Finance Friday - NGX Soars as Global Markets Wobble: July Market Recap

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to your Friday market wrap up. July closed on a high note for the Nigerian market, with the NGX recording impressive gains and strong earnings across key corporates. However, global markets told a different story, as risk-off sentiment drove broad declines across equities, commodities, and currencies. From NAHCO’s stellar growth to Ecobank’s pan-African strength, local momentum remains upbeat amid global volatility.

Nigerian News & Market Update

NGX closes July strong, gains ₦12.62trillion:

The Nigerian Exchange ended July 2025 on a strong bullish note, gaining ₦12.62 trillion in market value. The All-Share Index hit a record high of 139,863.67 points, marking a 17.03% monthly return and a 34.60% year-to-date gain. Trading activity was robust, with 1.1 billion shares worth ₦32.99 billion exchanged. UAC of Nigeria, Wema Bank, and Guinness led the gainers, while The Initiates Plc and AXA Mansard topped the losers. All key indices posted gains, reflecting sustained investor optimism ahead of earnings season and economic reforms. - Punch

Naira ends July at 1,533.55/$, down 0.25%:

The naira closed July 2025 at ₦1,533.55/$ in the official market, slightly weaker than June’s close but showing relative stability. Mid-month, it hit a 4-month high of ₦1,518/$, its strongest since March. The naira traded mostly within the ₦1,530–₦1,535/$ band, supported by CBN interventions and rising foreign investor inflows. At the parallel market, the naira ended at ₦1,545/$, with the spread between both markets narrowing, reducing speculation. Foreign reserves rose to $39.36billion, with the CBN announcing a peak of over $40billion, the highest in 33 months. - Punch

NAHCO records ₦8.88bn H1 profit:

NAHCO reported a 166.7% rise in profit to ₦8.88billion for H1 2025, driven by strong revenue growth and efficiency. Revenue doubled to ₦32.33billion, and all profit margins improved. The company is investing in technology, staff welfare, and diversification into hospitality and exports. It aims to reach ₦300billion revenue long-term and recently launched Nigeria’s first export processing centre to boost global competitiveness. - Punch

Caverton reports ₦2.09billion profit before tax:

Caverton posted a ₦2.09billion profit in H1 2025, recovering from a loss last year. Though revenue dropped, profit margins and operating performance improved significantly. The company is diversifying into electric ferries and drone services through strategic partnerships, while focusing on cost control, sustainability, and growth. - Punch

Ecobank Grows Profit Before Tax by 40% to ₦620.23billion in H1:

Ecobank posted a 40% increase in profit before tax to ₦620.23billion and profit after tax to ₦433.88billion in H1 2025. Gross earnings rose by 24% to ₦2.31trillion, while the cost-to-income ratio improved to 49.1%, its best in over a decade. The strong performance was driven by revenue growth, cost control, and increased deposits across its pan-African operations. - Thisday

