Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

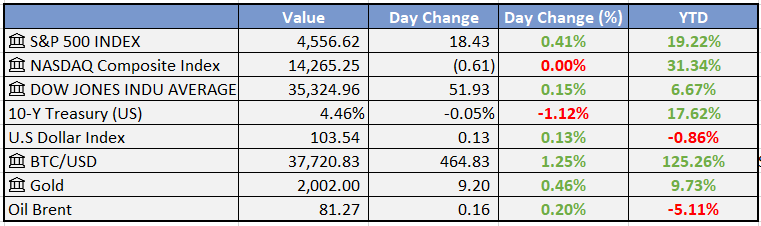

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Cardozo unveils CBN policy thrust today - Daily Trust

The Governor of the Central Bank of Nigeria, Mr. Olayemi Cardoso, is set to reveal the apex bank's monetary policy direction and economic outlook during the 58th Chartered Institute of Bankers of Nigeria Annual Bankers’ Dinner. The announcement, made via the central bank's official Twitter handle, invites stakeholders to join the unveiling event on YouTube at 5:00 pm on Friday.

Federal Govt, W/Bank Launch $750m Business Reforms Fund For States - leadership

The Nigerian federal government, in collaboration with the World Bank, is launching a $750 million Business Reforms Fund aimed at supporting business-friendly reforms in various states. The fund is designed to enhance the ease of doing business, attract investments, and foster economic growth at the subnational level.

FG begins Procurement Act review - Punch

The Nigerian federal government has commenced the review of the Public Procurement Act to enhance transparency, efficiency, and effectiveness in public procurement processes. The aim is to address challenges and loopholes in the current system, ensuring better governance and value for money in government expenditures.

TotalEnergies Confirms First Oil Leak at 2.3m Barrels Capacity Egina FPSO - This Day

TotalEnergies has confirmed the first oil leak at the Egina Floating Production Storage and Offloading (FPSO) vessel, with a capacity of 2.3 million barrels. The leak was reportedly detected during routine monitoring, prompting immediate action to address the issue. The company assured that the situation is under control, emphasizing its commitment to safety.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities closed mixed on Friday. Japan finished higher, although off its peak. Losses were seen in Seoul and Taipei, with India slightly lower and Southeast Asia showing mixed results. Australia was a little stronger, and New Zealand was higher after its coalition government was signed in.

Hong Kong experienced steep losses as many property stocks reversed gains from the previous day, though many still ended the week higher. Mainland China markets also closed lower.

Japan reported inflation numbers, with services inflation hitting a 30-year high. Headline inflation increased from 3% to 3.2% y/y, and core CPI rose to 2.9% y/y in October. Ex-fresh food and energy inflation eased to 4.0% from 4.2%, the lowest since March.

The Bank of Japan (BoJ), while initially aiming for an overshoot of the 2% inflation target, is now facing concerns about inflation remaining too high. An exit from the Negative Interest Rate Policy regime could be considered to control inflation and support the Yen.

Japan’s flash PMI reading showed marginal weakness in the manufacturing sector, while services expanded marginally. This reading follows Japan’s negative GDP growth on November 14th, driven by lower business investments.

South Korea’s stock market faces increased instability due to investors heavily betting against single stock futures after last month’s short-selling ban.

Lithium carbonate prices fell to a low since August 2021, dropping 80% y/y due to reduced EV sales in China and surplus inventories.

Europe, Middle East, Africa:

European equity markets were slightly higher, on course for modest gains on the week after closing higher in the previous session.

Germany’s Ifo Business Climate Index rose to 87.3, marking a four-month high. The uptick was observed across manufacturing, trading, and construction sectors, although sentiment in the service sector declined slightly.

The yield on Germany’s 10-year government bond continued to rise above 2.6%, partly due to Germany’s decision to suspend debt limits for the fourth year in a row.

Recent ECB meeting minutes showed that policymakers are open to further rate hikes, despite not considering it their main scenario.

The UK’s 10-year Gilt yield is rising towards 4.3%, driven by the Bank of England’s strong anti-inflation stance and positive PMI data. The GfK survey revealed a significant rebound in UK consumer confidence in November.

The Americas

Brazil’s Consumer Confidence Index marginally declined to 93, the lowest level since June, reflecting the central bank’s concerns about slowing economic growth.

Investors are rapidly selling U.S. dollars, anticipating that the Federal Reserve will halt rate hikes and possibly cut rates next year. This has led to the dollar’s largest monthly outflow since last November and its worst performance in a year.

A Deloitte report indicated that consumers intend to spend an average of $567 during Black Friday and Cyber Monday, marking a 13% increase from the previous year. The National Retail Federation projects that about 182 million shoppers will participate in these sales events, the highest number since 2017.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

US initial jobless claims down 22,000 to 209,000

US Revised UoM Consumer Sentiment declined 2.5 percentage points to 61.3 in November, from 63.8 in October

Thursday:

Eurozone composite PMI up to 47.1 in November

UK Flash Services PMI rose to 49.5 in November of 2023 from 49.3 in the previous month

Friday:

US Flash Services PMI sector saw an increase, rising from 47.8 to 48.2

UK Flash Manufacturing PMI contracted further to 48.1 from 48.7 in October

Investment Tip of The Day

Assess Technology Adoption Rates: Evaluate how quickly industries are adopting new technologies. Companies at the forefront of technological adoption may present better growth opportunities