Finance Friday- Market Conditions Reconfigure as Nigeria Tightens Liquidity and Global Energy Disruptions Shift Investor Sentiment

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where we track major shifts across Nigeria’s financial markets and the global economy. This edition highlights key domestic developments from Norrenberger’s bold NASD acquisition to policy updates on fuel import duties, pensions, and CBN liquidity tightening. We also cover sector performance, fixed income trends, and global market drivers, including oil supply disruptions and central bank actions.

Nigerian News & Market Update

Norrenberger acquires ₦1.31billion stake in NASD:

Norrenberger Securities has acquired a 4.35% stake in NASD Plc for ₦1.31billion at a major premium, signalling strong institutional confidence in the OTC exchange’s rapid growth and digital-focused future. - Punch

Tinubu shifts 15% fuel import duty to Q1 2026:

President Tinubu has deferred the 15% import duty on petrol and diesel until Q1 2026 to prevent fuel price hikes and allow better market readiness while local refineries scale up. - Punch

FG unveils Nigerian content equity fund for oil companies:

The Federal Government will launch a new Nigerian Content Equity Fund in December to provide long-term risk capital for indigenous oil and gas companies, reinforcing its push to strengthen local industry capacity. - Punch

PTAD disburses ₦3.9billion pension arrears to 91,146 retirees:

The Federal Government has paid ₦3.9billion in arrears to over 91,000 pensioners under the Defined Benefit Scheme as part of the newly approved ₦32,000 pension increment. - Punch

CBN Sells ₦2.55trillion OMO Bills as Subscription Hits ₦3.1trillion:

The CBN sold ₦2.55trillion in the Open Market Operations (OMO) bills after attracting ₦3.1trillion in bids, tightening excess liquidity with stop rates around 20.6% and effective yields near 23%. - Dmarketforces

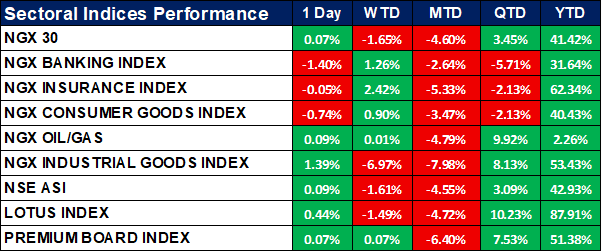

Nigeria Sectoral Indices Performance

The table below shows that the Industrial Goods Index led the market with the strongest 1-day gain (+1.39%), while the Banking Index lagged with a sharp decline (-1.40%). Month-to-date (MTD) performance is broadly negative across all indices, showing persistent market weakness in November. Year-to-date (YTD), the Lotus Index (+87.91%), Insurance (+62.34%), and Industrial Goods (+53.43%) remain the top outperformers, reflecting strong sectoral resilience.

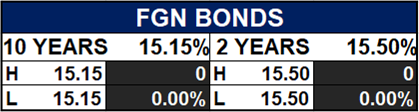

Fixed Income (FGN Bonds)

Global News & Market Update

Russia’s Lukoil in talks with potential buyers of its foreign assets:

Lukoil is seeking new buyers for its foreign assets after U.S. and UK sanctions and the collapse of a sale to trader Gunvor, aiming to keep operations and energy supplies running smoothly during the transition. - Reuters

Oil gains almost 2% as Russian port suspends oil exports after Ukrainian attack:

Oil prices rose nearly 2% as a Ukrainian drone attack forced Russia’s Novorossiisk port to halt oil exports, heightening supply fears amid tightening Western sanctions. - Reuters

Saudi Aramco to sign US LNG agreements during crown prince’s visit to Washington:

Saudi Aramco plans to sign U.S. LNG supply deals with Woodside Energy and Commonwealth LNG, aiming to expand its global LNG capacity and secure up to 4 mtpa of U.S. supply. - Reuters

Switzerland wins tariff rate cut to 15% in US trade deal:

The U.S. will cut tariffs on Swiss goods from 39% to 15%, easing export costs and encouraging Switzerland to shift some manufacturing to the U.S., leveling the playing field with EU competitors. - Reuters

India’s central bank resumes debt buying after 6 months, pulls down yields:

The Reserve Bank of India resumed government bond purchases, buying ₹124.7 billion to inject liquidity and stabilize yields, marking its first such activity in six months. - Reuters

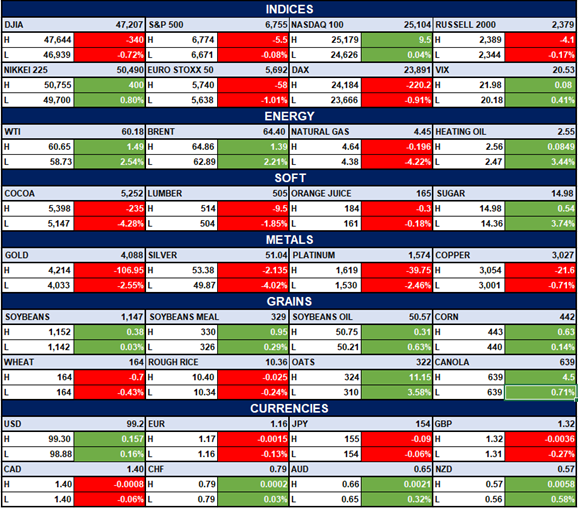

Indices, Commodities & Currencies

The table below shows that there was Mixed performance. The U.S. indices slightly down (DJIA -0.72%, S&P 500 -0.08%), while Nasdaq 100 edged up 0.04% and Nikkei 225 gained 0.80%; European indices fell (Euro Stoxx 50 -1.01%, DAX -0.91%). Oil prices rose (WTI +2.54%, Brent +2.21%), while metals dropped sharply (Gold -2.55%, Silver -4.02%, Platinum -2.46%), and soft commodities showed mixed results with sugar +3.74% and cocoa -4.28%. USD strengthened slightly; EUR and JPY slipped; grains generally rose with oats +3.58%, canola +0.71%, corn +0.14%, while wheat fell -0.43%.

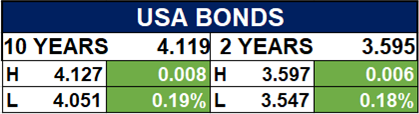

Fixed Income (USA Bonds)

Conclusion

As liquidity tightening by the CBN continues and sectoral indices show mixed momentum, investors could expect near-term volatility but selective strength in resilient sectors like industrials, insurance, and Shariah-aligned equities. Globally, oil price swings driven by geopolitical tensions and central bank policy shifts may influence Nigerian asset pricing and FX conditions. Staying positioned in quality names, fixed income opportunities, and oil-linked plays may offer better risk-adjusted returns in the coming sessions.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.