Finance Friday - Nigeria’s Inflation Eases, Oil Output Rises as Global Markets Stay Mixed

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to your Friday market wrap up. This week, Nigeria’s inflation eased to 21.88% in July on harvest season gains, while NNPC targets $4.5 billion in savings and a boost in oil production. The FG achieved 37.4% of its H1 revenue target, pushing reforms under AfCFTA. FMDQ announced plans to enter the equities market, challenging the NGX. Sector performance was mixed, with Insurance leading YTD gains but seeing the sharpest daily drop. Globally, the rand firmed on gold gains, European markets hit multi-month highs on earnings optimism, and world equities held steady ahead of Trump-Putin talks. Commodities saw oil prices dip, natural gas surge, grains rise, and metals soften.

Nigerian News & Market Update

Nigeria’s headline inflation moderates to 21.88 % in July as the harvest season kicks in:

Nigeria’s headline inflation eased to 21.88% year-on-year in July from 22.22% in June, helped by the harvest season, a high base effect, and greater stability in key price drivers. However, month-on-month inflation rose to 1.99% from 1.68%, reflecting ongoing price pressures, mainly from food supply disruptions due to security issues. Core inflation and food inflation also declined, with core inflation at 0.97% in July from 3.12% previously. - Businessday

FG eyes $4.5billion oil savings, grows output by 400,000bpd:

The Nigerian National Petroleum Company Limited (NNPC) aims to cut $3–4.5billion in costs by 2025, boost oil output, renew ageing infrastructure, adopt advanced tech like AI, and attract $30billion–$60billion in new investments through collaboration and innovative financing. - Punch

FG records 37.4% revenue performance in H1 2025:

The Federal Government grew H1 2025 revenue to 37.4% of its target, boosted state allocations to ₦7.1trillion, cut debt-to-GDP to 38.8%, and cleared ₦2trillion in capital arrears. Reforms aim for 7% GDP growth through Public-Private Partnership (PPP) investments, fiscal-monetary coordination, and export diversification under The African Continental Free Trade Area (AfCFTA). - Tribune

FMDQ confirms plans to launch equity market competing with NGX:

Financial Markets Dealers Quotations (FMDQ) Group plans to launch an equities market to compete with the NGX and has extended the holding period for long-term investors from 12 to 21 months with new long-dated FX Futures contracts, according to updates from its 13th AGM. - Nairametrics

