Finance Friday- Nigeria Adjusts Fiscal and Monetary Policy as Global Markets Navigate Supply Shocks

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick-off. Nigeria’s market opens the day with major fiscal and monetary updates shaping investor sentiment, including the FG’s ₦185billion gas debt repayment and expanded CBN T-bill issuances.

Global markets remain active, with new cobalt export rules from Congo, corporate stress in China’s property sector, and increased crude buying by Chinese refiners.

Today’s newsletter highlights how these domestic and global shifts may influence liquidity, sector performance, and short-term market direction.

Nigerian News & Market Update

FG approves ₦185billion payment to gas producers:

The Federal Government has approved a ₦185billion payment to settle long-standing debts owed to gas producers, aiming to restore confidence, boost gas supply, and improve Nigeria’s power generation. - Punch

ITFC, TDB sign $100milliom trade facility, target $200million:

The International Islamic Trade Finance Corporation (ITFC) and the Trade and Development Bank Group (TDB) have expanded their partnership by adding $100million to an existing trade finance facility, aiming to scale it to $200million to boost trade, liquidity, and strategic commodity flows across member countries. - Punch

Federal Begins ₦185 billion Gas Legacy Debt Repayment:

The Federal Government has begun repaying ₦185billion in gas legacy debts to restore investor confidence, boost gas supply, and improve Nigeria’s power generation capacity. - Dmarketforces

CBN Upgrades Treasury Bills Offer Size, Adds New Auction:

The CBN has expanded its December Treasury Bills programme to ₦1.45trillion and added a new auction, raising 364-day yields to 17.50% as investor demand shifts heavily toward long-tenor bills. - Dmarketforces

Nigeria Sectoral Indices Performance

The table below shows that the Nigerian equities closed broadly positive, with most sector indices up on the day and week, led by Industrial Goods (+2.06%) and Premium Board (+1.80%). Month-to-date performance remains negative across all sectors, reflecting recent market pullbacks. Year-to-date returns stay strongly positive, with Lotus (+87.32%), Industrial Goods (+54.32%) and Insurance (+53.02%) outperforming.

Fixed Income (FGN Bonds)

Global News & Market Update

Congo sets new export conditions to keep tight grip on cobalt:

Congo has imposed stricter cobalt export rules requiring a 10% upfront royalty and new verification certificates creating uncertainty and delays for global producers. - Reuters

China Vanke seeks second onshore bond extension, skips call on separate 2028 note:

China Vanke is seeking extensions on two major onshore bonds and skipping a call option on a 2028 note as its financial pressures trigger further rating downgrades. - Reuters

India central bank cuts key rate, boosts liquidity to support ‘goldilocks’ economy:

India’s central bank cut the repo rate to 5.25% and signaled room for more easing as low inflation allows aggressive moves to support growth and liquidity. - Reuters

Chinese refiners buy oil from storage, raise output with fresh import quota: Chinese “teapot” refiners are rapidly boosting output by buying deeply discounted Iranian crude from bonded tanks using newly issued import quotas. - Reuters

