Finance Friday - Nigeria Cuts Telecom Tax & Fuel Prices; Banks Post Record Profits as Global Oil Surges

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening, investors. This week’s market wrap reflects a dynamic mix of local and global developments. In Nigeria, policy moves such as the removal of the telecom tax and Dangote Refinery’s fuel price cuts aim to ease inflationary pressures and support growth. The banking sector continues to benefit from higher interest rates, while corporate recapitalization drives resilience. On the global stage, oil prices spiked after fresh supply disruptions in Russia, central banks in Brazil and India signaled caution on rate cuts, and UK inflation expectations reached multi-year highs, testing monetary policy credibility. Meanwhile, energy and grains markets gained momentum, though metals dragged on overall sentiment.

Nigerian News & Market Update

FG scraps 5% telecom tax, users celebrate relief:

The Nigerian government has abolished the 5% excise duty on telecom services, including voice calls and data, to ease costs for over 171 million users. Introduced in 2022, the tax had drawn criticism for increasing communication expenses amid rising living costs. The removal aims to reduce financial strain, boost digital access, and support growth in the telecom sector, aligning with President Tinubu’s broader agenda to cut multiple taxation and promote technology and innovation. - Punch

CBN tightening pushes banks’ interest income to ₦15.4trillion – Afrinvest:

Nigerian banks’ interest income surged to ₦15.4trillion in 2024 due to CBN’s rate hikes, with pre-tax profits rising 65.7% to ₦6.2trillion. The Afrinvest 2025 Report noted banks have raised ₦2.5trillion towards recapitalization, while the sector grew 15% in Q1 2025. Afrinvest highlighted seven key industries to drive Nigeria past a $1trillion economy and urged channeling subsidy savings into infrastructure, power, education, and healthcare for inclusive growth. - Punch

OMO, Treasury Bills Yields Drop as Investors Increase Bets:

Average yields on the Nigerian Open Market Operations (OMO) and Treasury bills fell to 18.7% in the secondary market as excess liquidity fueled demand, especially for short- and long-tenor bills. Despite no new supply from the CBN, strong interest drove yield contractions, with OMO yields dropping to 25%. Analysts expect rates to ease slightly in September, supported by ₦788.54billion net repayments, though high government borrowing and CBN’s policy stance could limit the decline. - dmarketforces

Dangote Refinery slashes pump prices:

Dangote Petroleum Refinery will launch CNG-powered trucks on September 15 to cut fuel distribution costs and lower pump prices, with fuel set at ₦841 in Lagos/South-West and ₦851 in Abuja, Rivers, Delta, Edo, and Kwara. The initiative, expected to save Nigeria ₦1.8trillion annually, will first cover major states before nationwide rollout. Backed by a ₦720billion investment, it aims to ease inflation, support 42 million MSMEs, revive dormant filling stations, and create new jobs, while calling for stakeholder partnerships to maximise impact. - TheNation

Central Bank, Securities Exchange Approve Wema Bank’s ₦150billion Rights Issue:

Wema Bank has successfully raised ₦150billionn through a rights issue, approved by the CBN and SEC, enabling it to surpass the ₦200billion minimum capital requirement for national banks ahead of the 2026 deadline. Alongside a pending ₦50billion private placement, the bank’s capital base has been strengthened to enhance resilience and support growth. MD/CEO Moruf Oseni said the achievement reflects strong shareholder confidence and positions Wema Bank for long-term stability and value creation. - Leadership

