Finance Friday- Nigeria Accelerates Market Reforms as Global Inflation Signals Shift Investor Sentiment

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick-off, where we track key shifts shaping Nigeria’s financial landscape and global risk sentiment. In this edition, we spotlight Nigeria’s move to a faster T+2 settlement cycle, major capital-raising plans across financial institutions, and emerging liquidity trends in the banking system. We also unpack global inflation signals, central bank policy expectations, and commodity movements that could influence near-term investor positioning.

Nigerian News & Market Update

CSCS goes live with T+2 settlement cycle:

Nigeria’s capital market has officially switched from T+3 to a faster T+2 trade settlement cycle, improving efficiency, liquidity, and aligning the market with global standards. - Punch

Guinea Insurance to raise ₦15billion additional capital:

Guinea Insurance plans to raise up to ₦15billion in new capital to meet the higher minimum capital requirements mandated by the NIIRA 2025 Act. - Punch

Access Holdings to raise ₦40billion via private placement:

Access Holdings plans to raise ₦40billion through a private placement, creating nearly 2 billion new shares to strengthen its capital base, subject to shareholder approval. - Punch

Banks Reduce Interest in CBN Placement as SDF Rate Falls :

Banks are cutting back deposits with the CBN after a rate-corridor adjustment reduced the Standing Deposit Facility (SDF) returns, pushing lenders to redirect liquidity toward private-sector credit and fixed-income markets. - Dmarketforces

Dangote contracts SAIPEM, EIL, others to expand fertiliser production:

Dangote Group is partnering with top global engineering firms to triple its urea production and build new fertiliser plants in Nigeria and Ethiopia, boosting Africa’s food security and industrial capacity. - TheSun

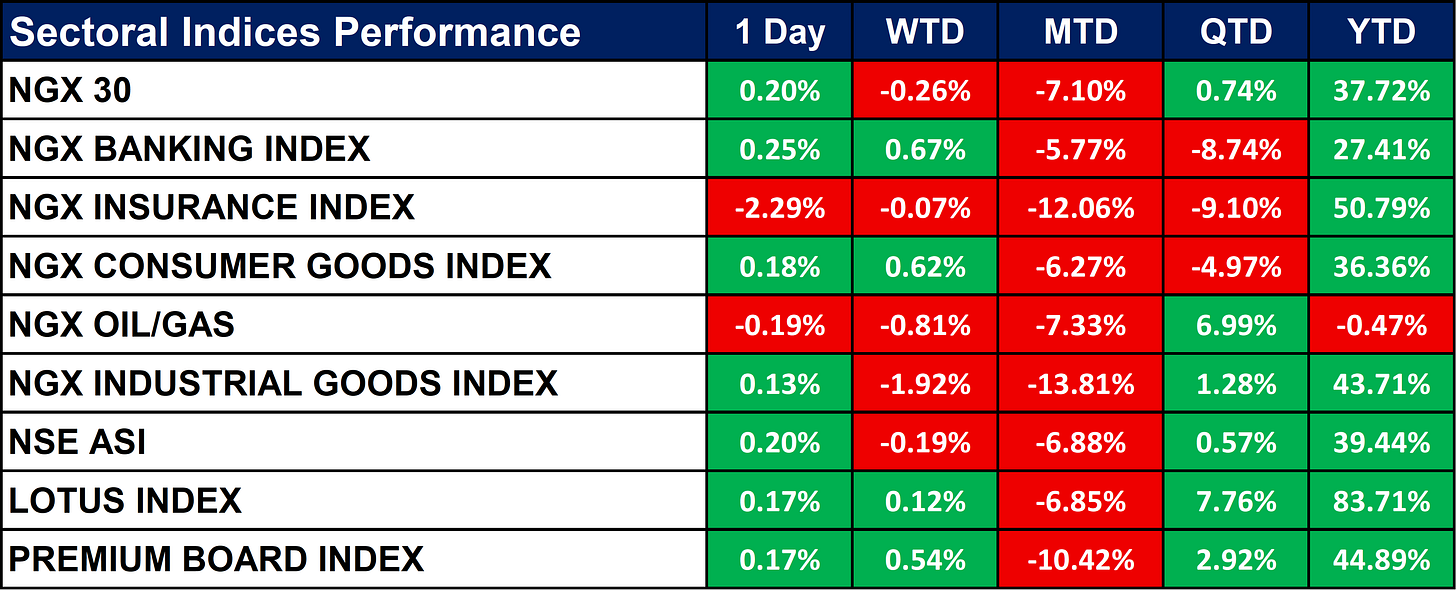

Nigeria Sectoral Indices Performance

The table below shows that the NGX Insurance Index was the weakest performer, showing sharp declines across MTD (-12.06%) and QTD (-9.10%) despite a strong YTD gain of 50.79%. Most sectors recorded positive YTD returns, led by the Lotus Index (+83.71%) and NGX 30 (+37.72%), indicating broad market strength. Daily performance was generally positive across all sectors, although short-term (MTD) momentum remains negative for nearly all indices.

Fixed Income (FGN Bonds)

Global News & Market Update

German inflation rises more than expected to 2.6% in November:

Germany’s inflation unexpectedly rose to 2.6% in November higher than the forecasted 2.4% signalling persistent price pressures in Europe’s largest economy. - Reuters

Core inflation in Japan’s capital brings BOJ closer to a rate hike:

Tokyo’s core inflation stayed elevated at 2.8% in November, strengthening expectations that the Bank of Japan may raise interest rates soon despite mixed economic signals. - Reuters

Colombia’s Ecopetrol to invest up to $7.2 billion in 2026:

Ecopetrol plans to invest 22–27 trillion pesos in 2026, maintaining disciplined spending as it targets steady production of up to 740,000 barrels per day. - Reuters

South Korea to cut planned income tax on dividend payouts:

South Korea’s ruling and opposition parties agreed to cap dividend income tax at 30%, lowering it from the proposed 35% to encourage investor-friendly payouts. - Reuters

Indices, Commodities & Currencies

The table below shows that the Global equity indices traded mostly higher, with strong gains across the DJIA, S&P 500, Nasdaq 100, Nikkei 225, and European markets, while the VIX declined sharply. Commodities showed mixed performance: energy prices inched up, metals rallied (especially platinum and copper), while soft commodities and grains posted a blend of mild gains and pullbacks. Currency markets were stable overall, with the USD slightly stronger, while EUR, JPY, GBP, CAD, and NZD showed marginal intraday fluctuations.

Fixed Income (USA Bonds)

Conclusion

Looking ahead, Nigeria’s recapitalisation wave, improved settlement efficiency, and shifting bank liquidity dynamics may drive renewed activity across equities, insurance, and fixed-income markets. Globally, firmer inflation readings in Germany and Japan signal a more hawkish monetary environment, while commodity volatility could shape sector-specific opportunities. Investors could watch for short-term pullbacks but expect medium-term momentum as capital-raising, policy shifts, and global macro trends continue to align.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.