Finance Friday - Markets Hold Firm: Dangote Expansion, Nestlé Struggles, Global Trade Tensions & Bullish NGX

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to Friday’s market wrap up. Today’s market overview shows Nigeria’s strong sectoral gains, driven by Banking, Consumer Goods, and the Lotus Index, while Oil/Gas remains negative YTD. Dangote Refinery plans to boost capacity to 700,000 bpd by Dec 2025, Nestlé struggles with weak China demand. Globally, the S&P 500 hit record highs on strong earnings, and Brazil risks major job losses from looming US tariffs. Commodities were mixed, with oil down, metals retreating, and cocoa up, while USD and JPY strength reflect cautious market sentiment.

Nigerian News & Market Update

Dangote refinery to hit 700,000bpd by December:

Dangote Refinery plans to raise capacity to 700,000 bpd by Dec 2025 (from 650,000 bpd). Crude intake hit 644,000 bpd in July, and it exported 1.35 billion litres of petrol between June and July, boosting Nigeria’s fuel supply and exports. - Punch

Nestle Struggles Amid Weak China Market:

Nestlé’s net profit fell 10.3% to CHF 5.1billion, with sales down 1.8% to CHF 44.2billion, as weak demand in China and a strong Swiss franc weighed on results. Q2 organic growth was 2.9%, but China remained a drag.

Shares dropped 3.5% on weaker-than-expected sales. The company maintained its 2025 margin target of at least 16% and is taking cost-cutting and product improvement measures to revive growth. - Channels