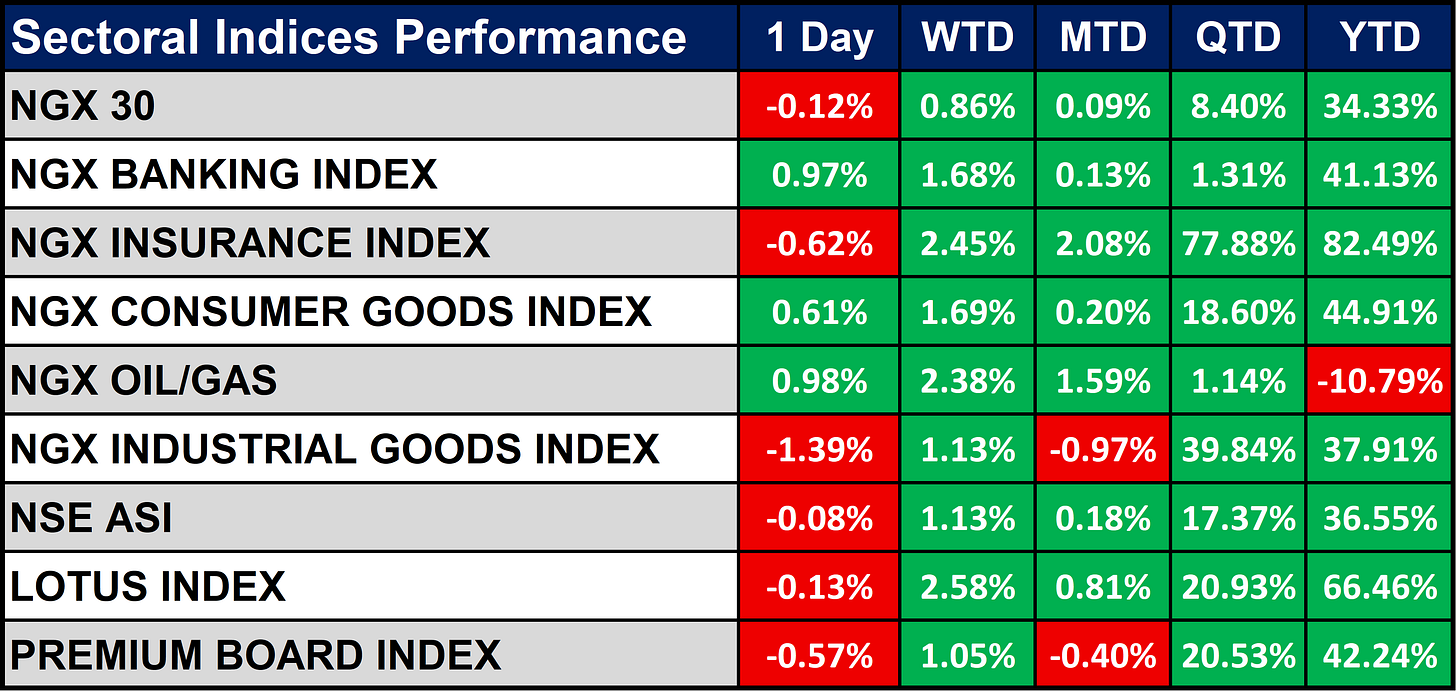

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices show mixed daily moves, but performance is strong overall. Insurance and Lotus indices are the biggest gainers year-to-date, while Oil/Gas is the only sector in negative territory. Overall, the market remains broadly positive with Insurance leading growth.

Fixed Income (FGN Bonds)

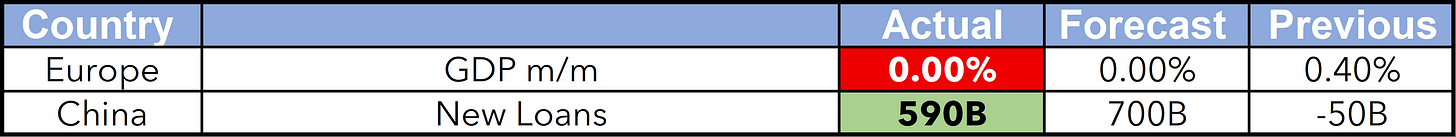

Global News & Market Update

Oil jumps nearly 2% after drones strike Russian terminal:

Oil prices rose nearly 2% after a Ukrainian drone strike on Russia’s Primorsk oil terminal, disrupting exports and heightening supply risks. Brent traded at $67.39 and WTI at $63.45, reversing losses from the previous session. Analysts warned that further attacks and sanctions could cut Russian crude flows despite oversupply concerns and weaker U.S. demand. Meanwhile, the IEA projected stronger global supply growth due to OPEC+ output, while OPEC maintained high demand forecasts. India’s Adani Group also banned Western-sanctioned tankers, potentially limiting Russian oil shipments, even as India remains Moscow’s top seaborne buyer. - Reuters

Brazil's central bank to keep rates unchanged at 15% on September 17:

Brazil’s central bank is expected to hold its benchmark Selic rate at 15% on September 17, marking a second straight pause after aggressive hikes since 2024. Despite a recent dip in monthly inflation (-0.11% in August), annual inflation remains at 5.13%, above the 3% target. Policymakers cite tight labor markets, sticky services inflation, and global uncertainties including new U.S. tariffs on Brazil as reasons for caution. Economists see rate cuts beginning gradually from December 2025 or early 2026, with the Selic projected to fall to 14.25% by Q1 2026. - Reuters

India's inflation edges up, but rate-cut bets stay alive:

India’s retail inflation rose to 2.07% in August, up from 1.61% in July, mainly due to higher prices for vegetables, meat, fish, and other essentials. Food inflation still declined 0.69% year-on-year, though at a slower pace than July. Core inflation held steady around 4.1%. With inflation well within the RBI’s 2–6% target range, economists expect the central bank to hold rates in October but possibly cut by 25–50bps from December if growth weakens further, especially under pressure from U.S. tariffs on Indian exports. - Reuters

UK public's long-term inflation expectations rise to highest since 2019:

UK inflation expectations rose in August, with the public seeing 3.8% inflation in five years (highest since 2019) and 3.6% over the next year, according to a Bank of England survey. This could worry policymakers ahead of next week’s rate decision, as higher expectations may fuel wage and price pressures. Public satisfaction with the BoE’s handling of inflation fell but remains above recent years. Actual consumer inflation hit 3.8% in July, and the BoE expects it to peak at 4% in September before easing back to target by 2027. Markets see little chance of another rate cut soon. - Reuters

