Finance Friday - Nigeria Market Wrap: Seplat JV, FG Pension Bond; EU LNG Ban, Kenya-US Trade Talks, Uganda Debt Rise

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to your Friday market wrap up. Today’s newsletter covers key Nigerian market updates including Seplat’s JV restructuring, VFD Group’s debt redemption, FG’s pension bond issuance, and Aradel’s ratings outlook. We also highlight sectoral index performance and major global developments, from EU sanctions on Russian LNG to Kenya’s trade talks with the U.S., Uganda’s rising debt, and Japan’s inflation trends.

Nigerian News & Market Update

Seplat Mulls 10% SEPNU Joint Venture Sale To NNPCL:

Seplat Energy is negotiating with NNPC to sell a 10% stake in their JV, leaving Seplat with 30% and NNPC with 70%. The company targets 200,000 boepd by 2030, $5–6billionn cash flow, and lower costs through major investments in wells and gas projects. - Channels

VFD group delivers ₦20billionn commercial paper with ₦4.2billion redemption:

VFD Group redeemed its ₦4.24billion Series 4 Commercial Paper, backed by strong earnings and assets. The firm said the move reflects solid liquidity management and supports its long-term growth strategy. - DailyTrust

FG to Issue ₦758billion bond to clear pension liabilities – PenCom:

The FG plans to issue a ₦758billion bond by early October to settle pension arrears as part of broader reforms to strengthen coverage, governance, and retiree protection. - Punch

Court stops NUPENG’s bid to shut down Dangote refinery, others over dispute:

The Industrial Court has barred NUPENG and trucking drivers from striking or disrupting Dangote Refinery operations, ordering them to maintain services pending resolution of the case. - TheSun

GCR Affirms Aradel Holdings AA-, A1+ Ratings with Stable Outlook:

GCR affirmed Aradel Holdings’ AA-(NG)/A1+(NG) ratings with a stable outlook, citing strong cash flow, low debt, and growth from recent acquisitions, with margins expected to rebound by 2026. - dmarketforces

