Finance Friday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

CBN disburses N173bn under 100-for-100 policy - Punch

The Central Bank of Nigeria has disbursed N173.31bn under its 100-for-100 Policy on Production and Productivity, creating 23,343 direct jobs. The initiative aims to boost domestic production, reduce imports, and improve the foreign exchange capacity of the Nigerian economy.

French govt reaffirms commitment to trade ties with Nigeria - The Guardian

The Consul-General of France in Lagos reaffirmed France's commitment to business ties with Nigeria, expressing interest in collaborating with the Nigerian Exchange Group (NGX) to list more brands. The Franco-Nigerian Chamber of Commerce also expressed interest in partnering with the NGX for French businesses' listing.

Rate hike: Expect higher prices, MAN, NECA warn CBN - Punch

The Manufacturers Association of Nigeria and the Nigeria Employers' Consultative Association expressed concerns about the Central Bank of Nigeria's increased Monetary Policy Rate, citing potential negative impacts on the manufacturing sector and investment. They called for coordinated measures to stimulate growth and address inflation.

AfDB canvasses investment opportunities in electric vehicles - Punch

The President of the African Development Bank, Akinwumi Adesina, stated that Africa's rich mineral deposits position it to attract private investment in the global electric vehicle market. He emphasized the need for Africa to manufacture lithium-ion batteries and proposed strategies to mobilize private financing for climate change and green growth.

NBET, Transcorp Sign 726MW Power Purchasing Pact - Daily Trust

The Nigerian Bulk Electricity Trading (NBET) and Transcorp Power signed a 20-year power purchase agreement for the 726 MW TransAfam Power Plant, aiming to enhance Nigeria's power generation capacity. The agreement assures government payment for the power generated and reinforces the commitment to drive power generation in the country.

Naira Declines on Sustain Forex Scarcity - MarketForces Africa

The Nigerian naira traded weak due to an imbalance between demand and supply of foreign currencies in the official and parallel markets. The outlook for the naira is expected to improve in the short term with the commencement of Dangote Refinery's operations, which will reduce foreign exchange spending and strengthen the local currency.

Emefiele raises alarm over low crude production - The Sun

CBN Governor Emefiele calls for increased crude oil production and defends the decision to raise interest rates. He highlights the impact of the Dangote Refinery and advocates for Nigeria to exit the subsidy era.

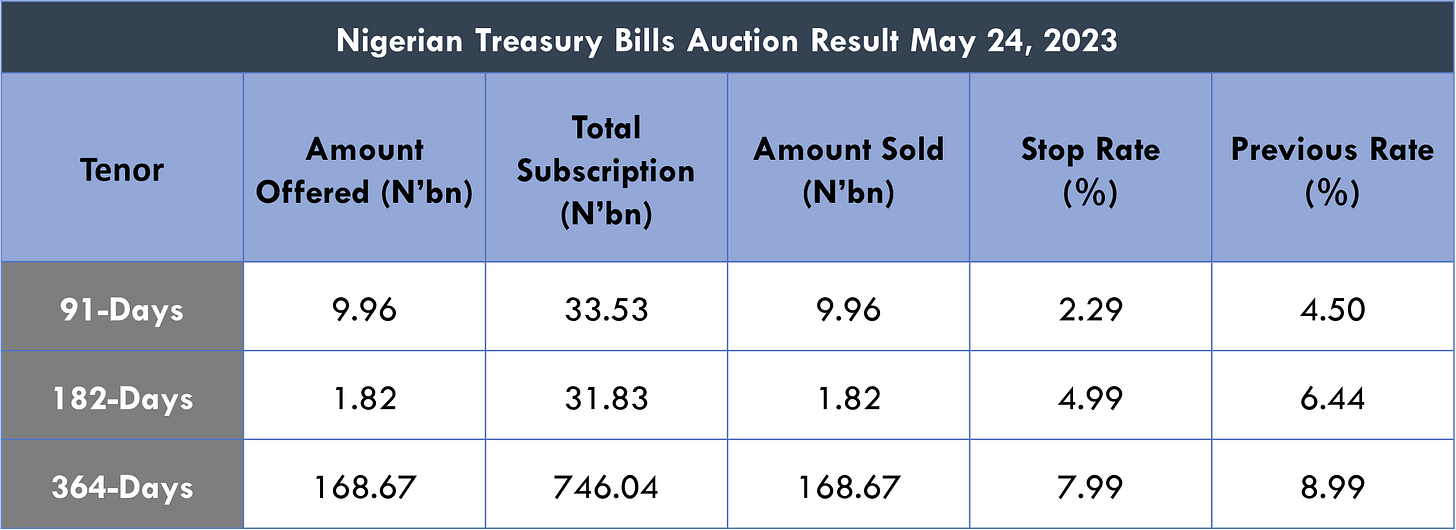

NTB Auction Rates Dip

Treasury bill market defies high interest rates as robust liquidity drives asset values, with significant rate drops observed. The auction saw high subscription but only a portion was allotted, while buying interest may decrease in the secondary market due to the impact of the MPR hike.

Global

The White House and Republicans have closed the gap on their differences over spending limits.