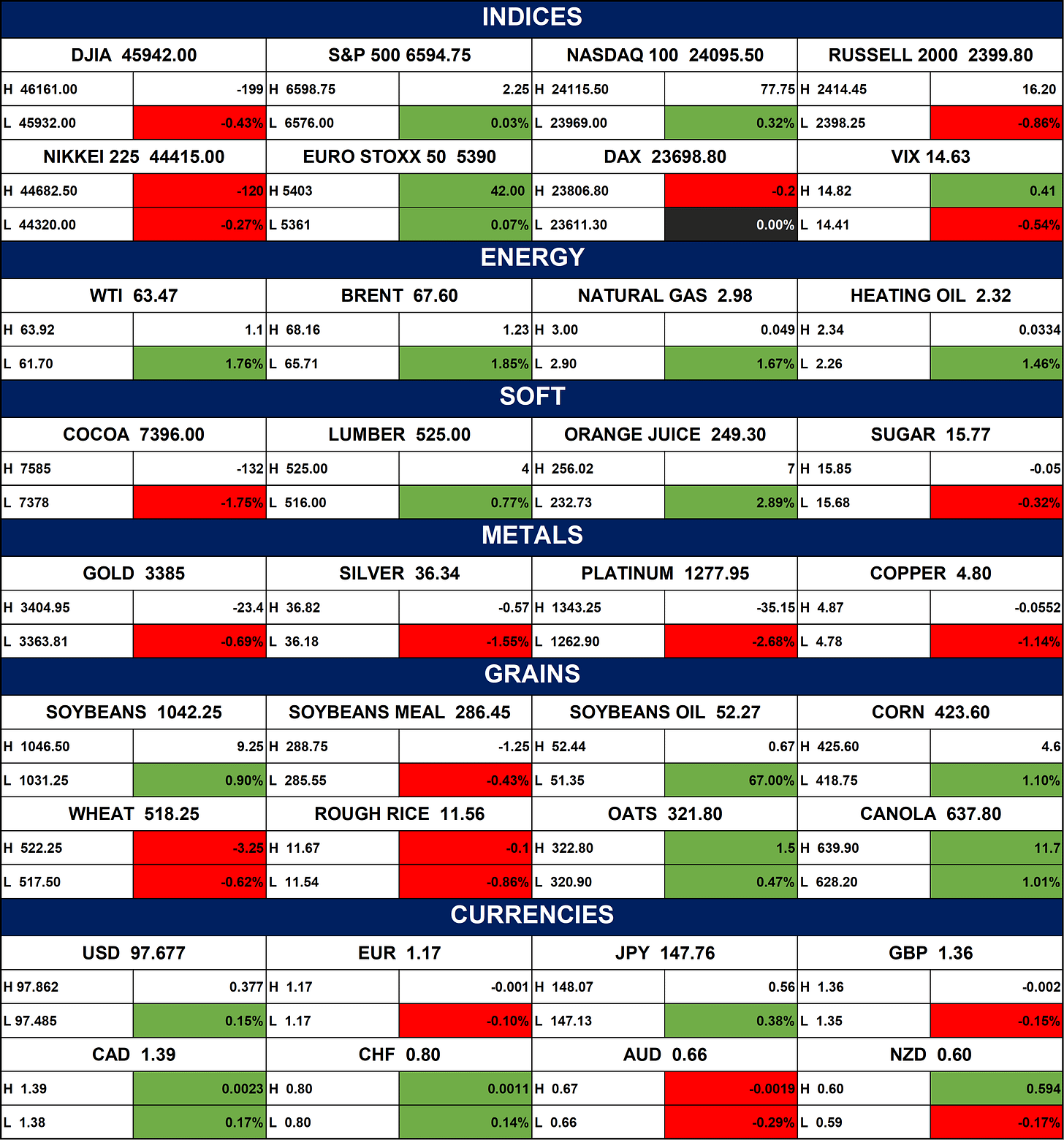

Indices, Commodities & Currencies

The table below Depicts that the Global markets were mixed, with U.S. equities showing slight weakness while European indices held steady. Energy prices rose strongly, led by oil and natural gas, while grains such as soybeans and corn also gained. In contrast, metals declined, with gold, silver, and platinum all lower. Soft commodities were mixed, as orange juice rallied but cocoa fell. In currencies, the U.S. dollar strengthened slightly, supported by gains in the yen and Canadian dollar, while the euro, pound, and Australian dollar slipped. Overall, momentum favored energy and grains, while metals weighed on sentiment.

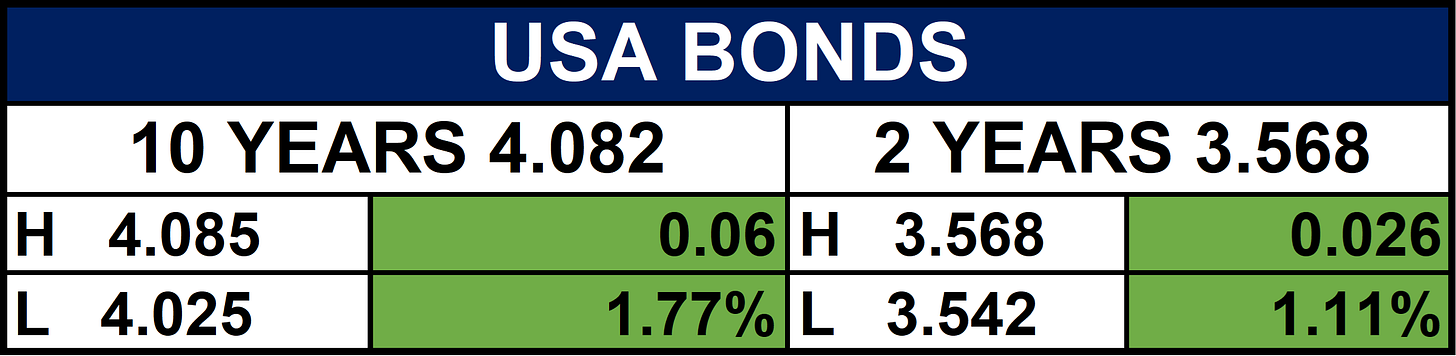

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, investors should watch for sustained policy support in Nigeria, which may boost banking, telecoms, and consumer sectors. Oil and gas remain volatile globally, with geopolitical risks likely to keep energy markets tight. Inflation dynamics will continue to guide central banks in major economies, suggesting near-term caution but potential easing later in 2025. For Nigerian equities, the Insurance and Lotus indices’ strong YTD gains highlight sectoral resilience, though Oil/Gas weakness remains a drag. Globally, energy and grains could sustain momentum, while metals may stay pressured. Overall, the coming weeks may see cautious optimism, with selective opportunities in resilient sectors and commodity-linked plays.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.