Finance Friday- FCMB Capital Raise, Rising Fuel Prices, and Bond Rally Define Nigeria’s Market Outlook as Global Inflation and Oil Trends Stabilize

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s financial landscape saw major moves as FCMB announced a ₦160 billion capital raise to boost efficiency, while $500 million was secured for solar manufacturing and fuel prices surged past ₦1,000/litre amid new import tariffs. Renewed investor appetite lifted Nigerian bonds after tax exemptions. Globally, stable Eurozone inflation, China’s renewed U.S. soybean imports, weakening oil prices, and Russia’s debut yuan bonds defined the week’s market mood signaling a cautious yet adaptive global economy.

Nigerian News & Market Update

FCMB to deploy fresh capital for cost efficiency:

FCMB Group is raising ₦160 billion to strengthen its capital base, boost profitability through technology investments, and cut its cost-to-income ratio below 50% by 2027. - Thenation

Governors, investors raise $500million for solar manufacturing – Adelabu:

Nigeria has secured nearly $500 million to build solar manufacturing plants, boosting local production, exports to Ghana, and positioning the country as a regional renewable energy hub. - Punch

Petrol soars above ₦1,000/ltr as Tinubu okays 15% import tariff:

Nigeria’s new 15% fuel import tariff aims to protect local refineries but has sparked fears that petrol prices could exceed ₦1,000 per litre and worsen economic hardship for consumers. - Punch

Nigerian Bonds Rally as Tax Exclusion Boosts Investors’ Appetite:

Investor demand for Nigerian bonds rose after their exclusion from withholding tax, driving mild yield declines and renewed interest in local fixed-income securities. - dmarketforces

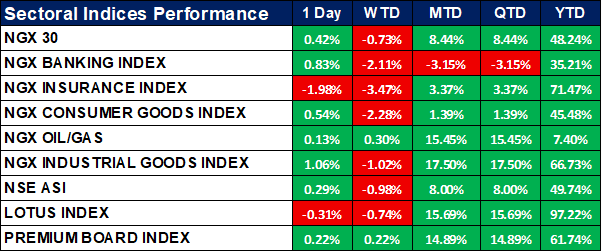

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities market closed positive as most sector indices gained. The Industrial Goods (+1.06%), Banking (+0.83%), and Consumer Goods (+0.54%) sectors led daily advances, while Insurance (-1.98%) and Lotus (-0.31%) declined. Overall, the NSE ASI rose 0.29%, bringing its year-to-date return to 49.74%, driven by sustained investor interest in growth and dividend-yielding stocks.

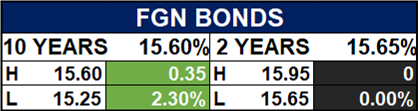

Fixed Income (FGN Bonds)

Global News & Market Update

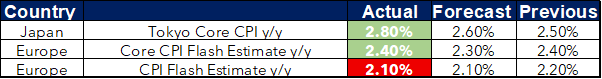

Euro zone inflation eases a touch in October but core steady:

Eurozone inflation eased to 2.1% in October, staying near the ECB’s 2% target and reinforcing expectations that the bank will pause further rate cuts. - Reuters

China to buy 12 million metric tons of US soybeans this season, Bessent says:

China agreed to resume major U.S. soybean purchases 12 million tons this season and 25 million tons annually for three years signaling a return to normal trade levels after years of tariff disruptions. - Reuters

Oil heads for third monthly decline as dollar, OPEC+ supply weigh:

Oil prices held steady but were set for a third monthly drop in October amid a strong dollar, weak Chinese demand, and rising global supply as OPEC+ considers a modest output increase. - Reuters

Russia plans to issue debut sovereign yuan-denominated bonds, sources say:

Russia plans to issue its first yuan-denominated bonds worth up to 400 billion roubles to absorb excess yuan liquidity from energy exports and offer local investors new options amid Western sanctions. - Reuters

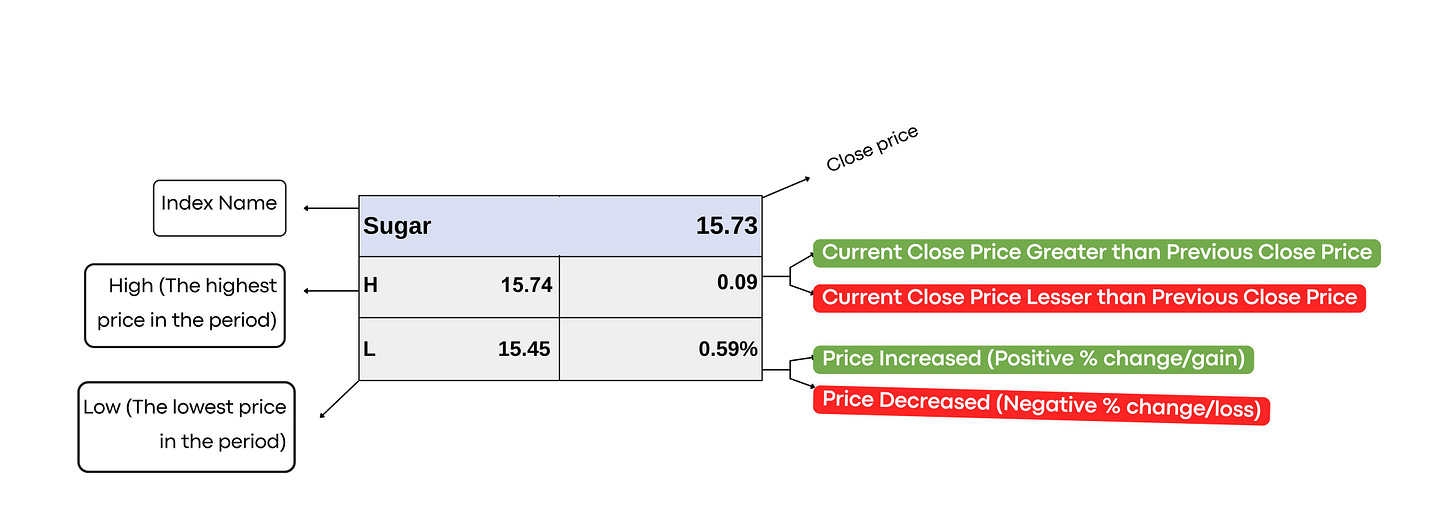

Indices, Commodities & Currencies

The table below shows that the Global markets were mostly positive, with major indices like the Nikkei 225 (+1.71%) and NASDAQ (+1.12%) posting gains.

Energy and metals rose, led by Natural Gas (+2.43%) and Gold (+0.37%), while Lumber (-0.92%) and Platinum (-1.39%) declined.

In currencies, the USD strengthened, while the EUR and GBP weakened slightly.

Fixed Income (USA Bonds)

Events

Conclusion

With FCMB’s capital raise and renewed bond market interest, Nigeria’s financial sector may see stronger liquidity and improved investor confidence despite rising fuel costs. Globally, easing Eurozone inflation and China’s revived U.S. soybean imports suggest cautious optimism, though oil market pressures and Russia’s yuan bond move highlight shifting capital flows. Investors should expect moderate volatility as markets adjust to currency, energy, and policy dynamics heading into year-end.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.