Finance Friday- CBN FX Injection, Trade Surplus, and Dangote Petrol Cuts Drive Nigerian Market Dynamics; Global Inflation and Central Bank Policies in Focus

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing. Expect insights on Nigeria’s FX interventions, trade surplus, and sectoral performance, alongside global developments in inflation, commodities, and central bank actions. This edition highlights key drivers likely to shape investor sentiment and market liquidity in the near term.

Nigerian News & Market Update

CBN Injects $150million to Boost Nigerian FX Market Liquidity:

CBN injected $150m into the FX market this week, but the naira continued to weaken toward ₦1,500/$ amid persistent dollar shortages and ineffective interventions. - Dmarketforces

SDF Placements Reduce as Banks Rotate Funds into OMO Bills:

Banks cut the Standing Deposit Facility (SDF) placements as they shift massive liquidity into high-yield Open Market Operstions (OMO) bills, driving strong system liquidity and easing short-term funding costs. - Dmarketforces

Nigeria’s exports outpace imports as trade surplus hits ₦6.69trillion:

Nigeria posted a ₦6.69trillion trade surplus in Q3 2025 as FX reforms boosted exports and dampened imports despite sectoral mixed performances. - Punch

Relief as Dangote cuts petrol to ₦699/litre:

Dangote Refinery slashed petrol’s ex-depot price to ₦699/litre, intensifying pressure on importers and reshaping Nigeria’s downstream market while offering consumers major relief. - Businessday

Nigeria’s crude oil output rises to 1.436mbdp:

Nigeria’s crude oil output in November rose slightly to 1.436mbpd but still fell short of its OPEC quota for the fourth consecutive month. - DailyTrust

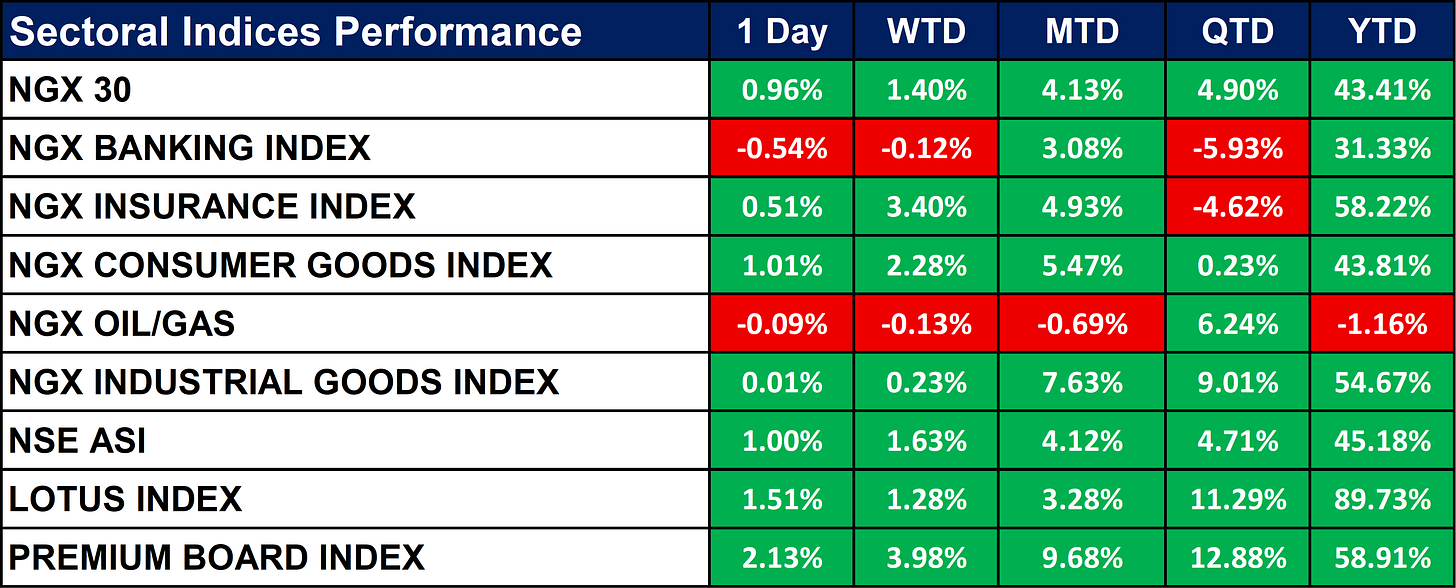

Nigeria Sectoral Indices Performance

The table below shows that Most NGX sector indices closed positive, with strong 1-day gains led by the Premium Board Index (+2.13%) and LOTUS Index (+1.51%). Month-to-date and year-to-date performance remain broadly robust, especially for Industrial Goods (+7.63% MTD) and LOTUS Index (+89.73% YTD). The only weak spots are the Banking and Oil/Gas indices, which posted slight declines across several time frames.

