Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

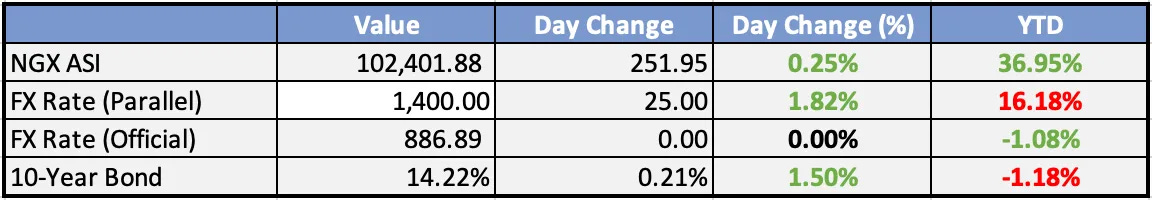

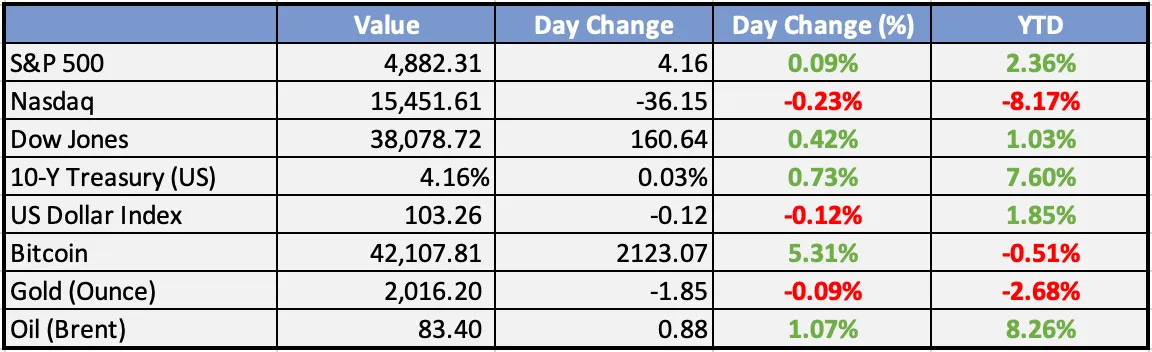

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Nigeria, Morocco fast-track talks on $30bn gas pipeline - Punch

The Federal Government has intensified discussions with the Kingdom of Morocco in a bid to fast-track the process of achieving the Final Investment Decision on the $30bn Nigeria-Morocco Gas Pipeline.

Agric Ministry, NASENI to boost food production with tech - The Sun

Permanent Secretary, Ministry of Agriculture and Food Security, Temitope Peter Fashedemi at the commissioning of the committee, yesterday in Abuja, explained that collaboration was timely bearing in mind that the world is being driven by the application of innovation and technology.

Global

US economy grew at 3.3% rate in latest quarter - New York Times

US economy surprised with 3.3% growth in Q4, capping strong 2023 and defying recession fears. Biden claims credit as data suggests "soft landing" with both slowing growth and cooling inflation. Strong numbers boost Biden's re-election hopes after public disapproval, even as GOP focuses on inflation. US outperforms bleak global outlook, prompting optimism for 2024.

Federal Reserve Board announces the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11 - Federal Reserve

US Federal Reserve to end new loans under Bank Term Funding Program on March 11, with existing loans running their course. Program served its purpose during pandemic stress period, while banks retain access to discount window for future liquidity needs. Interest rate adjusted for remaining loans.

US extends lead over China in race for world’s biggest economy - Bloomberg

US outpaces China in economic growth, widening lead as world's biggest economy. Strong consumer spending and vibrant stock market propel US, while China faces real estate woes, job losses, and deflation. Experts see structural weaknesses limiting China's future growth, while US holds potential for productivity boost.

Market Commentary:

Asia and Australia:

Asian markets displayed a mixed performance, with Chinese markets taking a breather after recent gains, Japan closing lower, JGB yields declining amid Japan macro releases, and South Korea closing higher. Notably, India and Australia were on holiday.

The January Tokyo Consumer Price Index (CPI) in Japan fell significantly below expectations. Analysts, however, emphasize that the focus for the Japanese Yen (JPY) and Bank of Japan (BOJ) policy remains primarily on the imminent wage negotiations.

Chinese Property Developer Evergrande faces hearings on Monday, January 29th, in Hong Kong, including a rare 'regulating order' session that could lead to the court appointing a liquidator.

Europe, Middle East, Africa:

European markets experienced a mixed session, with the FTSE 100 lifted by the highest GfK consumer confidence reading since January 2022. The French CAC 40 outperformed due to a rally in LVMH from earnings. The tech-heavy DAX faced pressure due to read across from Intel's downbeat earnings and an after-market fall of over 10%.

ECB speakers provided clarity on the timing of cuts, deviating from market expectations for the first half of the year. Post-fact sources reveal a willingness to consider rate cuts in March and potential actions in June.

EU earnings recap includes Remy Cointreau meeting revenue expectations, narrowing low-end FY23 revenue guidance, and strong Cognac sales. Volvo reported a Q4 bottom-line miss but a top-line beat, with strong truck demand from China and weakness from the EU. LVMH's healthy FY results after yesterday's close showed particularly good growth in perfumes, lifting luxury stocks. Signify reported a Q4 miss and anticipates challenging conditions persisting.

The Americas:

President Biden has temporarily halted pending approvals for exports from new liquefied natural gas (LNG) projects. Exemptions for national security are included, and the Department of Energy (DOE) will conduct a review during this pause to assess economic and environmental implications. The Biden administration assures that the pause will not adversely affect allies and emphasizes the availability of exemptions for national security if there is a demand for additional LNG.

US new home sales activity increased in December, supported by a drop in mortgage rates and a significant decrease in selling prices. New home sales rose by 8.0% MoM in December to a seasonally adjusted annual rate of 664,000 units.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

UK Flash Manufacturing PMI climbed to 47.3

UK Flash Services PMI climbed to 53.8

US Flash Manufacturing PMI came in at 50.3

US Flash Services PMI came in at 52.9

Thursday:

EA Main Refinancing Rate will stay at 4.50%

US Advance GDP q/q increased at an annual rate of 3.3 percent in the fourth quarter of 2023

US initial jobless claims up by 25,000 to 214,000

Friday:

European Central Bank ECB announced they are keeping their rates unchanged at 4.50% for the third straight month.

US new home sales rise MoM, coming in at 664k; est: 645k.

Investment Tip of The Day

Stay Cautious of Overleveraged Companies: Companies with excessive debt levels may face challenges. Monitor leverage ratios and assess the ability of companies to service their debt.