Finance Friday- Nigeria’s Corporate Funding and Bond Market Strength Amid Global Commodity Volatility and Policy Shifts

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market kick off, Today’s market wrap highlights key shifts across Nigeria’s capital markets, from strong corporate funding activity to easing money market rates despite aggressive CBN liquidity actions. We also track government financing momentum with Lagos’ successful multi-series bond issuance. Globally, commodities and currencies were volatile, with tariff rollbacks, BOJ policy signals, and geopolitical dynamics shaping risk sentiment.

Nigerian News & Market Update

Valency Agro secures ₦13billion to boost export expansion:

Valency Agro Nigeria raised an oversubscribed ₦13billlion commercial paper to expand its agro-processing capacity and strengthen its export-focused value chain. - Punch

Money Market Funding Costs Ease Despite Huge OMO Actions:

Money market rates eased despite massive CBN OMO liquidity mop-ups, as system liquidity remained high and short-term funding costs stayed relatively stable.- Dmarketforces

VFD Group Redeems ₦12.8billion Commercial Paper:

VFD Group successfully redeemed its ₦12.83billion commercial paper on schedule, showcasing strong liquidity, balance sheet discipline, and sustained investor confidence.- Leadership

Lagos raises ₦244.82billion in oversubscribed green, conventional bonds:

Lagos State raised N244.82bn through oversubscribed green and conventional bonds to fund major infrastructure and climate-aligned projects, reinforcing strong investor confidence. - Vanguard

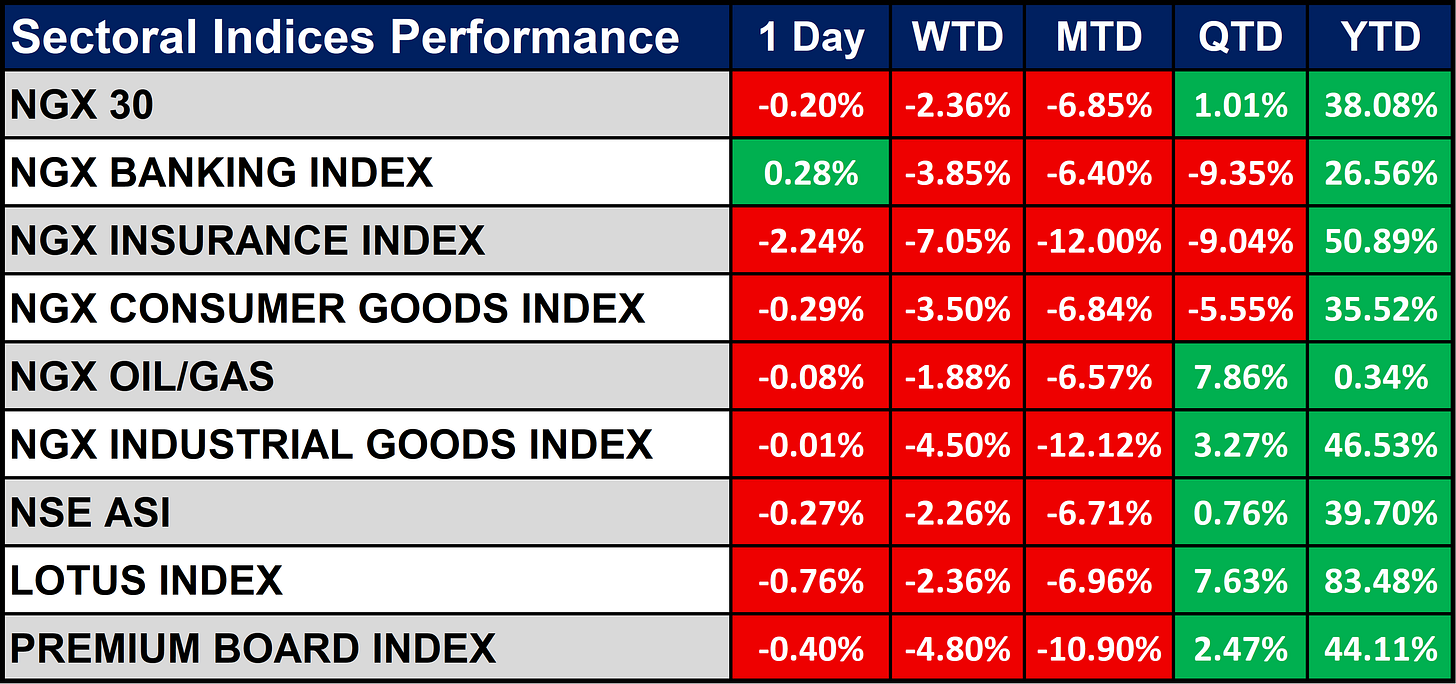

Nigeria Sectoral Indices Performance

The table below shows that Most NGX sector indices declined across 1-Day Except the Banking Index, WTD, and MTD, reflecting continued short-term market weakness. Despite recent losses, QTD and YTD performance remain broadly positive, with strong gains in the Insurance, Industrial Goods, and Lotus indices. The Oil/Gas and Premium Board indices show resilience QTD, while the NSE ASI maintains a solid YTD advance near 40%.