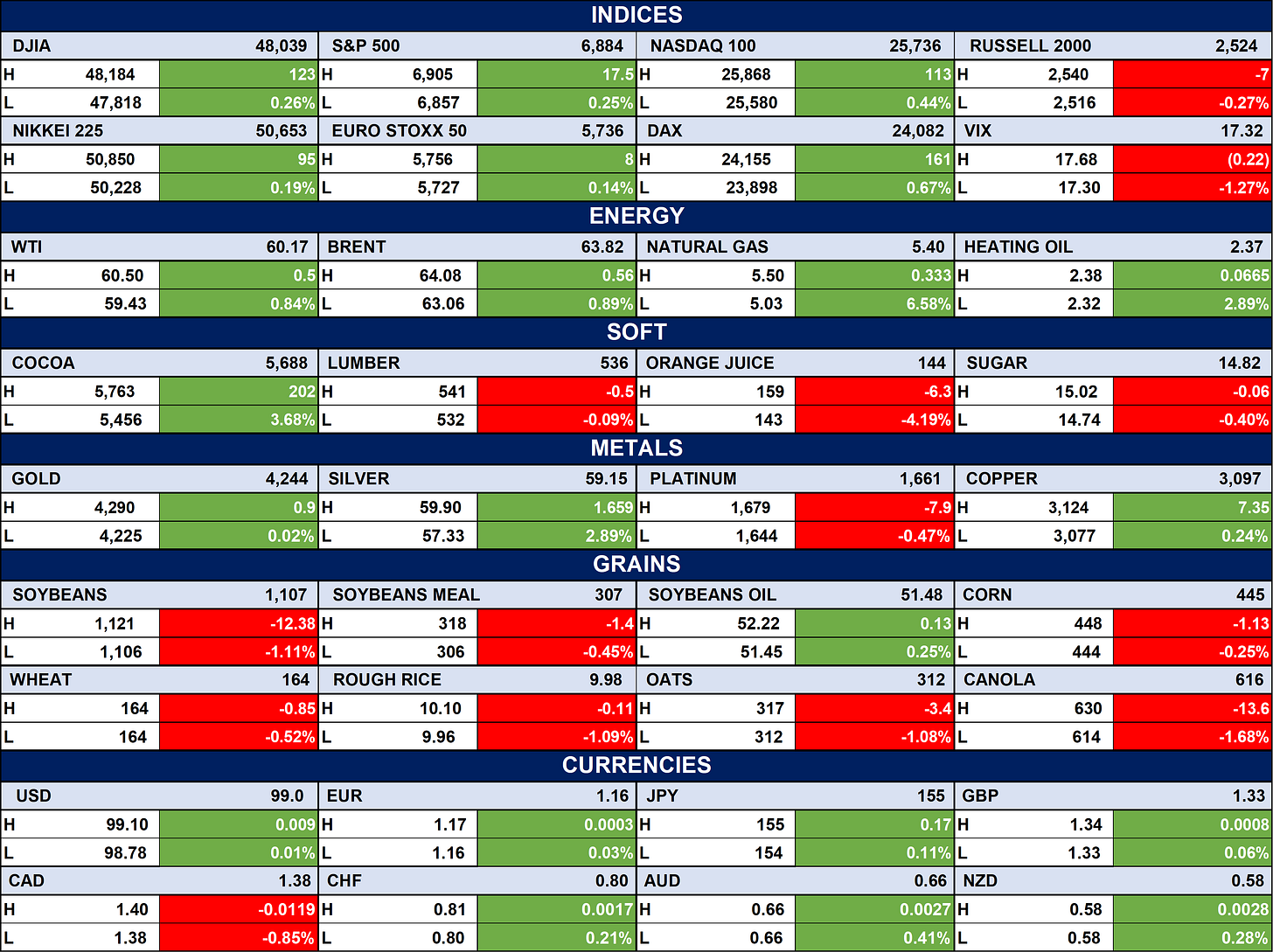

Indices, Commodities & Currencies

The table below shows that the Global equities were mostly positive, with major indices like the Dow, S&P 500, Nasdaq, DAX, and Nikkei posting modest gains.

Commodities were mixed energy futures (WTI, Brent, nat gas) edged higher, while softs and grains showed broad declines except cocoa and lumber.

Metals and currencies showed slight upward movement, led by gains in copper, silver, and modest strengthening across major FX pairs.

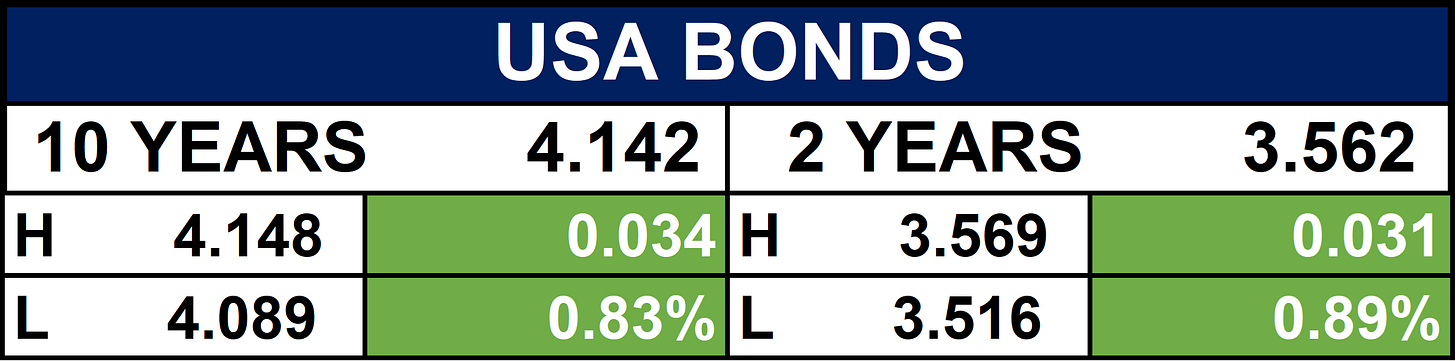

Fixed Income (USA Bonds)

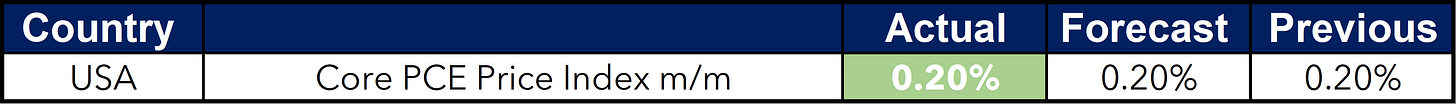

Event

Conclusion

As Nigeria strengthens gas supply payments and expands T-bill issuance, yields may stay elevated, supporting fixed-income demand while equities face mixed momentum.

Tightening cobalt supply and China’s refinancing pressures could influence commodity pricing and EM flows. Investors should prepare for moderate volatility and focus on fundamentally strong sectors amid shifting global risk appetite.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.