Finance Friday - Nigeria Strengthens Financial Stability as Global Markets Advance on Record ETF Inflows and Policy Adjustments.

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigerian markets remained active amid strong capital raises, rising forex turnover, and sectoral reforms aimed at boosting investor confidence. Globally, cautious optimism persists as central banks enhance transparency, commodity prices fluctuate, and global fund flows hit record highs.

Nigerian News & Market Update

Wema Bank Completes ₦50 Billion Private Placement:

Wema Bank raised ₦50billion via private placement, lifting total capital to ₦264.87billion above CBN’s ₦200billion requirement to boost growth and digital expansion. - dmarketforces

Nigeria’s Forex Market Turnover Rises by 56% to $8.6billion—CBN:

Nigeria’s forex turnover rose 56.4% to $8.6billion in 2025, driven by CBN reforms that boosted reserves to $43.4billion and investor confidence. The government projects 7% GDP growth by 2027–2028, supported by diversification and infrastructure investments. - dmarketforces

Nigeria’s oil output hits 454million barrels in nine months – Report:

Nigeria produced 454.28 million barrels of crude and condensates in the first nine months of 2025, averaging 1.66 mbpd below its Organization of the Petroleum Exporting Countries (OPEC) quota due to strikes and maintenance downtime. - Punch

CBN, Bank of Angola sign pact to boost bilateral financial cooperation:

The CBN and Bank of Angola signed an Memorandum of Understanding (MoU) to boost bilateral cooperation, strengthen financial stability, and enhance capacity building across key central banking areas. - Punch

Dangote refinery slashes crude intake:

Dangote Refinery has cut crude purchases by over 50% to below 300,000 barrels per day due to operational setbacks, raising concerns about fuel supply and higher petrol prices. - Punch

GCR Affirms Airtel Nigeria AAA/A1+ Ratings, Outlook Stable:

GCR affirmed Airtel Nigeria’s AAA rating with a stable outlook, highlighting strong performance and group support despite high debt and FX challenges. - dmarketforces

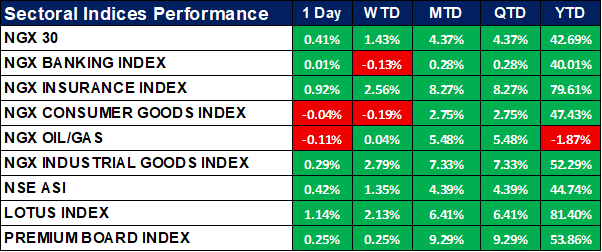

Nigeria Sectoral Indices Performance

The table below shows that the NGX All-Share Index gained 0.42% today, supported by strong performances in insurance (+0.92%) and industrial goods (+0.29%) sectors.

Banking and consumer goods indices were flat to mildly negative, while oil & gas dipped slightly by 0.11%. Year-to-date, market sentiment remains bullish, with the insurance (+79.6%) and lotus (+81.4%) indices leading overall gains.

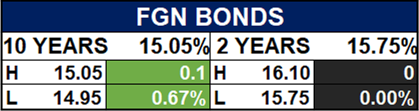

Fixed Income (FGN Bonds)

Global News & Market Update

High prices, bad quality slow down Ivory Coast cocoa purchases, sources say:

Cocoa purchases in Ivory Coast have stalled as record farmgate prices and poor-quality stocks create a liquidity crunch, deterring buyers and exporters. - Reuters

Bank of England to explain rates decisions in more detail from November:

The Bank of England will enhance transparency from next month by providing more detailed explanations of its monetary policy decisions and individual MPC members’ views. - Reuters

China allows more biofuel firms to export green aviation fuel, sources say:

China approved three more biofuel refiners to export sustainable aviation fuel, boosting 2025 export quotas to about 1.2 million tons and positioning Europe as a key market. - Reuters

Italy’s 2026 budget entails tax cuts and spending hike worth 18.7 billion euros:

Italy’s 2026 budget includes €18.7 billion in tax cuts and spending increases, with plans to boost defence without reducing welfare. - Reuters

Flows into US ETFs cross $1 trillion at record pace:

U.S. exchange-traded funds have attracted over $1 trillion in inflows this year, setting a record pace as investors shift from mutual funds to low-cost, liquid ETFs. - Reuters

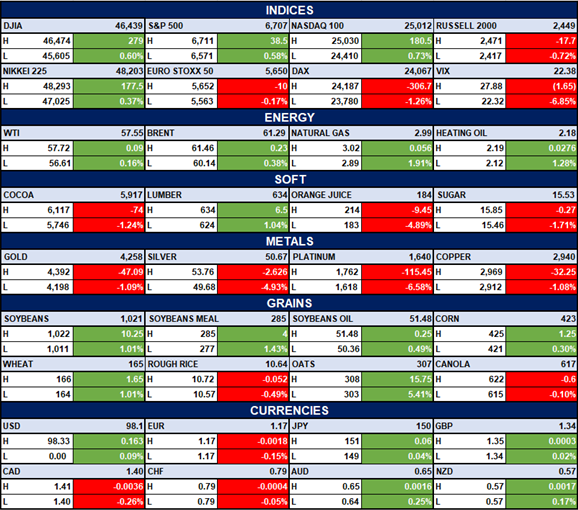

Indices, Commodities & Currencies

The table below depicts that the Global equities were mixed as the S&P 500 (+0.58%) and Nasdaq (+0.73%) gained, while DAX (-1.26%) and Russell 2000 (-0.72%) declined. In commodities, gold (-1.09%) and silver (-4.93%) fell, while WTI oil strengthened (+0.16%) and natural gas (+1.91%). The U.S. dollar strengthened slightly against the euro (-0.15%) and pound (+0.02%).

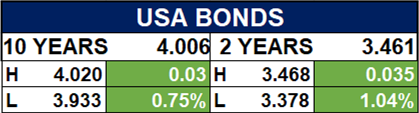

Fixed Income (USA Bonds)

Conclusion

Investor sentiment may remain mixed in the near term supported by improving FX liquidity and banking sector strength but tempered by oil output challenges and refinery disruptions. Globally, steady fund inflows and fiscal easing in major economies could sustain risk appetite, though volatility may rise ahead of key central bank decisions.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.