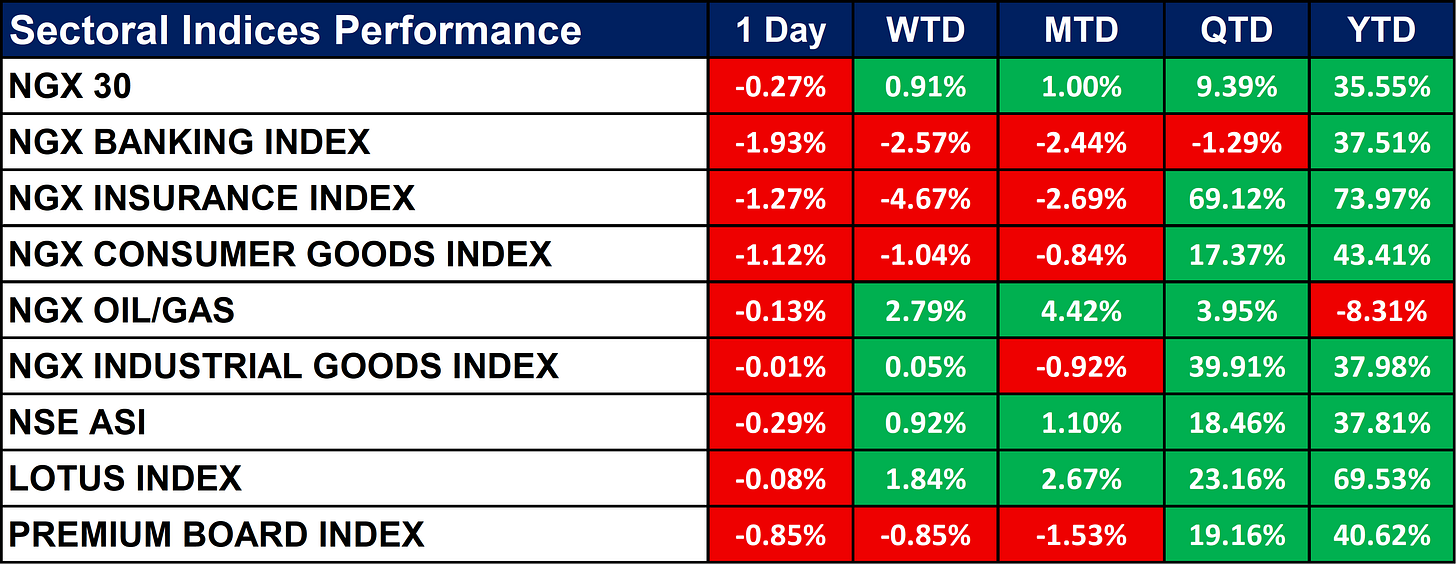

Nigeria Sectoral Indices Performance

The table below shows that the The NGX sectoral indices closed mostly negative on a 1-day basis, led by Banking (-1.93%) and Insurance (-1.27%). Week-to-date, Oil/Gas (+2.79%) and Lotus (+1.84%) gained, while Insurance (-4.67%) was the worst performer. Year-to-date, Insurance (+73.97%) and Lotus (+69.53%) lead the market, while Oil/Gas (-8.31%) is the only laggard.

Fixed Income (FGN Bonds)

Global News & Market Update

After Trump pressure, EU aims to bring forward Russian LNG import ban:

The EU will ban Russian LNG imports by Jan 2027, a year earlier than planned, as part of new sanctions to cut Moscow’s war revenues. The move, pushed by U.S. pressure, may raise EU reliance on American LNG as Russia’s share of imports falls. - Reuters

Kenya seeks to strike US trade deal by year-end, trade minister says:

Kenya aims to finalize a US trade deal by year-end to safeguard exports and textile jobs if AGOA expires, following recent tariffs and trade tensions. - Reuters

Uganda's debt surges 26% on back of larger domestic borrowing:

Uganda’s public debt rose 26% to $32.3billion in 2024/2025, driven by higher domestic borrowing, pushing debt-to-GDP to 51.3% and raising repayment concerns. - Reuters

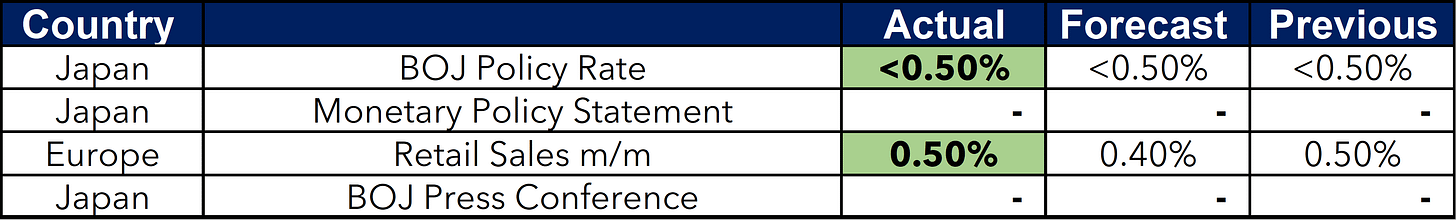

Japan's core inflation slows in August, stays above BOJ target:

Japan’s core CPI rose 2.7% in August, the slowest in nine months, while the BOJ is expected to keep rates at 0.5% amid cautious inflation monitoring. - Reuters

After Trump pressure, EU aims to bring forward Russian LNG import ban:

The EU will ban Russian LNG imports by Jan 2027 to cut Moscow’s war revenues, a move pushed by Trump that may raise reliance on U.S. LNG. - Reuters