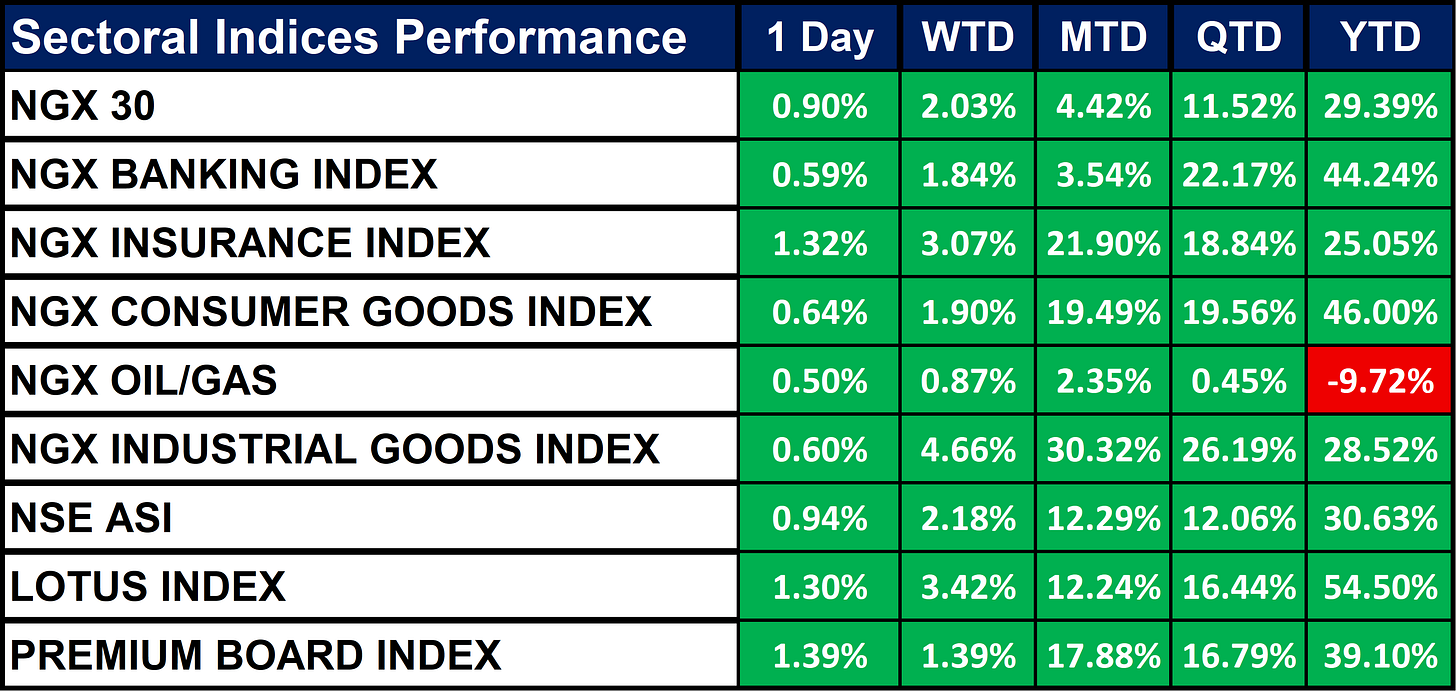

Nigeria Sectoral Indices Performance

The table below shows that All NGX sectors closed positive for the day, reflecting broad market optimism. NGX 30 rose 0.90% daily and is up 29.39% YTD. Banking (+44.24% YTD), Consumer Goods (+46.00% YTD), and Insurance (+25.05% YTD) showed strong yearly gains. Oil/Gas remains the only sector negative (-9.72% YTD) despite a slight daily rise. The Lotus Index leads with +54.50% YTD, while the NSE ASI is up 30.53% YTD, indicating sustained bullish market sentiment.

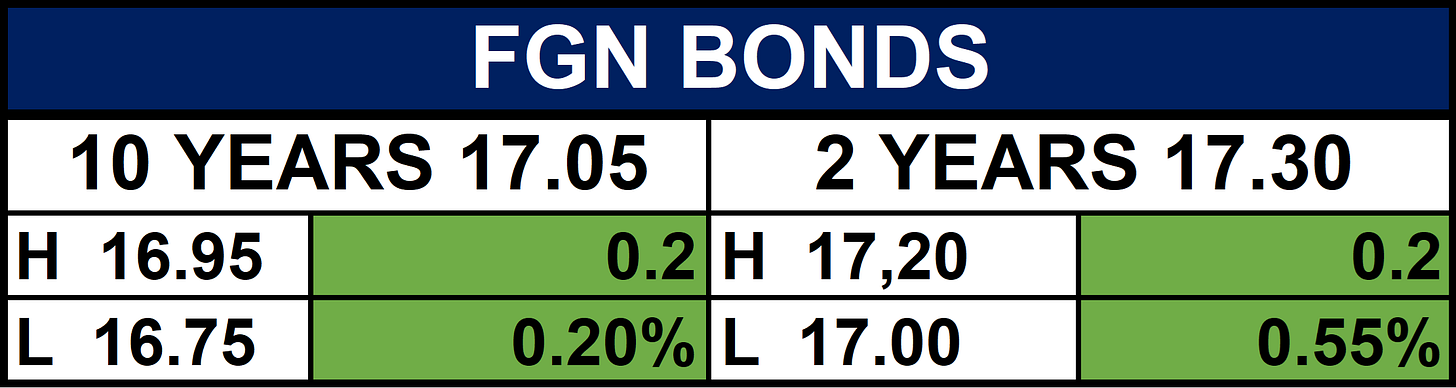

Fixed Income (FGN Bonds)

Global News & Market Update

S&P 500 rises, heads for winning week on strong earnings, trade deal optimism:

The S&P 500 (+1.2% weekly) hit its 13th record close for 2025, supported by strong earnings (82% beat estimates) and positive US trade deals. Analysts see the bull market continuing amid stable inflation. Focus shifts to next week’s Fed meeting (rates expected to hold) and key earnings from Meta and Apple. - CNBC

Brazil scrambles as U.S. tariff deadline looms, talks stall:

Brazil faces 50% US tariffs from Aug. 1, tied to Bolsonaro’s prosecution. Talks are stalled, risking 100,000+ job losses and export disruptions. Firms are redirecting production or suing, while Brazil calls the move “unacceptable blackmail.” - Reuters

