Finance Friday - Nigeria Sees Export Growth and Leadership Change as Oil/Gas Rebounds; Global Focus on India Policy, Netflix Backlash, and U.S. Data Halt

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s markets stayed highly liquid with ₦7.1trillion in system surplus, stable rates, and equities broadly positive led by Oil & Gas. Non-oil exports grew 25% in Q1, Stanbic appointed a new CEO, Ellah Lakes expanded in palm oil, and rig activity lifted output. Globally, India resumed rice bran exports, while the U.S. shutdown delayed jobs data, froze infrastructure funds, and sparked volatility, with Netflix briefly hit by an Elon Musk-led boycott.

Nigerian News & Market Update

Banks Placements with CBN Spike as Liquidity Surplus Hits ₦7trillion:

System liquidity hit ₦7.11trillion as CBN withheld the Open Market Operations (OMO) auctions, with banks placing ₦6.08trillion in its deposit facility. Rates stayed stable (OPR 24.5%, ON 24.9%) while the Nigerian Interbank Treasury Bills True Yield (NITTY) yields eased on strong demand. Excess liquidity continues to pressure yields lower. - dmarketforces

NEPC – Nigeria’s Non-Oil Export Hits $1.79billion in Q1, 2025:

Nigeria’s non-oil exports rose 25% to $1.79billion in Q1 2025, driven by sesame seed. NEPC urged better standards, traceability, and farmer training to curb rejections. Farmers seek aggregation centres and support to boost earnings. - dmarketforces

Stanbic IBTC Holdings Appoints Nwokocha As Substantive GCEO:

Stanbic IBTC named Chukwuma Nwokocha Group CEO from Oct 2, 2025.

Adedeji, who delivered record results and recapitalisation, returns as executive director. Nwokocha brings 30+ years’ banking leadership across Africa. - LeadershipNigeria’s Active Drilling Rigs Hit 50 From 31:

Nigeria raised active rigs to 50 by July 2025, pushing crude output to 1.7–1.83mbpd. Reforms and IOC divestments attracted $5.5billion investments to add 200,000bpd. Govt pledges investor-friendly policies and regional energy leadership. - Leadership

Ellah Lakes to acquire Tolaram’s ARPN in major expansion push:

Ellah Lakes will acquire ARPN, gaining 11,000+ hectares of plantations.

The deal doubles its palm oil capacity and supports diversification.