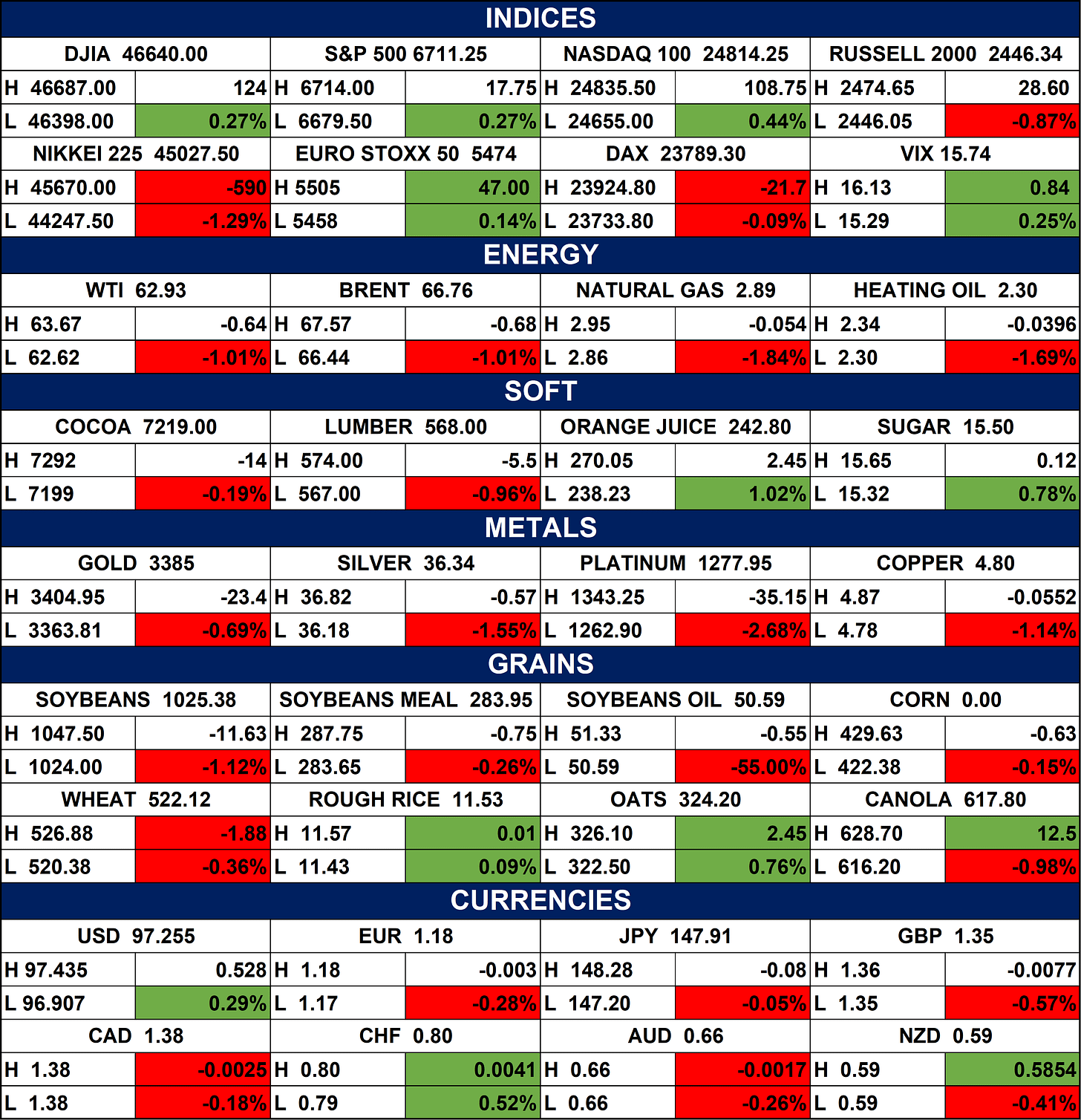

Indices, Commodities & Currencies

The table below Depicts the Global equities were mixed: U.S. indices gained modestly while Japan’s Nikkei fell sharply. Energy markets slid, with WTI, Brent, and Natural Gas all down, while Orange Juice and Sugar posted gains among soft commodities.

Metals and grains mostly declined, though Oats and Rough Rice edged higher; currencies were stable with slight USD strength.

Fixed Income (USA Bonds)

Events

Conclusion

In Nigeria, corporate actions and government reforms continue to shape market sentiment, with Insurance and Lotus leading YTD gains despite short-term pressures. Globally, shifting trade dynamics, sanctions, and inflationary signals remain in focus, underscoring a complex but opportunity-filled environment for investors. Staying agile and informed will be critical as both domestic reforms and global headwinds drive the next phase of market activity.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.