Finance Friday - NGX Rally, Easing Inflation, and Global Earnings Drive Investor Optimism

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening. Welcome to your market wrap-up. Markets ended the week strong, with the NGX gaining ₦2.27 trillion on cement stock rallies and inflation easing to 22.22%, showing economic stabilization. Investor confidence grew in bonds despite tight liquidity. Globally, US banks reported strong profits, oil prices stayed stable, and US stocks hit record highs, reflecting overall market optimism. Stay tuned for key insights and what this means for the coming week.

Nigerian News & Market Update

NGX gains N833bn on cement stock surge:

The Nigerian Exchange gained ₦2.27trillion over two days, as cement and blue-chip stocks drove strong market momentum. The All-Share Index rose to 130,283.84, up 2.8%, with a year-to-date return of 26.58%. BUA and Dangote Cement led the rally with nearly 10% gains, pushing the Industrial Index up 9.08%. Despite some notable losers like Berger Paints and May & Baker dropping 10%, trading remained robust with ₦42.76billion in turnover across 1.19billion shares. Investor sentiment remained strong, fueled by demand in banking and manufacturing sectors. - Punch

Nigeria’s Inflation Rate Drops To 22.22% In June 2025:

Nigeria’s inflation dropped to 22.22% in June 2025 from 22.97% in May, with a sharp fall from 34.19% in June 2024. However, monthly inflation rose slightly to 1.68%. Food inflation fell year-on-year to 21.97% but increased monthly to 3.25% due to rising prices of staples. Core inflation remained high at 22.76% year-on-year and rose month-on-month to 2.46%, indicating persistent underlying price pressures. - Channels

Access Bank Highlights Investor Confidence in Nigerian Bonds Amid FX Stabilization:

Access Bank reports renewed investor interest in Nigerian bonds and Treasury Bills due to attractive yields and stabilizing economic indicators, despite tight market liquidity. Medium to long-term bond bids increased, OMO(Open Market Operations) yields rose to 20.50%, and overnight rates exceeded 32%. The forex market remains stable after recent CBN interventions amid FDI profit-taking. - Thisday

Nigeria Sectoral Indices Performance

The table below shows that most sectors remain strong YTD(Year-To-Date) despite minor daily pullbacks in banking and consumer goods. Industrial Goods showed strong daily momentum, while Oil & Gas continues to underperform

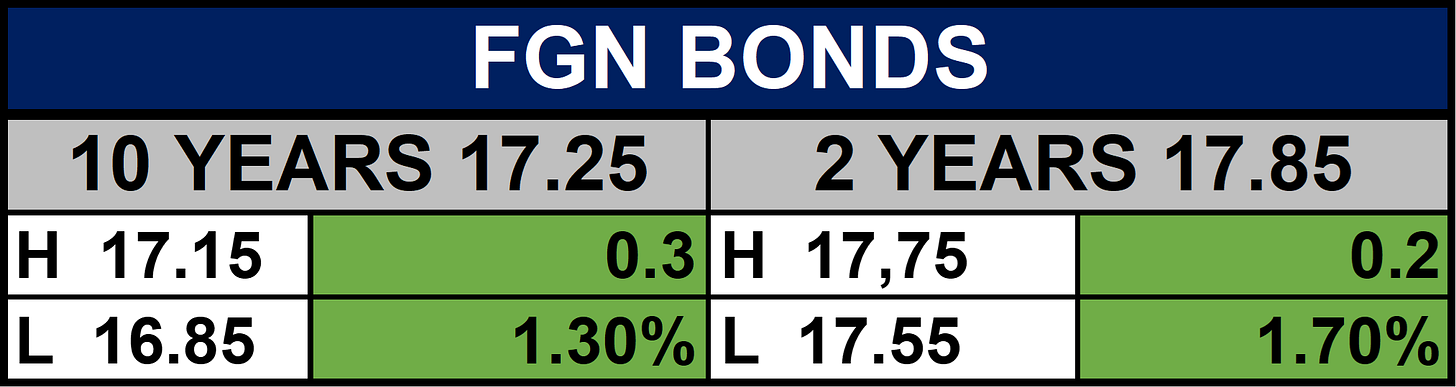

Fixed Income (FGN Bonds)

