Finance Friday- Corporate Actions Lift Nigerian Equities While Global Markets Navigate Energy Tightness and Policy Uncertainty

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing, where Nigeria’s equities reflect strong corporate confidence through capital raises, ratings upgrades, and strategic exits. Key domestic highlights include banking sector recapitalisation progress, renewed investor interest in power and gas infrastructure, and fresh public offers supporting expansion. Globally, markets are balancing tighter oil supply, shifting trade policies, and expectations of delayed rate cuts in the U.S. amid mixed growth signals.

Nigerian News & Market Update

Stanbic Insurance gets A, A1 ratings from Agusto:

Stanbic IBTC Insurance received A (long-term) and A1 (short-term) ratings from Agusto & Co., reflecting strong financial resilience, sound governance, and solid capacity to meet policyholder obligations. - Punch

UBA surpasses ₦500billion capital milestone via rights issue:

UBA has crossed the ₦500billion regulatory capital threshold after successfully completing a ₦157.8billion oversubscribed rights issue, fully meeting the CBN’s new minimum capital requirement for international banks. - Punch

Otedola Sells Geregu Power after 1,041.50% Gain in 3 Years:

Femi Otedola has exited Geregu Power Plc after a 1,041% rise in its share price since listing, selling his controlling stake via a block deal that transfers majority ownership to MA’AM Energy Limited. - Dmarketforces

Champion Breweries Begins ₦42billlion Public Offer:

Champion Breweries Plc has launched a ₦42billion public offer at ₦16 per share to fund the acquisition of the Bullet brand portfolio and support pan-African expansion following strong earnings growth. - Leadership

BlueCore acquires Axxela, signals confidence in Nigeria’s gas infrastructure:

BlueCore Gas InfraCo has acquired Axxela from foreign investors, marking a shift to local institutional ownership and reinforcing confidence in Nigeria’s midstream gas infrastructure. - Businessday

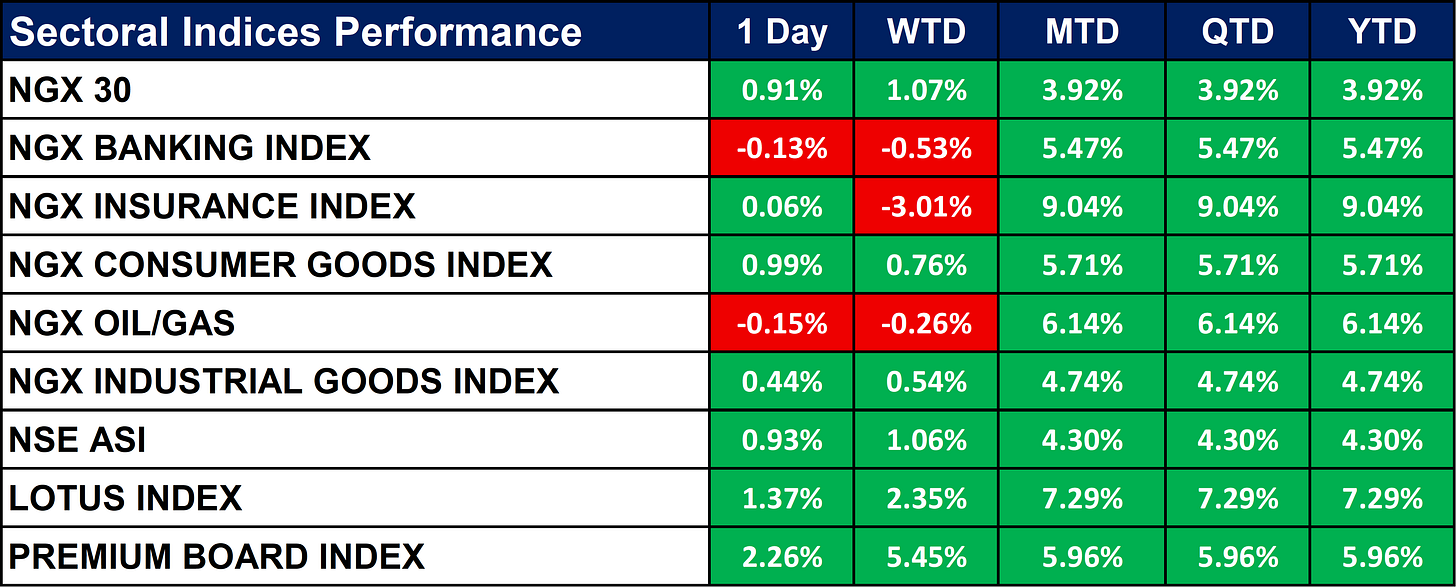

Nigeria Sectoral Indices Performance

The table below shows that the NGX closed broadly positive as NGX 30, Consumer Goods, Industrial Goods and the NSE ASI all posted solid 1-day gains, led by the Premium Board Index. Banking and Oil/Gas indices dipped slightly on the day and week-to-date, while Insurance lagged WTD despite strong month-to-date performance. Overall momentum remains bullish, with all sectors showing strong MTD, QTD and YTD gains, led by Insurance, Oil/Gas and the Premium Board.