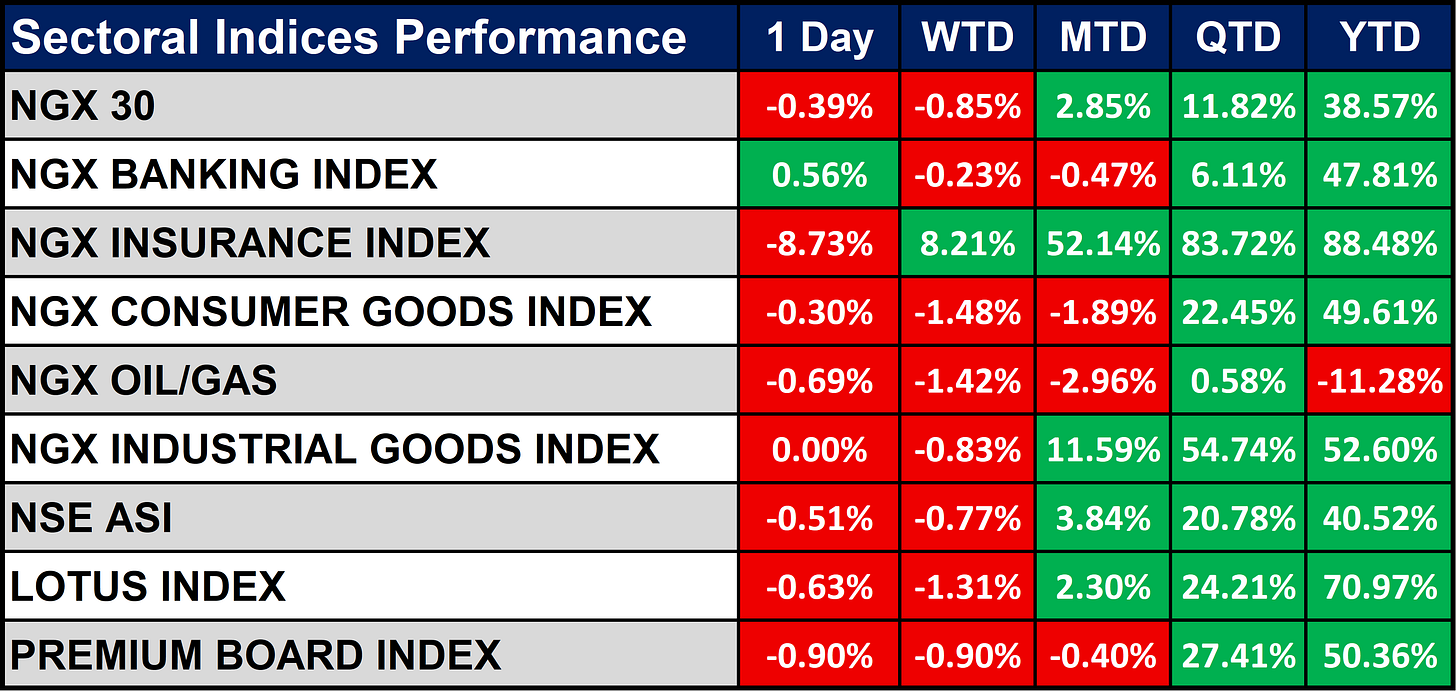

Nigeria Sectoral Indices Performance

The table below shows that the NGX sector indices showed mixed performance. Insurance remains the top performer year-to-date (+88.48%) while Oil/Gas is the weakest (-11.28%). Most sectors declined over the past day, with Insurance seeing the sharpest drop (-8.73%) and Banking posting the only notable gain (+0.56%).

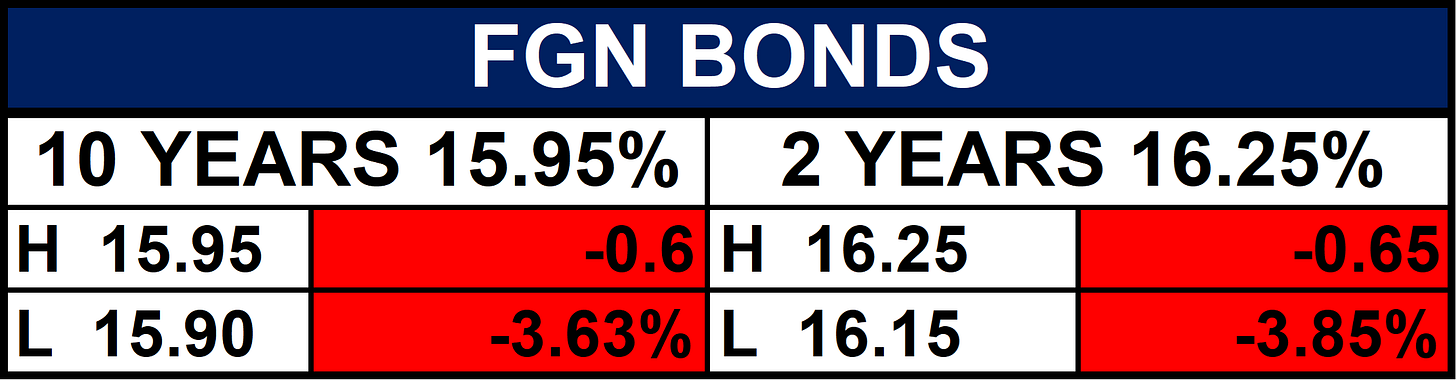

Fixed Income (FGN Bonds)

Global News & Market Update

South African rand lifted by gold, focus on inflation data next week:

South Africa’s rand strengthened 0.2% to 17.58/$, supported by higher gold prices as a weaker dollar boosted demand for the metal. Investors await next week’s inflation data for economic insights. The Johannesburg Stock Exchange (JSE) Top-40 index fell 0.1%, while the 2035 government bond yield eased to 9.6%. - Reuters

European shares hit near five-month high, eyes on Trump-Putin talks:

European shares hit a near five-month high, with the STOXX 600 up 0.3% on strong earnings, gains in mining and chemical stocks, and optimism over a possible Ukraine ceasefire from the Trump-Putin meeting. The FTSE 100 reached record highs, Germany’s DAX hit a one-month high, and Spain’s IBEX also gained. Miners like Antofagasta, Anglo American, and Glencore rose, while NKT surged on an outlook upgrade. Chipmakers fell on weak China demand and tariff concerns, and Pandora plunged on slowing European sales. - Reuters

World equities flat, crude oil prices fall as markets await Trump-Putin talks:

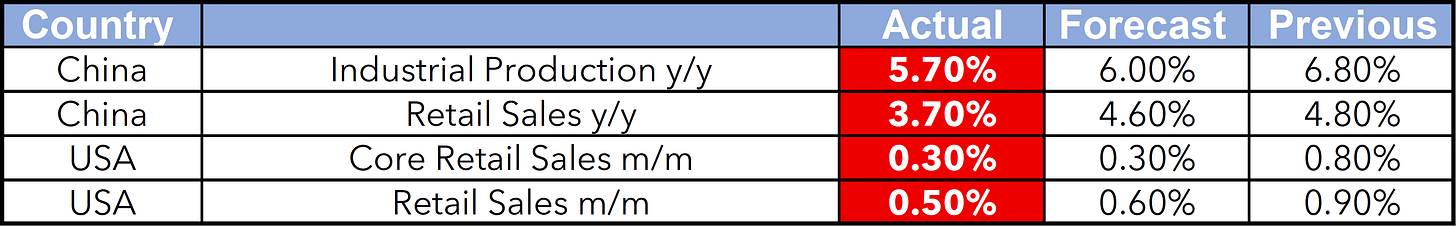

Global stocks stayed near record highs as markets awaited the Trump-Putin Ukraine talks, with the Dow hitting a record but the S&P 500 and Nasdaq slipping. U.S. retail sales rose 0.5%, denting Fed rate-cut hopes. The dollar weakened, gold inched up, oil fell, and bitcoin eased after a record high. - Reuters

