Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

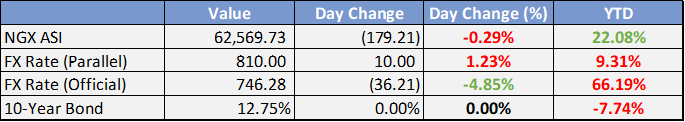

Local

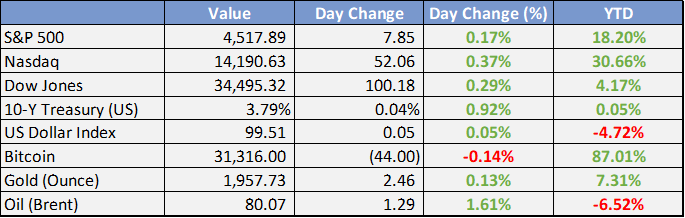

Global

*Data as of 6pm WAT

Market News

Local

Nigeria Raises Crude Oil Production by 65,000bpd to hit 1.25m Daily Output in June - This Day

Nigeria's crude oil production in June slightly increased to 1.25 million barrels per day (bpd), falling short of OPEC's target of 1.742 million bpd. Despite remaining Africa's top producer, it did not reach the projected 1.69 million bpd in the country's 2023 budget. Improvement was seen at specific terminals.Food shortage: Tinubu declares state of emergency, plans 500,000 hectares farmland – Punch

President Bola Tinubu has declared a state of emergency on food security in Nigeria. Efforts are being made to address food inflation, including the inclusion of food and water availability under the National Security Council's purview. Immediate measures include the release of fertilizers and grains to farmers and households.Dangote Cement plans new plants in Nigeria, Ghana, others – Punch

Dangote Cement plans to expand its production capacity by constructing a new integrated cement plant in Itori, Ogun State. The company also aims to establish grinding plants in Ghana and Cote d'Ivoire to ensure wider availability of cement in Africa. The project aims to strengthen local production of Dangote Cement on the continent.CBN upgrades eNaira app with NFC chip, widens sensitization – The Sun

The Central Bank of Nigeria (CBN) has upgraded its eNaira app with Near Field Communication (NFC) technology, enhancing its user-friendliness and service offerings. The NFC-enabled payments reader allows for secure and convenient contactless payments, positioning eNaira as a top-notch and globally recognized application.Capital importation into Nigeria down 28% in Q1 2023 – The Sun

Capital importation into Nigeria fell by 28% in Q1 2023, from $2.18 billion in Q1 2022 to $1.57 billion in Q1 2023. The decline was attributed to a number of factors, including the global economic slowdown, political instability in Nigeria, and the rising cost of doing business in the country.

Global

St. Louis Fed president Jim Bullard is stepping down - CNBC

Bullard, who has been a vocal advocate for higher interest rates, will leave his post on August 1. His departure comes as the Federal Reserve is facing growing pressure to raise rates more aggressively in order to combat inflation.

Cost of servicing US debt jumped 25% from Q1-Q3 - Bloomberg

The US government paid $652 billion in interest on its debt in the first three quarters of 2023, up from $522 billion in the same period last year. The increase is due to the rising interest rates, which have made it more expensive for the government to borrow money.

SEC adopted new rules for money-market funds (WSJ

The new rules, which are designed to prevent future bailouts of money-market funds, will require funds to hold more cash and liquid assets. The rules also give investors more control over how their money is invested.

Both headline and core producer prices rose by less than expected in June.

PPI and core PPI increased by 0.1% each, below consensus expectations of +0.2%.

On an annual basis, headline PPI fell to just 0.1%, the lowest since August 2020.

Core PPI, meanwhile, dropped to its lowest YoY reading since January 2021.

Following a very positive CPI report, the print gives the Fed more reason to consider easing up on rate hikes.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Former BoJ executive director says central bank may tweak YCC program at July meeting. The news says any tweaks could be minor but, this could mean a big change for the markets.

BOJ may raise its FY23 core inflation forecast into the 2% range in the next Outlook Report to be published at the July 27-28 policy meeting. The current forecast is 1.8%.

Yuan extends rebound as Fed tightening campaign nears end, China authorities extend policy support.

Australian PM Albanese announced RBA Deputy Governor Bullock will replace Philip Lowe as governor when his term expires in September.

Singapore's Q2 GDP grew 0.3% q/q in initial estimate, narrowly avoiding technical recession following 0.4% Q1's contraction.

Europe, Middle East, Africa

No surprises from June ECB minutes. Confirmed very broad consensus supported the 25-bp rate increase, but there was also preference expressed for 50 bps due to risk high inflation becoming more persistent.

A study by law firm Weil, Gotshal & Manges LLP, which showed real estate was the most distressed sector in Europe due to higher interest rates, increased debt servicing costs and a fall in demand for office space.

Germany urges companies to 'de-risk' from China, not seeking decoupling.

The Americas

St Louis Fed's Bullard announces resignation effective mid-August.

Used EV prices falling faster than overall used car market, driven by Tesla's recent price cuts.

US-China dialogue remains active, Beijing demands US lift sanctions on Chinese companies.

United Health delivers a double beat, raises lower end of their guidance. Q2 EPS $6.14 ex-items vs FactSet $5.99. Revenue $92.90B vs FactSet $90.97B

BlackRock beats on EPS, misses on marginally on revenue. Reports Q2 adj EPS $9.28 vs FactSet $8.52. Revenue $4.46B vs FactSet $4.47B. BlackRock Assets Rise to $9.4 Trillion, Fueled by Bull Market.

Wells Fargo reports Q2 EPS $1.25 vs FactSet $1.16; Revenue $20.53B vs FactSet $20.11B.

The Week Ahead:

Wednesday:

US Consumer price index - 3.00%

US Core CPI

Thursday:

US Initial jobless claims.

US Producer price index.

US Federal budget.

Friday:

US Consumer Sentiment.

Investment Tip of The Day

Monitor key economic indicators such as employment data, consumer confidence, and manufacturing indices to gauge the health of the economy. Economic reports provide insights into business cycles, consumption patterns, and investment opportunities