Finance Friday - Nigeria’s Banking Consolidation and Bond Market Gains Contrast With Global Trade Tensions and Inflation Risks

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening, investors, and welcome to today’s market update. Nigeria’s financial sector continues to see significant structural moves, with TAJBank meeting the CBN’s recapitalisation threshold, AMCON selling Unity Bank’s stake to Providus, and the DMO preparing a ₦200bn bond issuance. Meanwhile, Shell and Agip’s acquisition of TotalEnergies’ stake in OML 118 underscores renewed deepwater commitments. On the global stage, markets are adjusting to new U.S. tariffs, rising oil prices from Russia’s export cuts, and mixed central bank actions from Mexico, the UK, and the U.S. Consumer spending remains resilient in America, while Argentina’s policy reversal highlights continued currency pressures in emerging markets.

Nigerian News & Market Update

TAJBank meets new recapitalisation threshold – CEO :

TAJBank has met CBN’s new ₦20billion capital requirement ahead of the 2026 deadline and plans to expand tech and services, as CBN confirms 14 banks are compliant. - Punch

Shell, Agip acquire TotalEnergies’ stake in OML 118:

TotalEnergies is divesting its 12.5% stake in OML 118 to Shell and Agip for $510m, with both assuming related liabilities, boosting their hold in the Bonga deepwater field. - Punch

Debt Office to Open FGN Bonds Worth ₦200billion for Subscription:

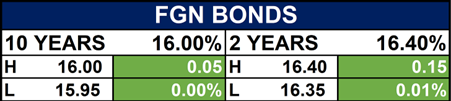

The Debt Management Office (DMO) plans to raise ₦200billion through 5-year and 7-year FGN bonds at its September auction. Investors expect lower spot rates after the CBN’s dovish stance, with bond yields closing flat at 16.52%. Excess market liquidity above ₦2trillion is keeping interest rates in check. - dmarketforces

AMCON sells 34% major stake in Unity Bank to Providus Bank:

AMCON sold its 34% stake in Unity Bank to Providus Bank for N6.5bn, advancing their merger. The deal expands Providus into a national bank using Unity’s 211 branches. Shareholders will vote on cash or share swap terms, backed by a CBN N700bn lifeline. - TheNation

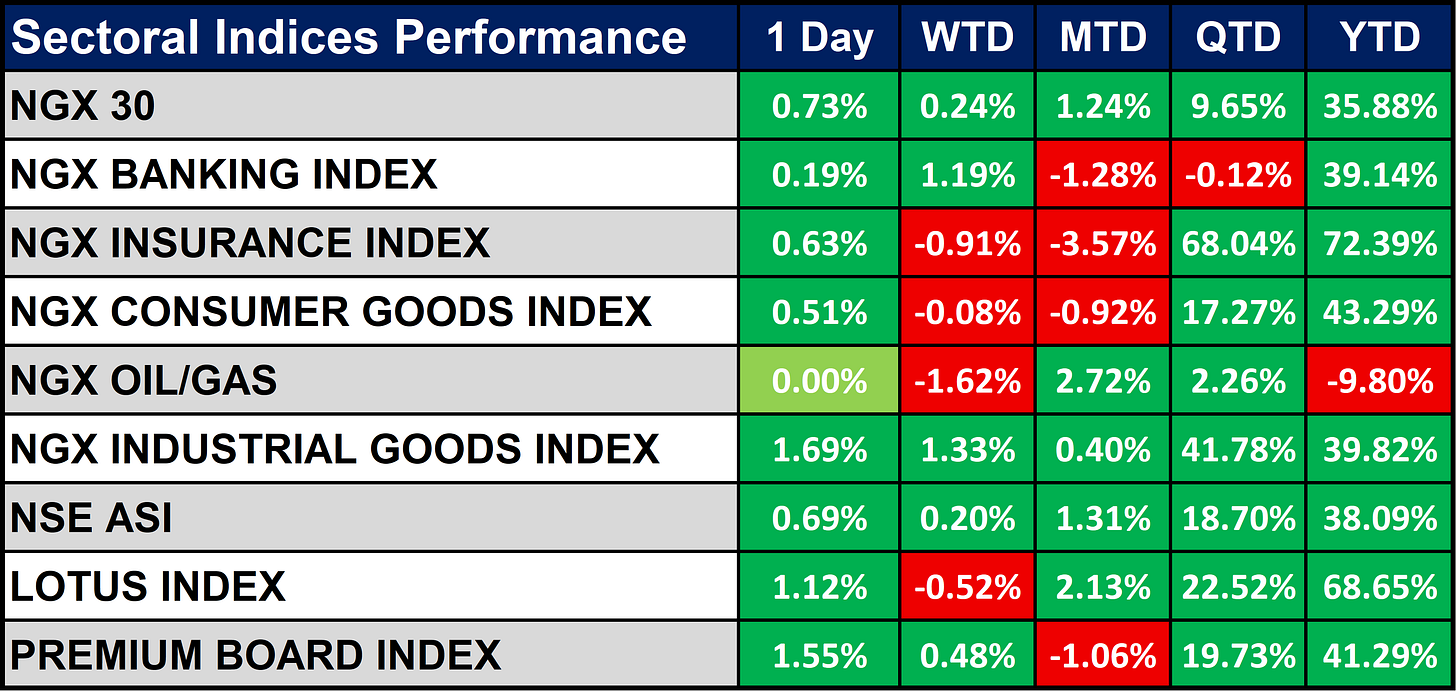

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices show mixed daily moves, but performance is strong overall. Insurance and Lotus indices are the biggest gainers year-to-date, while Oil/Gas is the only sector in negative territory. Overall, the market remains broadly positive with Insurance leading growth.

