Finance Friday -Nigeria Strengthens Global Energy Footprint as Reserves Hit 6-Year High; Global Markets Rally Amid Oil Gains and Geopolitical Tensions

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s energy and financial landscape gained momentum as NNPC celebrated key the Gas Exporting Countries Forum (GECF) appointments, external reserves hit a 6-year high of $42.87billion, and Lasaco Assurance strengthened its capital base. Globally, markets advanced on upbeat sentiment, with oil prices rising and geopolitical tensions shaping trade and energy dynamics.

Nigerian News & Market Update

NNPC Ltd. Applauds Ekperikpo, Mshelbila’s Emergence as GECF Chairman, Secretary-General:

The Nigerian National Petroleum Company Limited (NNPC) Ltd. hailed President Tinubu’s leadership as Nigeria’s Dr. Philip Mshelbila and Dr. Ekperikpe Ekpo secured top positions in the Gas Exporting Countries Forum, strengthening Nigeria’s global energy influence. - dmarketforces

Nigeria’s Gross External Reserves Increase to $42.865 billion:

Nigeria’s external reserves rose to $42.87 billion, the highest since 2019, driven by stronger oil earnings, portfolio inflows, and remittances. - dmarketforces

Lasaco Assurance Raises ₦11.1billion Fresh Capital Ahead Of Recapitalisation:

Lasaco Assurance Plc paid ₦13.1 billion in claims in 2024 over 50% of its ₦22.82 billion revenue while boosting profit, raising ₦11.1 billion in fresh capital, and advancing recapitalisation and digital transformation efforts. - Leadership

Stallion Group Unveils 4 New MG Models In Nigeria:

Stallion Group expanded its MG lineup in Nigeria with four new models the RX9, RX5, MG5 CNG, and T60 pickup enhancing local assembly and promoting innovative, fuel-efficient, and sustainable mobility solutions. - Leadership

FG unveils prices for new housing units:

The Federal Ministry of Housing set uniform nationwide prices for Renewed Hope Estate homes ₦8.5million for one-bedroom, ₦11.5million for two-bedroom, and ₦12.5million for three-bedroom units to promote affordable and equitable homeownership. - Punch

Nigeria Sectoral Indices Performance

The table below shows that the NGX market advanced broadly, with the NGX Oil/Gas (+2.96%) and Industrial Goods (+1.18%) driving gains. Banking stocks lagged, falling -0.56% amid sectoral weakness. Year-to-date, the Lotus Index (+98.68%) and Insurance (+77.63%) remain the best performers, reflecting strong market breadth.

Fixed Income (FGN Bonds)

Global News & Market Update

Russia’s fourth-largest oil refinery halts processing unit after drone attack, sources say:

A Ukrainian drone strike forced Russia’s Ryazan oil refinery to halt a key crude unit, cutting output and worsening regional fuel shortages amid stalled peace talks. - Reuters

Russia’s top Indian oil client Reliance says will abide by western sanctions:

Reliance Industries said it will comply with Western sanctions on Russia while continuing crude imports under existing supply deals with Rosneft and other intermediaries. - Reuters

Brussels to host EU-China talks on rare earth export controls:

The European Union (EU) and Chinese officials will meet in Brussels to ease trade tensions over China’s rare earth export controls, which threaten key EU industries like automotive manufacturing. - Reuters

Angola bids for majority stake in De Beers, source says:

Angola’s state-owned Endiama has bid for a majority stake in De Beers, setting up a potential clash with Botswana, which also seeks full control of the diamond giant amid falling prices. - Reuters

Pakistan’s central bank likely to hold rate at 11% on cautious inflation outlook:

Pakistan’s central bank is expected to keep its policy rate at 11% as flood-related food inflation and a low base effect limit room for further monetary easing. - Reuters