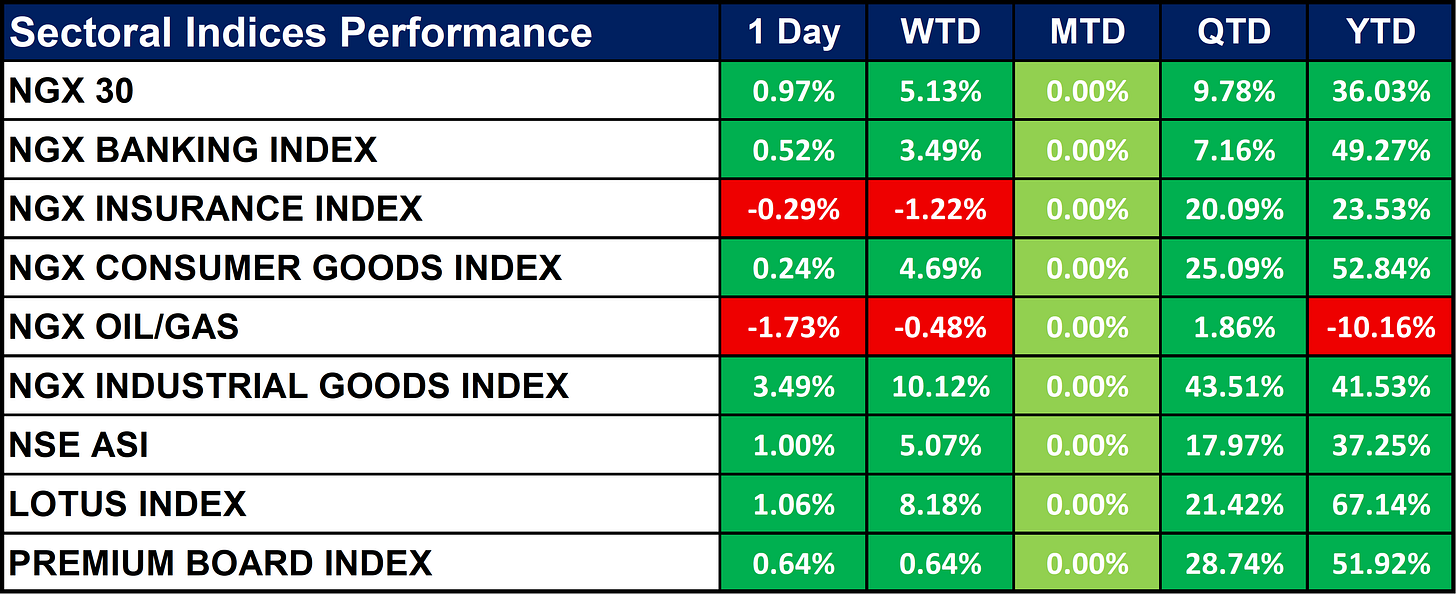

Nigeria Sectoral Indices Performance

The table below shows that the NGX market kicked off the month on a positive note, with most indices recording gains. The Industrial Goods, Consumer Goods, and Lotus Index led performance across the week, quarter, and year. In contrast, the Oil & Gas Index remains the weakest, being the only sector with negative year-to-date returns (-10.16%). Investor sentiment is strongest in industrial and Sharia-compliant stocks.

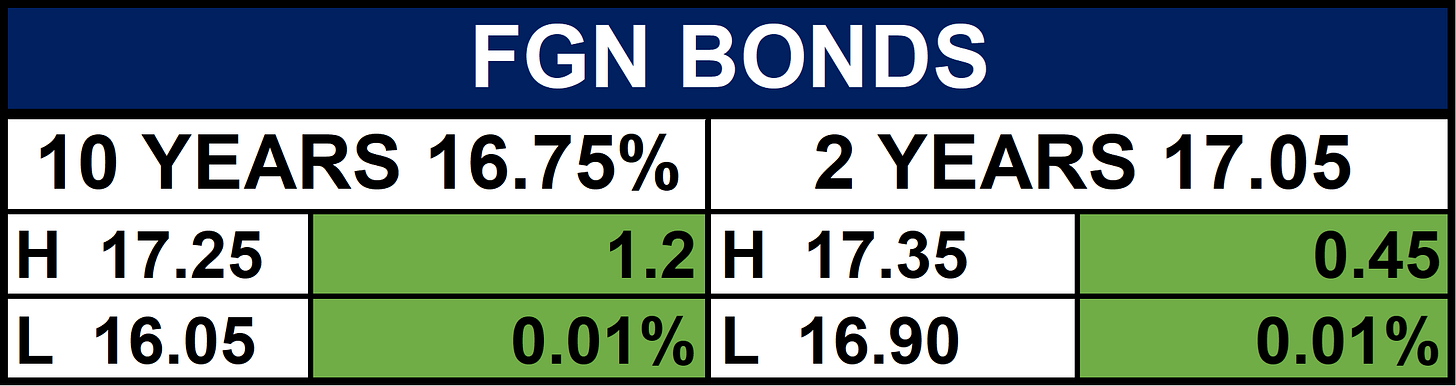

Fixed Income (FGN Bonds)