Fixed Income (FGN Bonds)

Global News & Market Update

Trump slaps new US tariffs on drugs, trucks and furniture:

Trump imposed new tariffs: 100% on branded drugs without U.S. plants, 25% on trucks, and up to 50% on furniture. The move, aimed at protecting U.S. industry, has reignited global trade tensions. Markets reacted mixed, with Asian shares down but U.S. investors largely steady. - Reuters

Oil prices rise as Russia cuts fuel exports:

Oil prices rose over 4% for the week as Ukraine’s attacks on Russian energy sites pushed Moscow to extend fuel export bans. Brent traded at $70.31 and WTI at $66.14, marking their biggest weekly gains since June. Tensions from the war, possible sanctions, and solid U.S. economic data are supporting demand expectations. - Reuters

Starbucks CTO resigned Monday, interim named:

Starbucks CTO Deb Hall Lefevre resigned, with Ningyu Chen named interim CTO. The company will close underperforming stores and cut 900 roles by 2025 while pushing AI tech upgrades. Shares are down 12% in a year versus the S&P 500’s 16% gain. - Reuters

UK longer-term inflation expectations rise as BoE gauges price pressures:

UK long-term inflation expectations rose to 4.1% in September from 3.9% in August, while short-term expectations held steady at 4.0%. The Bank of England has kept rates at 4% and signaled a slower pace of cuts amid persistent inflation. Headline inflation hit 3.8% in August, the highest in the G7, and is forecast to peak at 4% before easing to 2% by 2027. - Reuters

Mexico’s central bank cuts interest rate despite core inflation concerns:

Banxico cut its benchmark rate by 25bps to 7.5%, its lowest since May 2022, citing weak growth and global trade pressures. Core inflation rose to 4.26% in mid-September, prompting the bank to raise its year-end forecast to 4.0% despite its 3% target. - Reuters

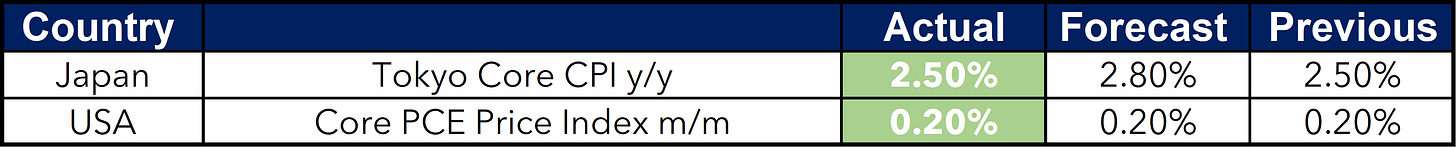

US consumer spending powers ahead in August; inflation picking up:

U.S. consumer spending rose 0.6% in August, driven by high-income households, even as job growth stalls. Inflation picked up, with the PCE price index rising 2.7% year-on-year, above the Fed’s 2% target. Economists expect spending to slow later this year as tariffs and weaker wages pressure households. - Reuters

Argentina resumes export taxes on grains and by-products:

Argentina reinstated export taxes on soy, corn, wheat, and by-products after hitting a $7billion sales cap just two days into a temporary suspension. The measure was aimed at boosting exports and shoring up dollar reserves to support the peso. Tax suspensions on beef and poultry exports remain in place until end-October without a cap. - Reuters

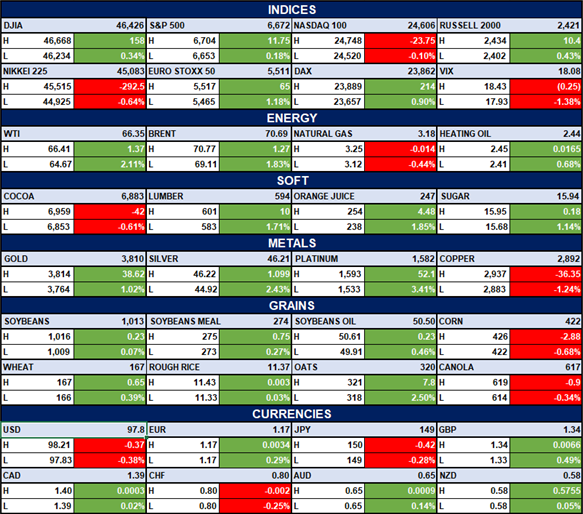

Indices, Commodities & Currencies

The table below Depicts that the Global equities were mixed, with DJIA, S&P 500, and DAX up, while Nasdaq and Nikkei slipped. Energy markets rose on stronger WTI and Brent, but natural gas and heating oil declined. USD fell, while metals and most grains gained, though corn dropped.

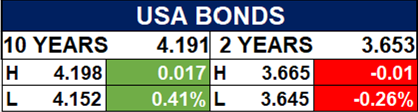

Fixed Income (USA Bonds)

Events

Conclusion

Looking ahead, Nigerian bonds may benefit from excess liquidity and dovish CBN policy, while bank mergers and energy deals could drive equities. Globally, trade tensions, rising oil, and sticky inflation may sustain volatility, so investors should stay cautious but watch for opportunities in banking, fixed income, and commodities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.