Finance Friday- Nigeria Equities Ease Amid Strong YTD Gains; Ample Liquidity Anchors Rates as Global Trade Sentiment Improves

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap, where we unpack key developments shaping both the Nigerian and global markets. Today’s newsletter highlights rising system liquidity, major capital market fundraisings, and policy actions influencing investment flows locally. We also explore global trade shifts, energy deals, and market performance trends to help investors stay informed and positioned ahead of the week.

Nigerian News & Market Update

Excess Liquidity in Financial System Hits ₦5trillion, Rates Swing:

Excess liquidity in Nigeria’s financial system surged to about ₦5 trillion, keeping short-term interest rates relatively low despite rising funding costs and limited CBN intervention. - dmarketforces

Lagos Opens ₦200 billion Bond for Investors Subscriptions:

Lagos State has opened a ₦200 billion bond issuance, offering 16.15%–16.25% to fund key infrastructure projects, backed by strong the Internally Generated Revenue (IGR) growth and high credit ratings. - dmarketforces

CRC appoints new Executive Director:

CRC Credit Bureau has appointed Mrs. Jelilat Kareem as its first Executive Director, recognising her long-standing contributions and reinforcing the company’s commitment to strong leadership and corporate governance. - Punch

Presco plans ₦237 billion rights issue:

Presco Plc is raising ₦237 billion through a rights issue to fund working capital, strategic acquisitions, and expansion, offering shareholders 1 new share for every 6 held at ₦1,420 each. - TheGuardian

Ellah Lakes receives SEC approval for ₦235 billion public offer:

Ellah Lakes has secured SEC approval for a ₦235 billion public offer to fund the acquisition of the Agric-Resources and Products Nigeria Limited (ARPN) and expand its agro-industrial capacity, boosting its oil palm and cassava operations. - BusinessDay

Customs Launch E-Cargo Tracking System At Apapa Port For Trade Facilitation:

The Nigeria Customs Service has launched an Electronic Cargo Tracking System (ECTS) to enable real-time monitoring of container movement, enhance security, and streamline trade, starting with a pilot at Apapa Port. - Leadership

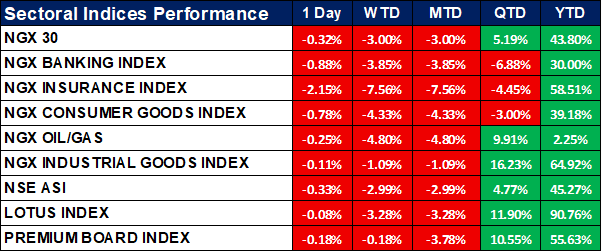

Nigeria Sectoral Indices Performance

The table below shows that the NGX market closed broadly negative, with all sector indices in the red for the day, week-to-date, and month-to-date.

Industrial Goods and Oil & Gas remain the strongest performers on a quarterly and yearly basis, up 16.23% QTD and 64.92% YTD, and 9.91% QTD respectively.

Despite short-term declines, long-term performance remains robust, with the NSE ASI up 45.27% YTD and the Lotus Index leading at 90.76% YTD.

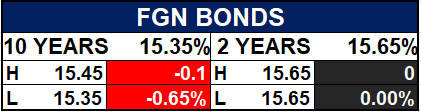

Fixed Income (FGN Bonds)

Global News & Market Update

China restores soybean licenses for U.S. firms, ends log ban:

China will restore U.S. soybean import licences and lift its ban on U.S. log imports from Nov. 10, signalling easing trade tensions despite remaining tariffs. - Reuters

Afreximbank approves $1.3 billion loan for Angola fertiliser plant:

Afreximbank has approved $1.3 billion to support Angola’s $2 billion fertiliser plant project, set to boost local production and reduce import dependence by 2027. - Reuters

China lifts Brazilian poultry imports ban over bird flu:

China has lifted its nationwide ban on poultry imports from Brazil after concluding its avian flu risk assessment. - Reuters

German exports rise more than expected in September on US increase:

German exports rose 1.4% in September, driven by a rebound in U.S.-bound shipments, though trade remains below pre-tariff levels and exports to China continue to decline. - Reuters

Bank of Mexico cuts interest rate, tone turns more cautious:

Mexico’s central bank cut its benchmark rate to 7.25% but signaled caution on further easing due to stubborn core inflation despite economic weakness. - Reuters

Greece signs first long term LNG supply deal with US:

Greece has signed its first long-term U.S. Liquefied Natural Gas (LNG) supply deal to import 0.7 Billion Cubic Metres (bcm) annually from 2030, supporting efforts to replace Russian gas in Europe. - Reuters