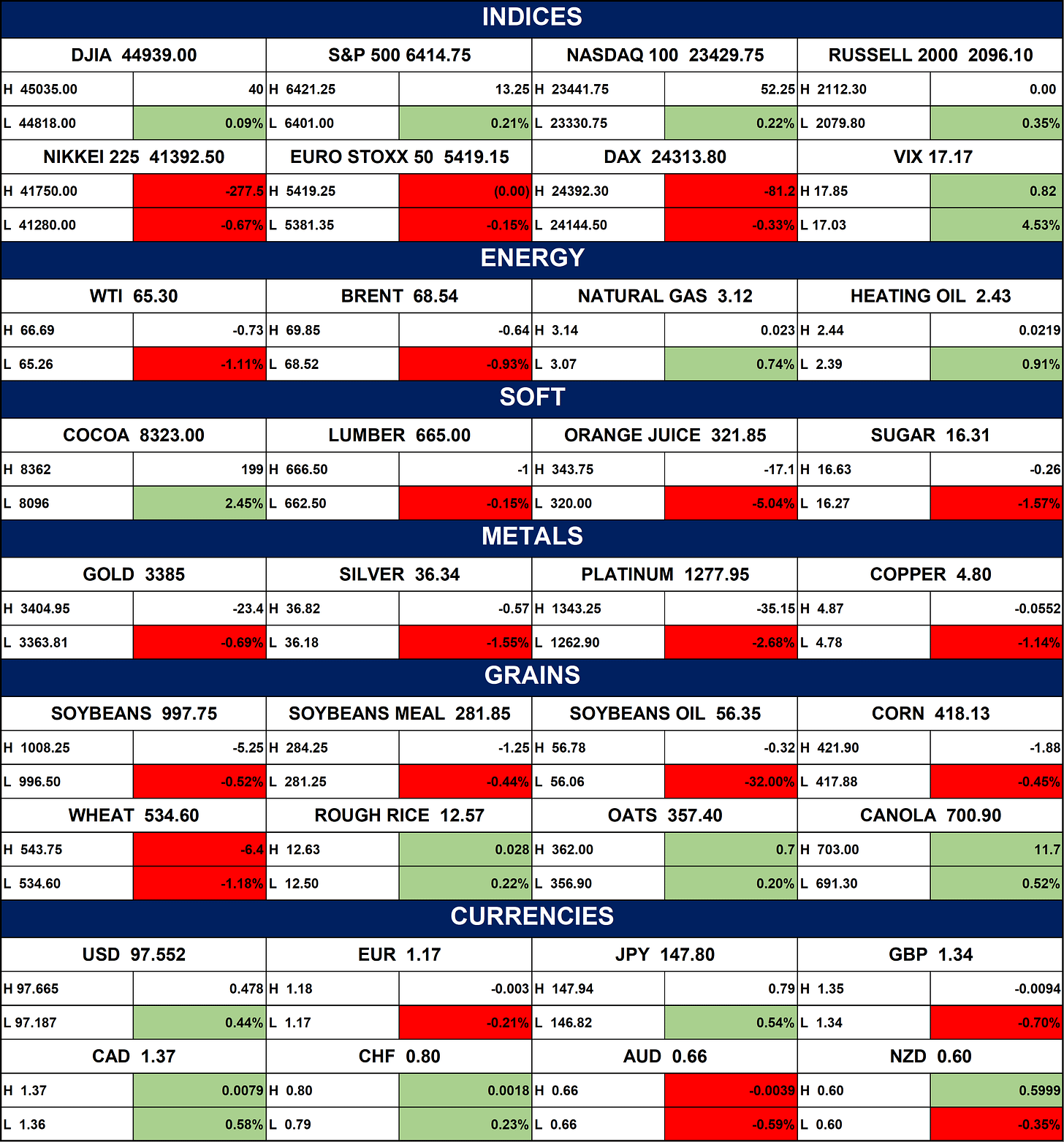

Indices, Commodities & Currencies

The table below Depicts that US stocks rose modestly, with the S&P 500, Nasdaq, and Dow up, while Nikkei and European markets dipped. VIX climbed +4.5%, signaling rising volatility. Oil prices fell, but Natural Gas gained. Metals dropped, including Gold and Platinum, while Cocoa surged and Orange Juice tumbled. Most grains declined, with small gains in Rough Rice and Oats. In currencies, USD and JPY strengthened, while EUR and AUD weakened, reflecting cautious market sentiment.

