcity and oil price fluctuations influence petrol prices.

Global

Tech investors face ‘new era’ of China restrictions after Biden order limits funding in AI chips - CNBC

The Biden administration's order curtails US investments in Chinese tech, driven by concerns over national security and China's progress. This, alongside geopolitical tensions, prompts US tech investors to withdraw from China. The ban, focused on technologies such as semiconductors and AI, is expected next year, causing potential complications for existing investments.

Weekly Investment Watchlist

Market Commentary

Asia and Australia:

Asian equities ended Friday mostly lower, with Australia closing the day down, Seoul reversing early gains to trade lower, and Taiex also experiencing losses.

China’s July M2 money supply growth was +10.7% compared to the expected +11.0% YoY.

China’s property stocks, particularly in the Hang Seng Mainland Properties Index, continued to face pressure, declining more than 10% for the week and approaching its lowest level since November 2022. Moody’s downgraded Country Garden (2007-HK) to Caa1 from B1, reflecting elevated refinancing risks.

China announced that it will allow provinces to raise about CNY1 trillion ($139 billion) through bond sales to repay local government financing vehicle (LGFV) debt and other off-balance sheet issuers. This is a positive step toward alleviating the debt burden of local governments under significant pressure.

RBA Governor Lowe did not rule out further tightening, indicating that future decisions would depend on data.

The threat of a strike at Australian LNG facilities continued to keep Natural Gas prices elevated.

Europe, Middle East, Africa:

European equity markets traded lower, near their worst levels, following the second strong positive close in a row on Thursday.

UBS voluntarily terminated the 9 billion franc ($10.3 billion) Loss Protection Agreement with the Swiss government after stress-testing a portfolio of Credit Suisse’s non-core assets. This suggests that estimated losses from Credit Suisse might be better than previously perceived.

France’s labor market showed signs of cooling, with the unemployment rate for Q2 rising to 7.2% compared to the expected 7.1%. Mainland unemployment was also higher than expected at 6.9% versus an expected 6.8%.

Economists saw scope for an ECB pause in September, citing President Lagarde’s admission that the bank currently doesn’t have more ground to cover and Europe’s economic challenges, particularly in Germany.

The Americas:

US jobless claims rose to a 5-week high, reaching 248,000 for the week ending August 5, up from 227,000 the previous week. Despite the increase, the rise wasn’t enough to raise significant concern.

President Biden expressed concerns that China’s problems could be a “ticking time bomb” for the world.

Investors worried about potential Beijing retaliation in response to Biden’s move to restrict some US technology investments in China.

The Fed was seen as likely to stay on hold after CPI data, although some policymakers were concerned that pausing too soon could risk a reacceleration of inflation.

The White House submitted a request to Congress for an additional $24 billion to fund the Ukraine war.

The IEA flagged the risk of higher oil prices and cut its 2024 demand view by 150,000 barrels per day.

Bank of America suggested that PayPal’s stablecoin is unlikely to see significant adoption in the near term.

The Week Ahead:

Monday:

Tuesday:

US consumer credit report rose: +$17.84b; est +$13.55b.

US July jobs report non-farm payrolls expanded 187k, unemployment is 3.5%; est: 3.6%.

Wednesday:

Consumer Price Index CPI in China increased to 102.90 points in July from 102.70 points in June of 2023.

Thursday:

The US Consumer Price Index rose 3.2% year-on-year in July 2023, beating expectations but slowing from June.

The US budget deficit widened to USD 221 billion in July 2023, below market expectations but still more than double the deficit a year earlier.

Friday:

Gross Domestic Product (US)

the Consumer Price Index (CPI) in France increased by 0.1% over one month, after +0.2% in June

core producer inflation in the US remained unchanged at 2.4%, aligning with June and maintaining the lowest point since January 2021.

Michigan US consumer sentiment was revised down to 71.6 from the initial reading of 72.6.

Investment Tip of The Day

Stay updated on advancements in healthcare and biotechnology, as breakthroughs in medical research can create investment opportunities in innovative therapies and treatments.