Global News & Market Update

Switzerland’s tariff shock-The 39% U.S. hit no one saw coming:

Switzerland faces a 39% U.S. import tariff starting August 7, shocking businesses and threatening exports and jobs. While industry groups warn of serious economic impact, analysts and trade officials remain hopeful for last-minute negotiations, with the Swiss-American Chamber of Commerce saying it’s not the end of discussions. - CNBC

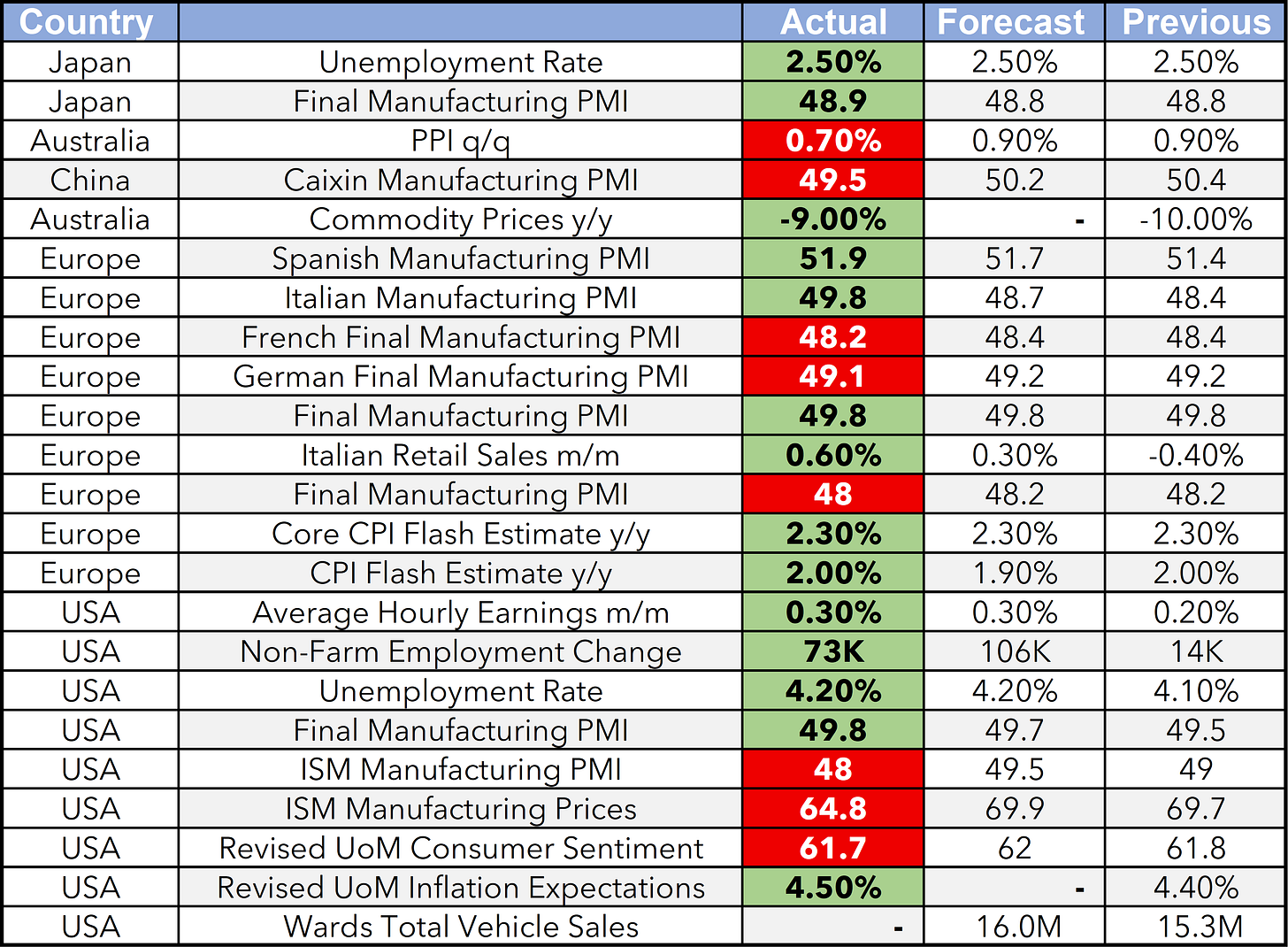

Dollar tumbles, traders price in more US rate cuts after weak jobs report:

The U.S. dollar fell after weak July jobs data showed only 73,000 jobs added, with June’s numbers revised down sharply. This led traders to increase bets on Federal Reserve rate cuts, possibly starting in September. The euro, yen, and Canadian dollar gained against the dollar, while the Swiss franc dropped amid news of a 39% U.S. tariff on Swiss imports. Markets now await the next jobs report to gauge the Fed’s next move. - Reuters

Euro zone inflation holds steady at higher-than-expected 2% in July:

Euro zone inflation stayed at 2% in July, above the expected 1.9%, while core inflation remained at 2.3%. Economic growth slowed to 0.1% in Q2, but the region showed resilience despite U.S. tariffs. The ECB is expected to keep interest rates steady, with no immediate cuts likely. - CNBC