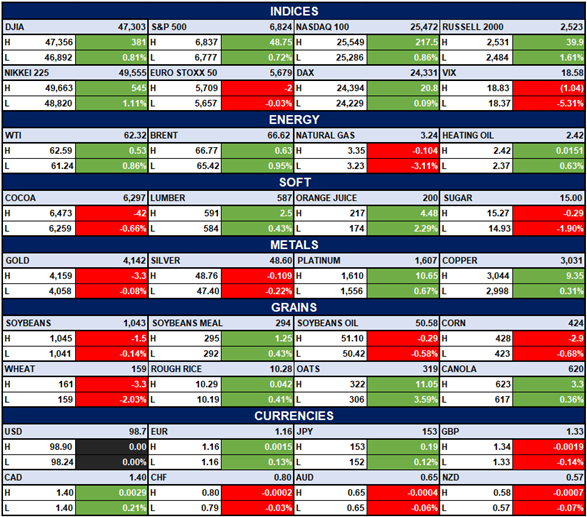

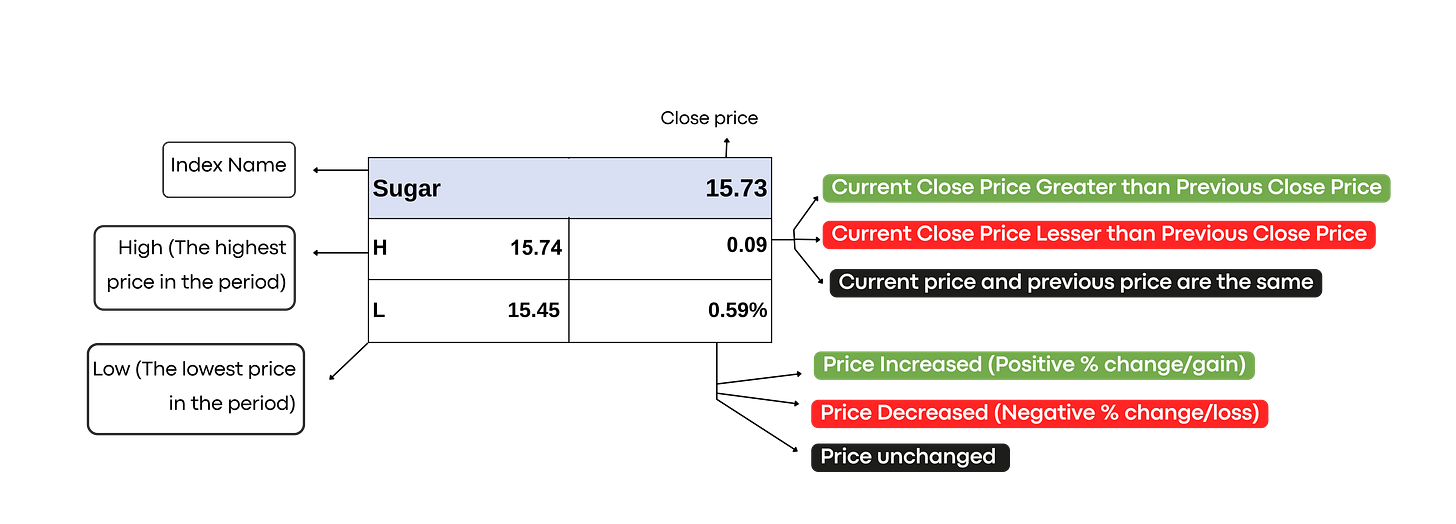

Indices, Commodities & Currencies

The table below depicts that the Global equities advanced broadly, led by the Dow Jones (+0.81%), S&P 500 (+0.72%), and Nikkei 225 (+1.11%).

Energy prices rose as WTI (+0.86%) and Brent (+0.95%) gained, while natural gas slipped (-3.11%). Metals and grains were mixed, with platinum (+0.67%) and oats (+3.59%) higher, while cocoa (-0.66%) and wheat (-2.03%) declined.

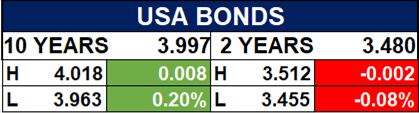

Fixed Income (USA Bonds)

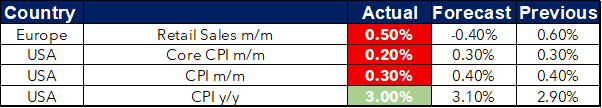

Events

Conclusion

Nigeria’s growing global influence in energy and steady macro recovery signal improving investor confidence. Meanwhile, global markets remain resilient amid mixed commodity trends and cautious monetary stances. Overall, optimism persists across both local and international markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.