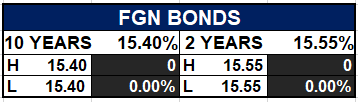

Fixed Income (FGN Bonds)

Global News & Market Update

Global coffee prices plunge after Trump removes tariffs on Brazil:

Global coffee prices plunged after the U.S. scrapped 40% tariffs on Brazilian imports, easing price pressures but shocking already tight coffee markets. - Reuters

Taiwan lifts restrictions on food imports from Japan:

Taiwan has fully lifted post-Fukushima food import restrictions on Japan, citing negligible radiation risk amid rising Japan–China tensions. - Reuters

Bank of Japan signals chance of December rate hike as yen slides:

BOJ Governor Ueda signaled a possible December rate hike, citing the weak yen’s growing inflation impact and the need for more wage data. - Reuters

Oil extends decline as US presses for Russia-Ukraine peace deal:

Oil prices fell for a third day as U.S.-led Russia–Ukraine peace efforts and interest rate uncertainty dampened market sentiment. - Reuters

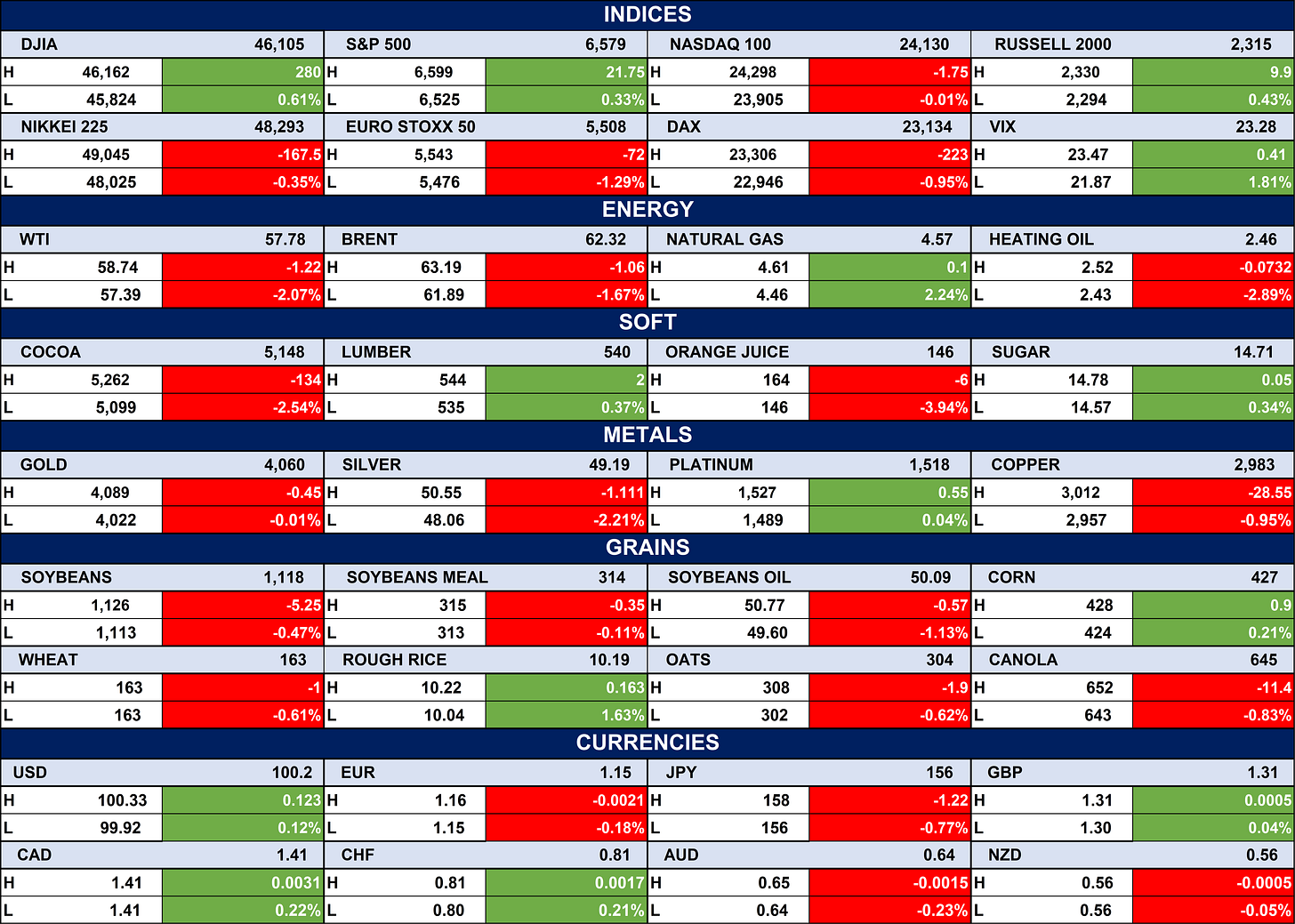

Indices, Commodities & Currencies

The table below shows that the Global equity markets were mostly lower, with major U.S. and European indices slipping while the VIX spiked, indicating rising risk-off sentiment. Energy markets were mixed as oil prices declined, but natural gas saw gains, while soft commodities especially cocoa and orange juice experienced sharp volatility. Metals and grains showed a mixed performance, and currency movements were modest, with the USD slightly firmer against major peers.

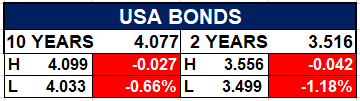

Fixed Income (USA Bonds)

Event

Conclusion

Investors could expect continued volatility as domestic liquidity tightening meets strong corporate balance sheet activity, while global markets react to shifting monetary stances and geopolitical negotiations. Nigeria’s fixed-income space may see firmer yields as OMO and NTB settlements bite, even as equities digest recent sector-wide pullbacks. Globally, commodity markets and FX trends may remain sensitive to policy surprises, presenting both risks and selective opportunities.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.