A potential deal would include a 3% increase in defense spending, measures to support the shift to renewable energy, and expedited permits for fossil fuel projects.

It would also reduce the recent $80 billion IRS budget increase by $10 billion.

No deal has been reached, however, as disagreements over a specific spending cap still remain.

And the pressure is mounting: the Treasury’s cash balance dropped to $49.5 billion on Wednesday, the lowest since December 2021.

The latest GDP data show the economy grew by 1.3% in Q1, up from previous estimates of 1.1%.

The increase was driven by higher-than-expected growth in consumer spending, which was partially offset by a decrease in inventory investment.

Both the GDP price index (deflator) and core PCE prices were revised higher over initial estimates, clocking in at 4.2% and 5.0%, respectively.

Meanwhile, US corporate profits–if you exclude the Fed’s profits (losses)–rose, albeit at a slower pace than in previous quarters.

Recent revisions to US unemployment benefits data reveal a far more resilient labor market than previous data suggested.

Total revisions to 3 months of data have resulted in ~171,000 fewer initial jobless claims than previously reported.

Last week, claims rose by 4,000 to 229,000 but the trend in recent months is clearly tilted to the downside.

This suggests next Friday’s jobs report could surprise to the upside, putting further pressure on the Fed to raise rates.

Nothing changes sentiment like price.

Wall Street strategists are raising their estimates for the S&P 500.

Earlier this week, BofA’s Savita Subramanian raised her price target for the index to 4,300 from 4,000, with a range as high as 4,600.

She also lifted her 2023 EPS outlook to $215 from $200.

At Morgan Stanley, senior portfolio manager Andrew Slimmon admitted the S&P could blow past his target of 4,200 and reach around 4,600 by year’s end.

Mutual funds began the quarter significantly underweight most of the stocks that have led this year’s rally.

Now–as many long-only funds hit their cash ceilings–they’re beginning to rotate that cash into Big Tech.

Hedge funds, meanwhile, have increased their allocations to tech stocks to 15.5% of overall single-stock net exposure from 9.7% to start the year.

Notional net buying in US equities among hedge funds from May 5 to May 18 was the largest since October 2022.

OPEC+ will meet next week to discuss oil production levels.

If you ask Saudia Arabia, cuts to output are on the table.

If you ask Russia, no immediate changes are necessary.

Oil traders are also weighing a stronger USD and concerns about weak demand growth (mainly from China), both of which present headwinds for prices.

Meanwhile, oil positioning among money managers has returned to early Covid levels.

Tesla leak reportedly shows thousands of Full Self-Driving safety complaints - The Verge

Tesla whistleblower leaks 100GB of data revealing thousands of customer complaints about safety issues with Full Self-Driving (FSD) features. Concerns include self-acceleration, braking problems, and accidents, prompting investigations and a recall by the National Highway Traffic Safety Administration.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Tokyo core inflation slowed to 3.2% y/y in May, lower than consensus 3.4% and prior month's 3.5%. Largely reflected drop in electricity and gas prices due in part to government subsidies that came into effect earlier this year. Ex-energy and food inflation accelerated to an in-line 3.9% from 3.8%, fastest since 1982. - A deceleration in inflation means that the BoJ will probably not consider a shift in policy just yet

Taiwan's government said Q1 GDP contracted -2.9% y/y against consensus expectations of -3.0%, FY growth forecast at 2.0% from previous 2.1%.

China easing bets ratcheted up with cost of 12-month interest rate swaps slipped to 2.06% this week, as compared with 2.47% two months ago.

Yen weakened to above ¥140 per dollar as markets price in another Fed rate hike

Europe, Middle East, Africa

UK retail sales data came in at 0.5% - positive and better than expected.

The Turkish Lira falls to 20 to the dollar for the first time as polls predict Erdogan victory at runoff election

The Americas

US president Joe Biden signaled late on Thursday that White House officials were “making progress” in negotiations over the US debt ceiling, as the looming deadline over an unprecedented government default stretched investors’ nerves.

The second estimate for Q1 GDP was revised up to 1.3% from the advance estimate of 1.1% and the GDP Price Deflator was revised up to 4.2% from the advance estimate of 4.0%.

US money market fund assets have swelled to a record high of $5.4T from less than $5.3tn in late April and $4.8tn at the start of the year.

Elon Musk's brain implant firm Neuralink receives FDA approval to conduct human trials

Chapter 11 filings by indebted companies jump in May, including five during a 24-hour span

The Week Ahead:

Monday: Fed talk - Bullard, Barkin, Bostic, Daly

Tuesday: US Manufacturing PMI comes in at 48.5; est: 50.2, US new homes sales come in at 683k; est: 663k.

Wednesday: FOMC minutes

Thursday: Initial jobless claims, GDP growth, pending home sales

Friday: Core PCE, personal income & spending, durable goods orders, Michigan consumer sentiment

Investment Tip of The Day

Reassess your investment goals. Take the time to reassess your investment goals and make sure they align with your evolving financial circumstances. Adjust your investment strategy and asset allocation as needed to stay on track towards achieving your objectives.