Global News & Market Update

Banks are thriving so far in Trump’s economy. Here’s what that means for markets and the consumer:

US banks posted strong second-quarter profits, driven by increased trading, investment banking, and loan growth as recession fears eased. JPMorgan led with $15 billion profit, while overall economic indicators improved, supporting continued consumer and corporate borrowing. Bank leaders remain optimistic about the economy despite lingering risks. - CNBC

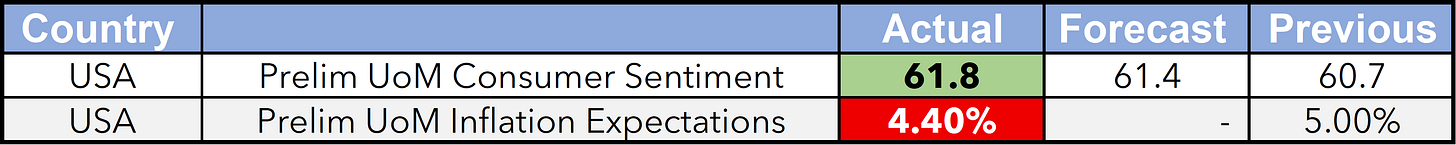

Oil Trades Steady as Market Parses Impact on Russia Energy Curbs:

Oil prices stayed steady as the EU(European Union) imposed new sanctions on Russian crude and refined products, raising diesel supply concerns. Diesel market tightness continues to support crude prices despite global stock builds. Strong US consumer sentiment also boosted market confidence, while crude remains in backwardation, indicating tight short-term supply. - Bloomberg

S&P 500 Hits Record on Signs Economy in Good Shape:

US stocks hit record highs as strong retail sales and low jobless claims signaled economic strength, boosting market optimism. The dollar rose, short-term bonds fell, and crypto gained from a stable coin bill. While Fed rate cut expectations remain mixed, solid consumer spending supports earnings growth despite lingering concerns over tariffs, inflation, and potential changes in Fed leadership. - Bloomberg