Global News & Market Update

OPEC oil output falls in December on Iran and Venezuela:

OPEC’s oil output fell in December as U.S. sanctions cut supply from Iran and Venezuela, offsetting planned production increases by OPEC+ members. - Reuters

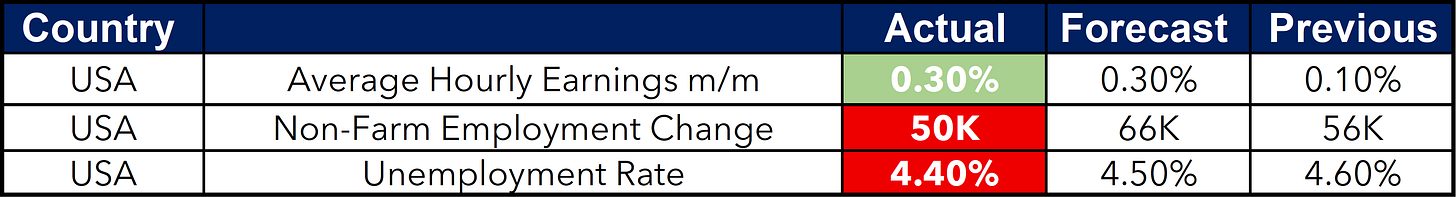

Fed seen on longer rate-cut pause after jobs data:

U.S. jobs data showing a lower unemployment rate has strengthened expectations that the Federal Reserve will pause rate cuts for longer, with markets now pricing the next cut around June. - Reuters

China to scrap export tax rebates for photovoltaic and battery products:

China will scrap export VAT rebates for photovoltaic products from April and progressively eliminate rebates for battery exports to curb price wars, overcapacity, and rising trade frictions. - Reuters

Brazil’s annual inflation ends 2025 within target range, rate cuts seen ahead:

Brazil's annual inflation ended 2025 within the central bank’s target at 4.26%, raising expectations for imminent interest rate cuts. - Reuters

Serbia’s Russian-owned NIS refiner buys first crude since US sanctions waiver:

Serbia’s Russian-owned NIS refinery imports its first crude shipments under a U.S. sanctions waiver, allowing operations to resume amid winter fuel concerns. - Reuters

Indices, Commodities & Currencies

The table below shows that the Global equities were mixed: U.S. indices were broadly flat with the S&P 500 marginally higher, while Europe closed firmer led by the Euro Stoxx 50 and DAX; Asia outperformed as the Nikkei posted strong gains.

Energy prices were mostly higher with WTI and Brent up, but natural gas declined, while metals advanced across the board led by silver and platinum.

Grains and soft commodities were largely positive, currencies were stable with a slightly stronger dollar, and FX moves remained contained across majors.

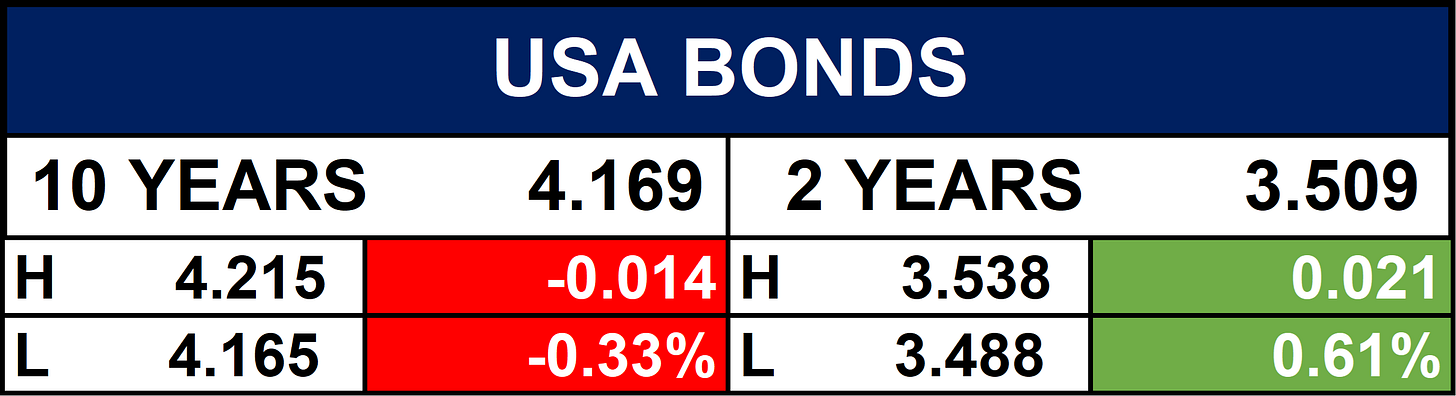

Fixed Income (USA Bonds)

Event

Conclusion

Looking ahead, Nigerian equities may continue to attract flows into fundamentally strong sectors such as banking, insurance, energy, and consumer goods, supported by improving balance sheets and deal activity. Globally, oil price dynamics, central bank policy signals, and China’s trade adjustments could drive volatility across commodities and risk assets.

Investors could expect selective opportunities, with market direction shaped by earnings resilience at home and macro policy clarity abroad.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.