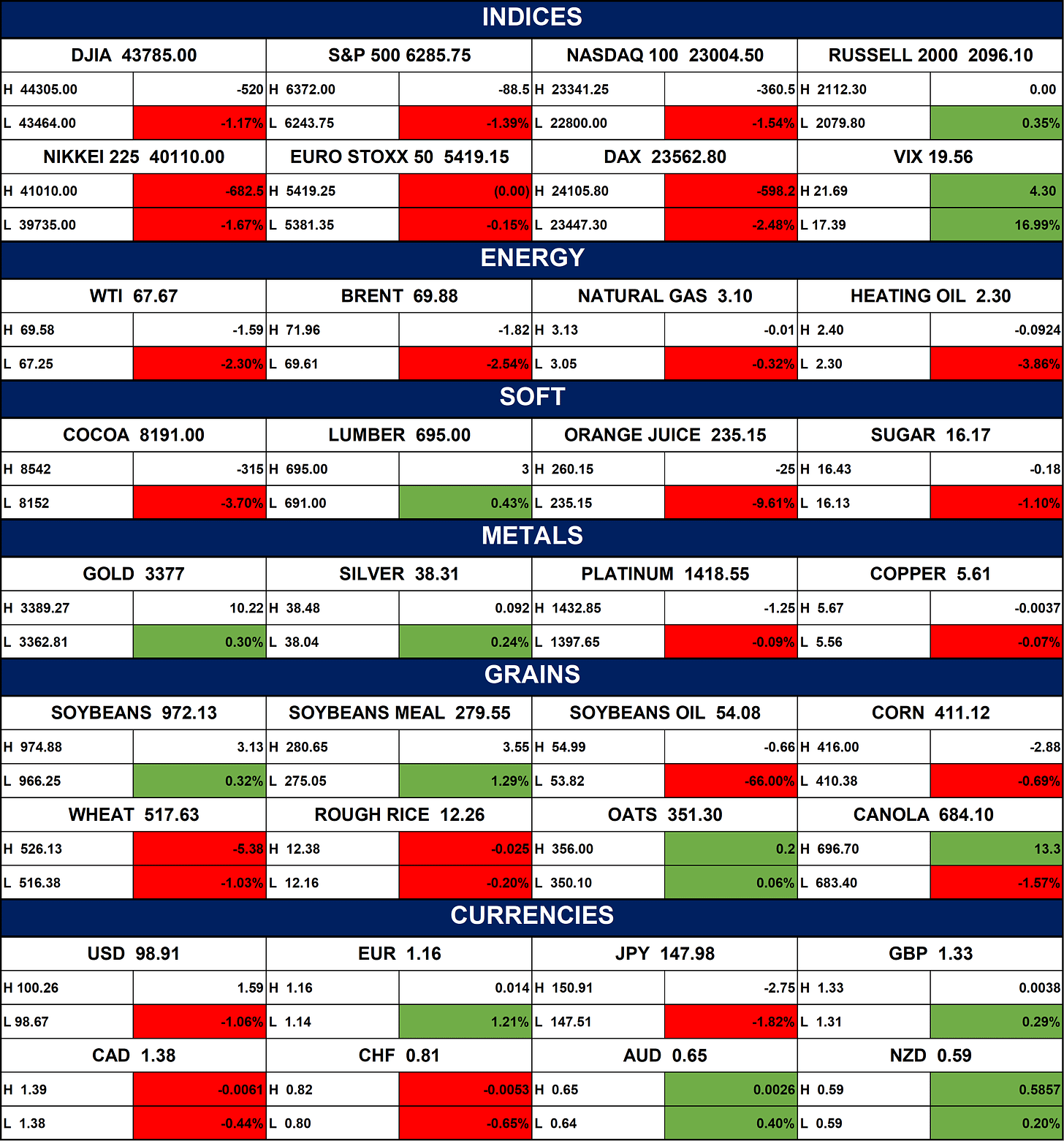

Indices, Commodities & Currencies

The table below Depicts that the Global markets declined amid risk-off sentiment, with equities, energy, and soft commodities falling, while volatility spiked and safe-haven assets like gold edged higher. The U.S. dollar weakened, boosting other major currencies, and grains showed mixed performance.

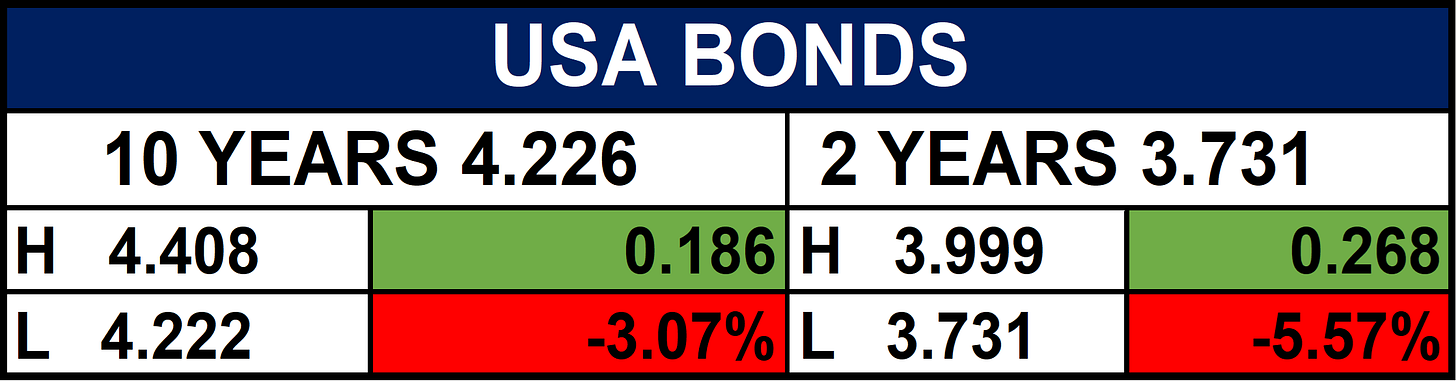

Fixed Income (USA Bonds)

Events

Conclusion

As we move into August, investors may see continued strength in Nigerian equities, especially with earnings season in full swing and reforms attracting foreign inflows. The stable naira and rising reserves could further support market sentiment. Globally, caution may persist due to soft U.S. jobs data, dollar weakness, and trade tensions particularly the surprise U.S. tariffs on Swiss goods. Investors should stay nimble, watching for central bank cues, inflation signals, and corporate earnings to guide positioning in both local and global markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.