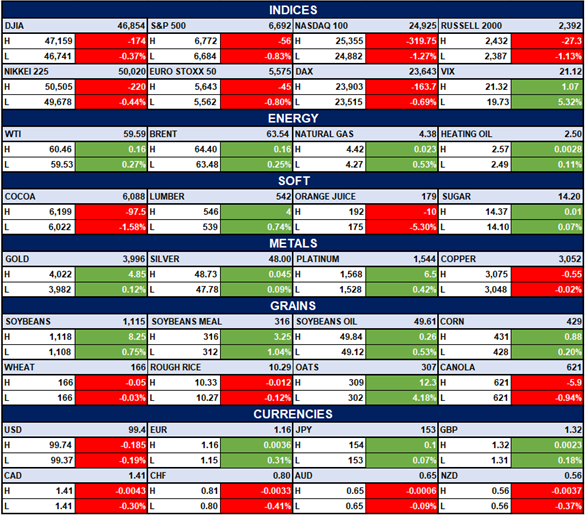

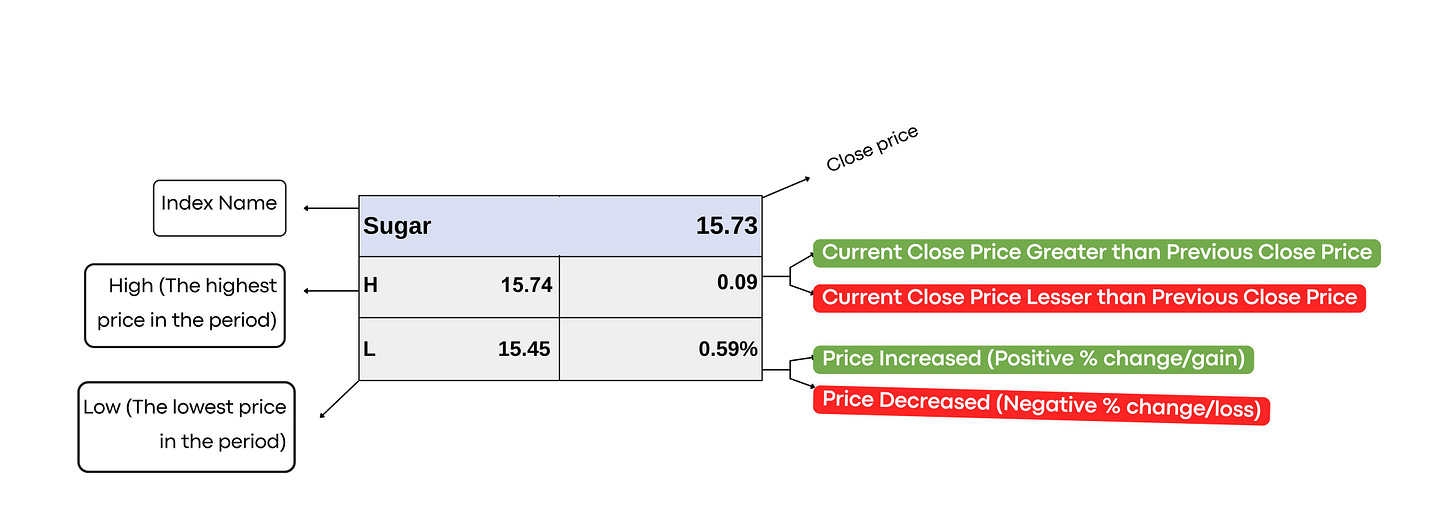

Indices, Commodities & Currencies

The table below shows that the Global equities mostly traded lower, with major indices like the S&P 500, Nasdaq and Euro Stoxx 50 declining, while volatility (VIX) jumped. Energy prices were slightly higher, with WTI, Brent and Natural Gas posting modest gains. Soft commodities were mixed cocoa and orange juice fell sharply, while metals and grains saw mild gains and the USD weakened against EUR and GBP.

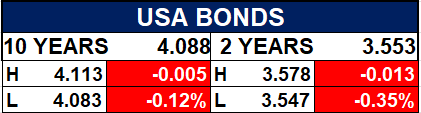

Fixed Income (USA Bonds)

Conclusion

With excess liquidity keeping yields suppressed and multiple corporate capital raises underway, investors could expect continued activity in primary markets and selective buying in fundamentally strong stocks. Globally, easing trade tensions and new energy supply deals may support risk sentiment, though inflation and policy signals remain key market drivers. Overall, cautious optimism is advised focus on quality names, monitor fixed income yields, and stay alert to shifts in global macroeconomic trends that could influence local markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.