Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

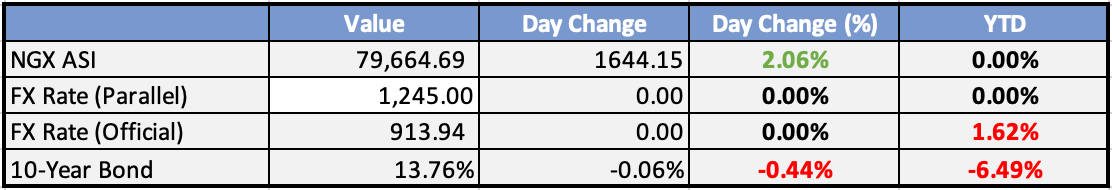

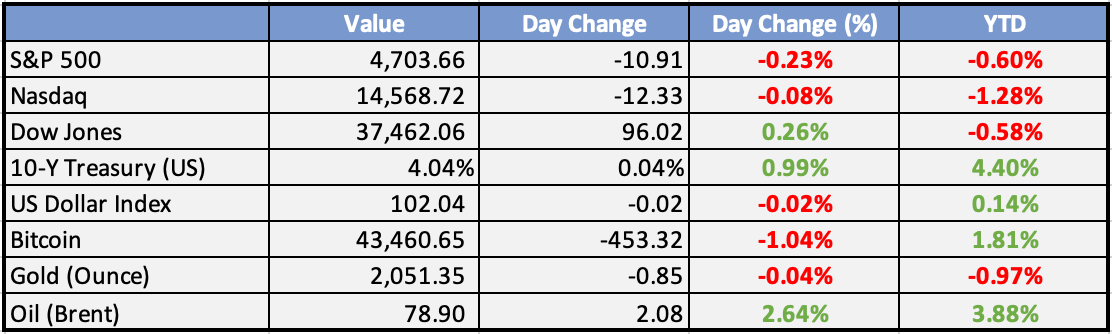

Market Data

Local

Global

x*Data as of 4pm WAT

Market News

Local

Malabu Oil Deal: FG Drops Charge against Adoke, Others after Their ‘No-Case Submissions’ - ThisDay

The federal government has said it would not be challenging the no-case submissions made by a former Attorney-General of the Federation (AGF) and Minister of Justice, Mohammed Bello Adoke and five others in their alleged complicity in the Malabu Oil and Gas deal.

NAICOM targets N1 trillion GPI benchmark for sector in Q1 - TheGuardian

There are indications that the National Insurance Commission (NAICOM) may consider the first quarter of this year to meet the N1 trillion Gross Premium Income (GPI) benchmark in the industry.

NGX, PenCom to Deepen PFAs’ Equity Participation with Pension Broad Index - ThisDay

Nigerian Exchange Limited (NGX), the National Pension Commission (PenCom) have assured that the NGX Pension Broad Index (NGXPENBRD) will deepen Pension Fund Administrators (PFAs) participation in the equities market.

EFCC raids Dangote Head Office over $3.4bn forex allocation - BusinessNewsReport

Operatives of the EFCC are said to be at Dangote Head Office conducting a search operation over the unofficial allocation of $3.6 billion by Emefiele lead CBN at the head office of the Dangote Group as the anti corruption agency widens investigations into the foreign exchange transactions during the tenure of former governor of the Central Bank of Nigeria.

Nigeria, China to build new steel plant, Ajaokuta Steel to build military hardwares—Minister - BusinessNewsReport

Minister of Steel Development, Prince Shuaibu Audu, Thursday, disclosed that Nigeria and China to build new steel company in Nigeria. This is contained in a statement signed by Head, Press and Public Relations Department, Salamatu Jibaniya.

Ghana official creditors to meet Monday to discuss debt restructuring terms - BusinessNewsReport

Ghana’s official creditors are scheduled to meet on Monday to discuss restructuring some $5.4 billion in loans to the country, three sources told Reuters, a key step needed to secure its next tranche of funding from the International Monetary Fund.

Global

Investors kick off 2024 with $123 bln record cash shift -BofA - Reuters

Investors went back to cash in record numbers for the first week of 2024, marking a shift from 2023's record inflows to stocks and bonds. While equities saw some inflows, energy stocks suffered outflows and the market awaits the Fed's next move on interest rates. Overall, sentiment remains neutral despite reaching a near-term high.

Oil prices rise on Middle East tensions - Reuters

Oil prices climbed despite US stockpiles after Israel-Hamas tensions and Red Sea disruptions raised supply concerns. Blinken's Middle East trip seeks to calm the conflict, while mixed economic data keeps rate cut timing uncertain. Oil bulls are watching US jobs data for future demand clues.

Market Commentary:

Asia and Australia

Asian stocks mostly ended lower in muted trading on Friday.

Chinese and Hong Kong markets led regional losses on persistent concerns over the economic recovery.

China's Shanghai Composite Index fell 0.9% to 2,929.18.

Hong Kong's Hang Seng Index settled 0.7% lower at 16,535.33, following the downgrade of four Chinese bad-debt managers by Fitch Ratings.

Japanese shares saw modest gains as the yen weakened on doubts over early interest rate cuts by the Federal Reserve.

The Nikkei 225 Index rose 0.3% to 33,377.42, with automakers and financials leading the gains.

The broader Topix Index gained 0.6% to close at 2,393.54.

Toyota Motor advanced 2.5%, and Mitsubishi UFJ Financial Group added 2.7%.

Europe, the Middle East, and Africa:

European stocks fell on Friday, facing their first weekly loss in eight.

Investors awaited euro area consumer and producer inflation reports and U.S. non-farm payrolls data for clues on potential interest rate cuts by the European Central Bank and the Federal Reserve.

U.K. stocks traded lower amid uncertainty about the Federal Reserve's rate path.

U.K. house prices increased for the third successive month in December, reflecting a shortage of properties. However, a survey by Halifax and S&P Global indicates an expected slump in prices this year.

The Americas:

The dollar experienced a broad upswing ahead of key U.S. payrolls data.

Oil edged up due to supply issues in Libya and lingering Middle East tensions.

U.S. stocks ended mostly lower overnight, with the tech-heavy Nasdaq Composite slipping 0.6% and the S&P 500 easing 0.3%.

The 10-year Treasury yield edged closer to 4% as strong labor market data raised uncertainty about potential rate cuts.

Private sector added more jobs than anticipated in December, while weekly jobless claims fell more than expected, hitting a two-month low.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

US Job openings nudged lower in November, down to 1.4 per available worker

US Manufacturing PMI increased to 47.4 last month

Thursday:

ADP: US private payrolls up by 164,000 in December

US job cuts at 34,817 in December

Friday:

US average hourly earnings up 0.4%, generating a YoY increase of 4.1%

US nonfarm payrolls up by 216,000 in December

US The unemployment rate held steady at 3.7%

US factory orders up by 2.6% in November

Investment Tip of The Day

Evaluate Supply Chain Resilience: Companies with resilient and diversified supply chains are better positioned to navigate disruptions. Assess how well companies in your portfolio manage supply chain risks.