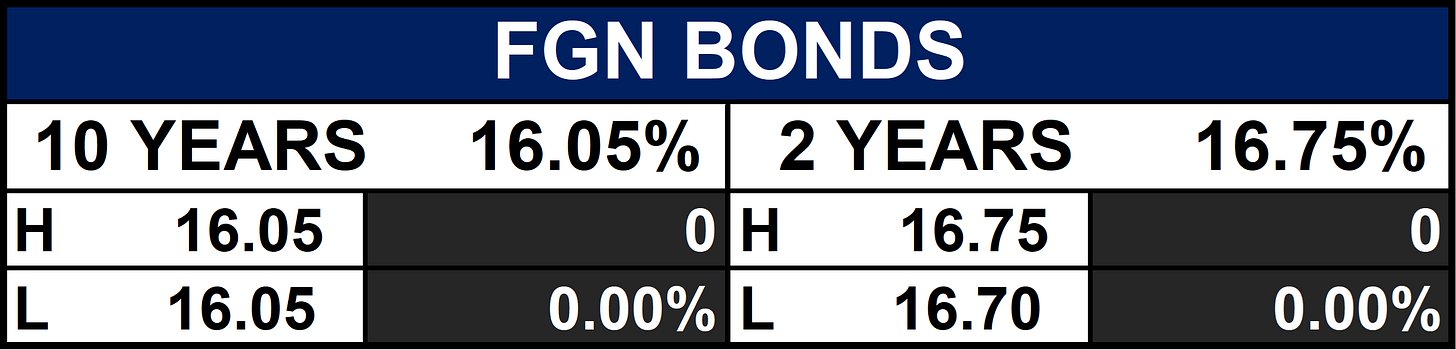

Fixed Income (FGN Bonds)

Global News & Market Update

German inflation confirmed at 2.6% in November:

German inflation edged up to 2.6% in November, confirming earlier estimates and marking a rise from October’s 2.3%. - Reuters

India’s inflation rises from record low:

India’s inflation edged up to 0.71% in November but stayed below the RBI’s target band, giving room for another possible rate cut in February. - Reuters

China to regulate steel exports with a licence system:

China will introduce a licensing system for steel exports from 2026 to curb record outbound shipments and ease rising global protectionist pressure. - Reuters

Pakistan central bank likely to hold rate at 11% as IMF flags inflation risks:

Pakistan’s central bank is expected to hold rates at 11% as the IMF urges a tight, data-driven stance and analysts delay rate-cut forecasts to late FY26 or FY27 amid renewed inflation and external pressures. - Reuters