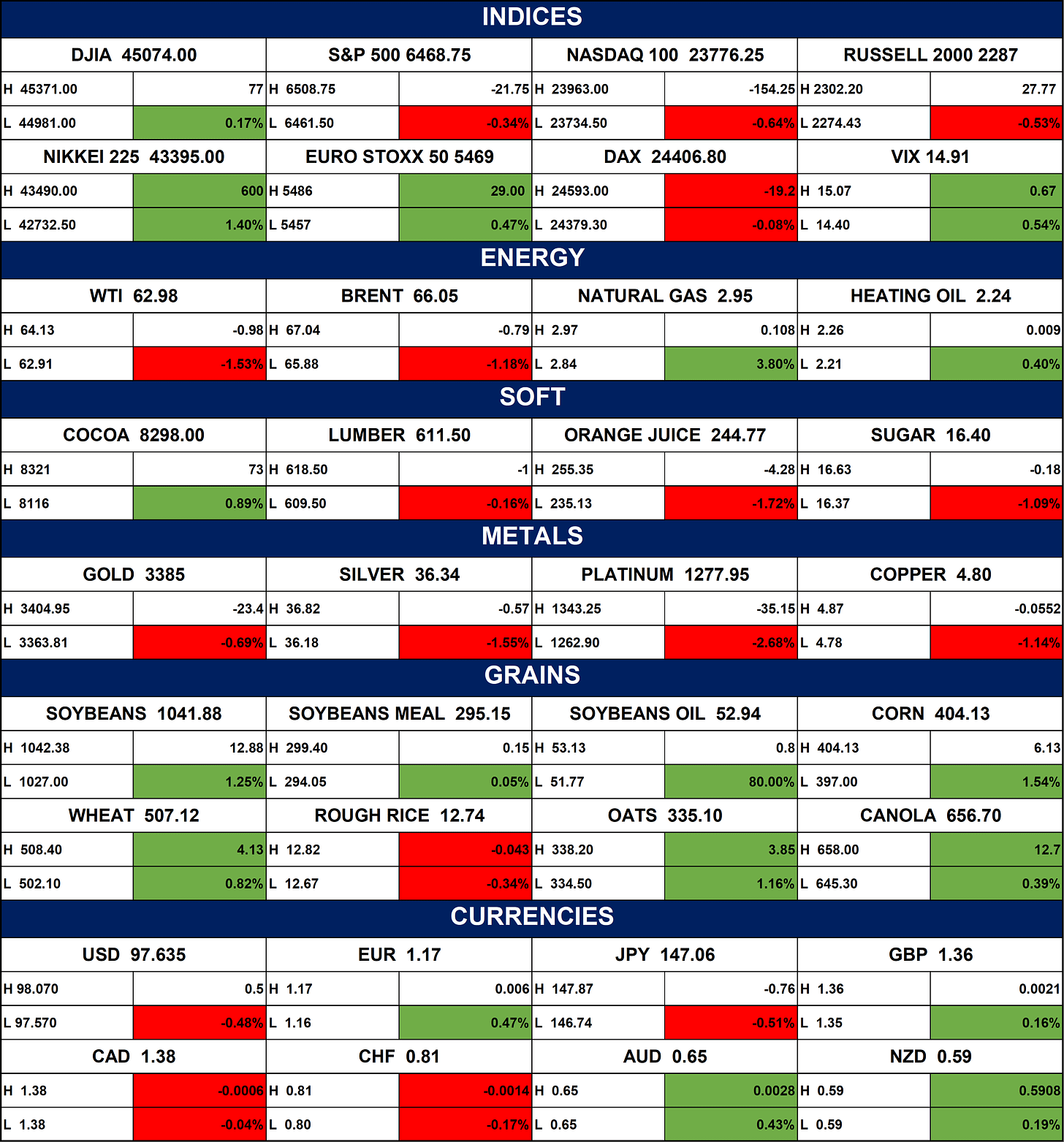

Indices, Commodities & Currencies

The table below Depicts the Global markets were mixed. U.S. and Japanese stocks gained, but tech-heavy Nasdaq fell. Oil prices dropped while natural gas surged. Cocoa and most grains rose sharply, especially soybean oil, but metals slipped. The euro and NZD strengthened, while the yen and USD weakened.

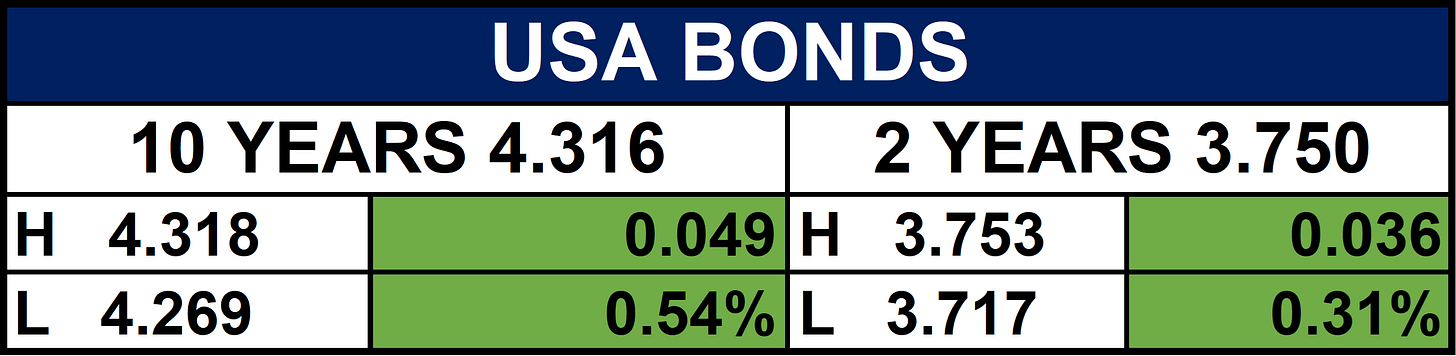

Fixed Income (USA Bonds)

Events

Conclusion

Nigeria’s economic updates show progress in inflation control, oil production, and fiscal reforms, while global markets remain cautiously optimistic amid geopolitical watchpoints. Investors are navigating mixed signals in equities, commodities, and currencies as key policy and earnings drivers unfold.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.