Completion is due Dec 2025, pending regulatory approval. - BusinessDay

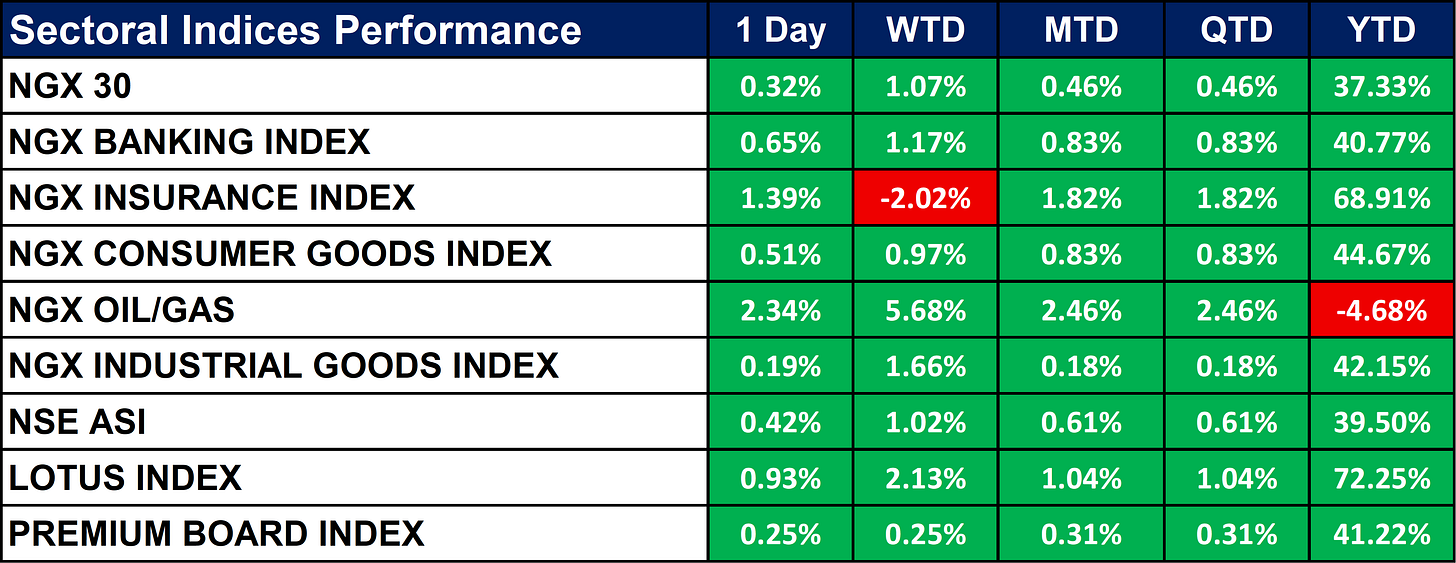

Nigeria Sectoral Indices Performance

The table below shows that the NGX market closed broadly positive, led by Oil/Gas (+2.34%) and Insurance (+1.39%) on the day. Week-to-date, Oil/Gas gained the most (+5.68%), while Insurance lagged (–2.02%).

Year-to-date, all indices remain positive except Oil/Gas (–4.68%), with Lotus Index (+72.25%) and Insurance (+68.91%) leading gains.

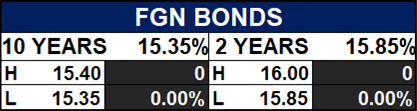

Fixed Income (FGN Bonds)

Global News & Market Update

India allows exports of de-oiled rice bran after two-year ban:

India lifted its two-year ban on de-oiled rice bran exports.

The move boosts cattle feed, rice bran oil output, and farmer earnings.

It also supports milling profitability and cuts oil import reliance. - ReutersElon Musk is telling his followers to cancel Netflix subscriptions.:

Elon Musk urged a Netflix boycott over a transgender-themed show, sending shares down 4%. Analysts say the backlash won’t significantly affect subscribers or revenue. They expect the controversy to be short-lived. - CNBC

Trump admin freezes $2.1 billion for Chicago projects, blames Democrats for shutdown holdup:

Trump administration froze $2.1billion Chicago transit funds over race/gender contracting review. Similar freezes hit $18billion in New York and $8billion in Democratic states. The Department of Transportation (DOT) blames Democrats for the shutdown; critics call it political targeting. - CNBC

Payroll data on ice gives Wall Street newfound free time, but a big problem reading the economy:

The U.S. jobs report was halted by the government shutdown. Its absence raises market risk, with payrolls seen as crucial data. Traders may exit positions if delays persist beyond mid-October. - Reuters

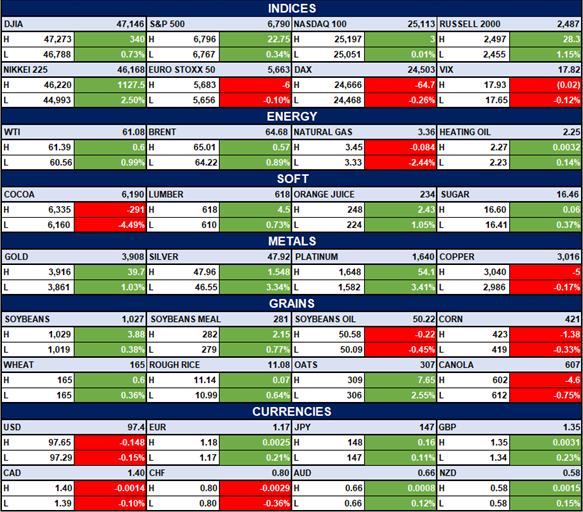

Indices, Commodities & Currencies

The table below Depicts that the U.S. equities closed mixed, with the DJIA up 0.73%, S&P 500 up 0.34%, and NASDAQ gaining 0.01%, while European markets slipped as the Euro Stoxx fell (-0.10%) and the DAX declined (-0.26%). In commodities, energy prices was mixed with WTI up 0.99%, Brent up 0.89%, and Natural Gas lower by (-2.44%), while metals strengthened, led by Gold up 1.03% and Silver up 3.34%. The U.S. dollar fell slightly( -0.15)%.

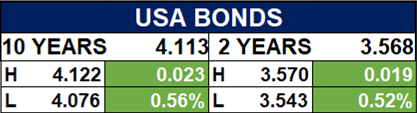

Fixed Income (USA Bonds)

Conclusion

Nigerian markets are supported by robust liquidity, strong export performance, and corporate activity in banking and agriculture. While Oil & Gas remains a laggard, policy reforms and rising rig activity signal potential medium-term upside. Globally, investor focus will remain on U.S. politics and the Fed’s policy path amid missing jobs data. Meanwhile, India’s export shift may benefit commodity-linked sectors. Overall, Nigerian equities may be positioned for steady gains in Q4, though external volatility warrants caution.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.