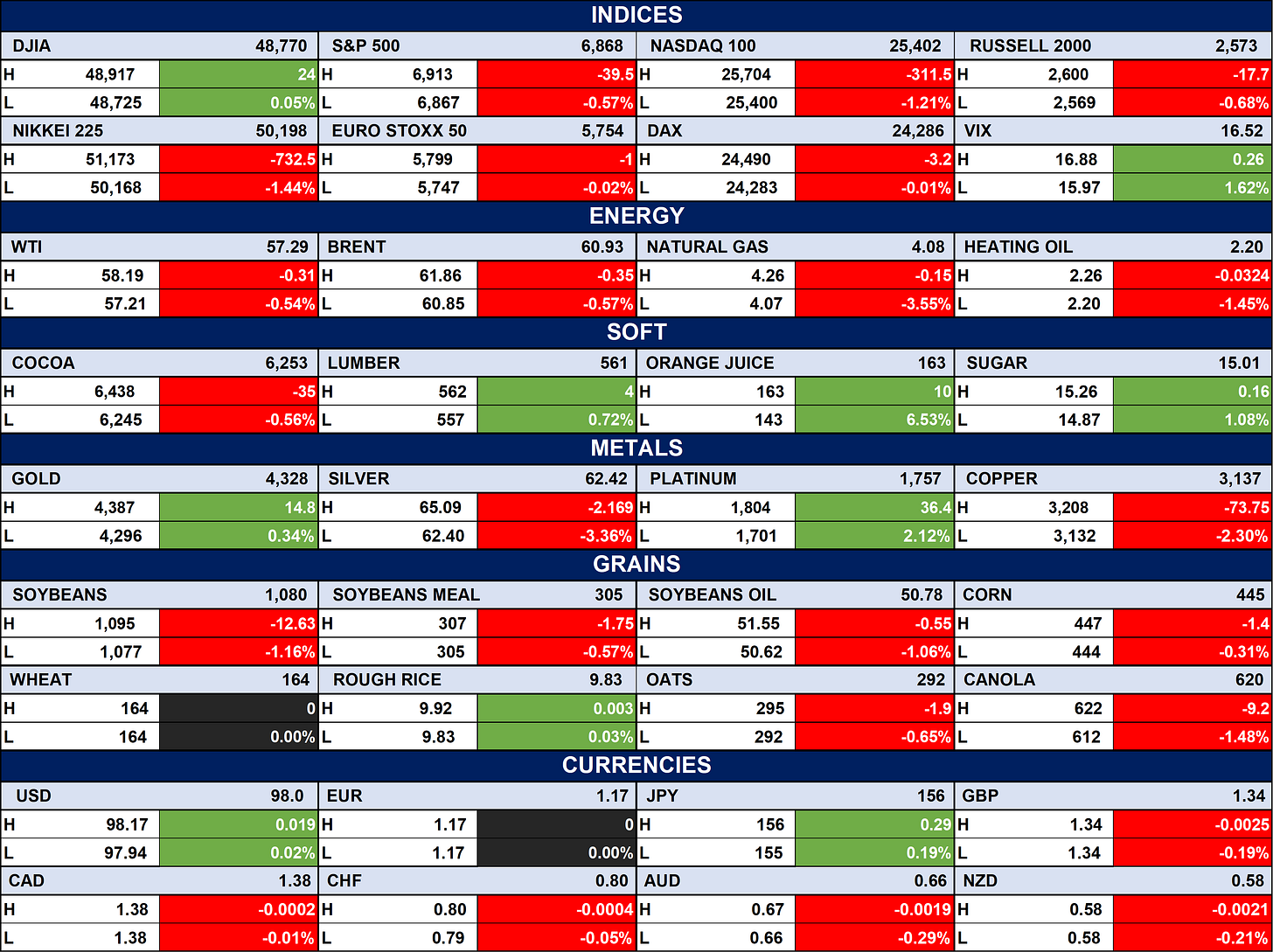

Indices, Commodities & Currencies

The table below shows that the Global equity indices were mixed, with the DJIA edging up while the S&P 500, Nasdaq 100, and Nikkei 225 posted declines. Commodity markets showed broad weakness: energy (WTI, Brent, NatGas) and most softs and grains fell, though orange juice, sugar and lumber saw notable gains. Metals were also mixed, with gold and platinum up slightly, while silver and copper declined; major currencies traded mostly flat with slight strengthening in USD and JPY.

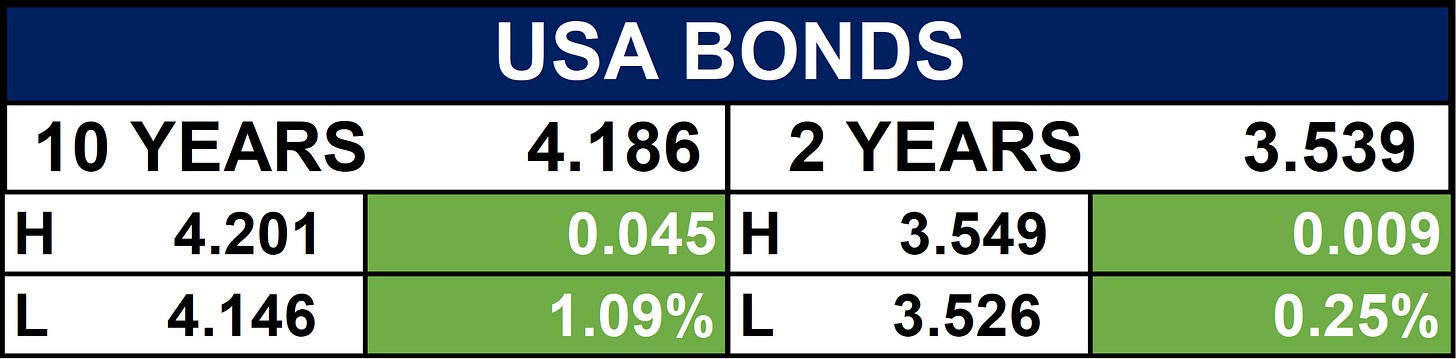

Fixed Income (USA Bonds)

Event

Conclusion

Investors should monitor continued naira pressure and liquidity shifts toward high-yield OMO bills, as well as sectoral winners in industrials and LOTUS-listed stocks. Globally, inflation trends in Germany and India, China’s steel export controls, and cautious central bank policies may influence market flows and risk sentiment in the coming weeks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.