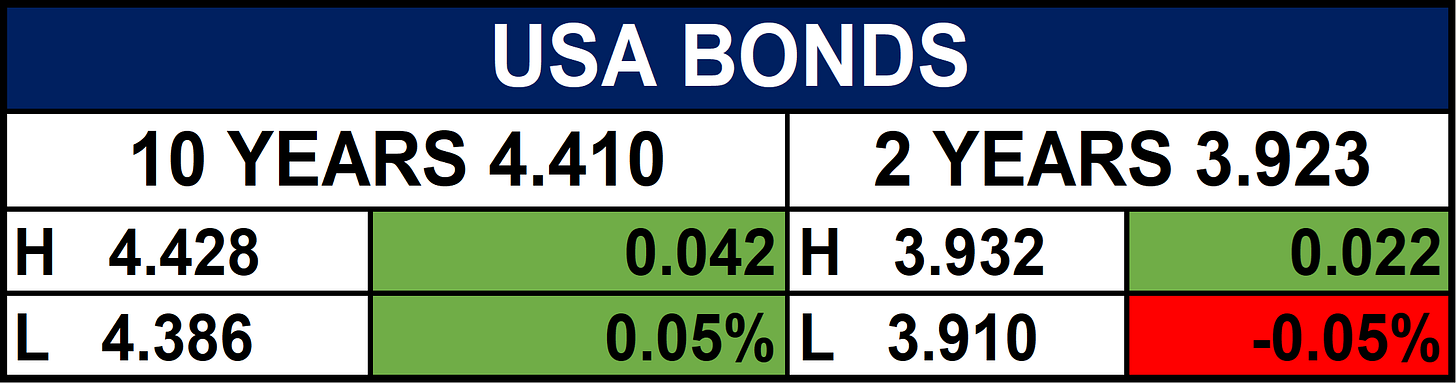

Fixed Income (USA Bonds)

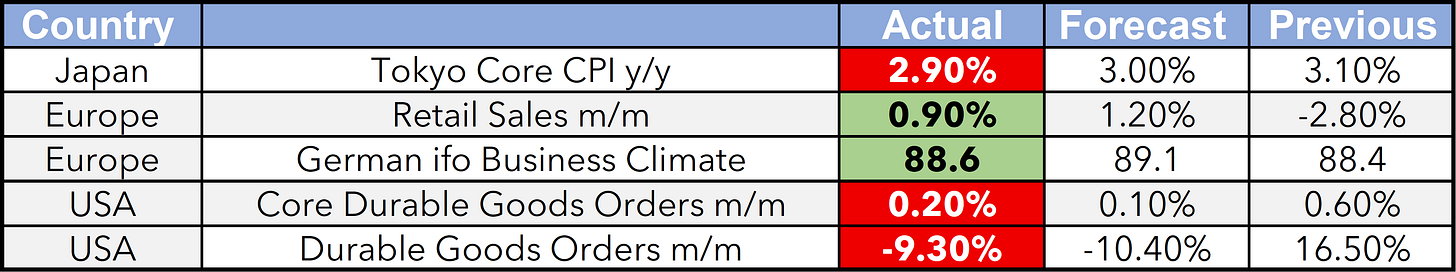

Events

Conclusion

As the week ends, strong earnings and local market gains support sentiment, but global risks like US-Brazil tariffs and China’s slowdown weigh on outlooks. Next week, focus shifts to the Fed meeting (rates likely unchanged) and earnings from Meta and Apple, while in Nigeria, attention remains on NGX performance and Dangote’s refinery expansion.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.