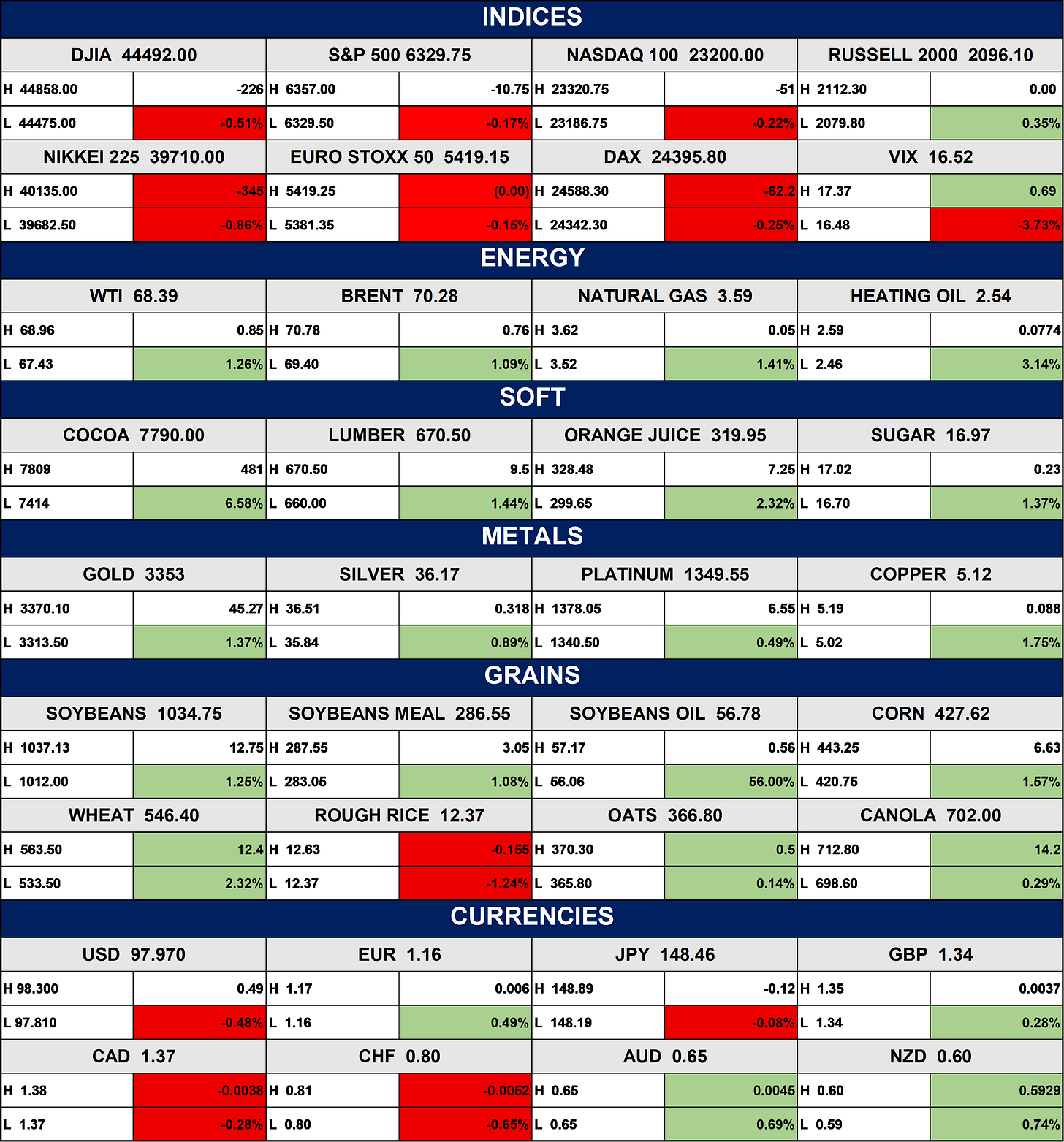

Indices, Commodities & Currencies

The table below Depicts that most Asian and European indices closed negative while US indices were mixed. Crude oil and natural gas prices rose, indicating positive energy sentiment. Cocoa led soft commodities with strong gains, while metals saw modest increases, especially copper and gold. Wheat and soybeans led grain gains despite a drop in rough rice. The USD and CAD declined, while the EUR and NZD strengthened. Overall, commodities were broadly strong, equities mixed, and the dollar softer today.

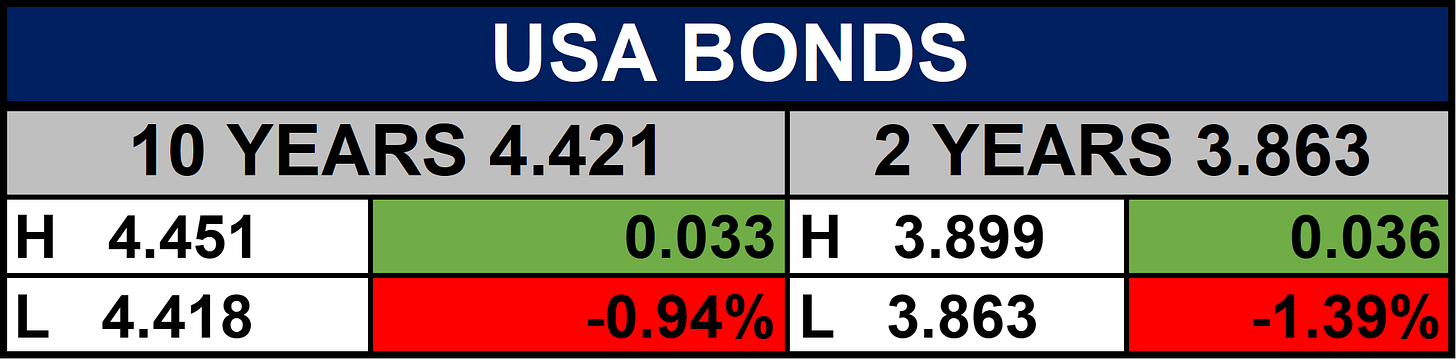

Fixed Income (USA Bonds)

Events

Conclusion

Overall, Markets closed strong on easing inflation and solid earnings, but persistent core inflation, tight liquidity, and policy uncertainties may limit gains next week. Investors will watch central bank signals closely, with industrial stocks likely to remain favored while fixed income yields stay elevated, potentially slowing equity inflows.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.