Finance Friday- Nigeria’s Inflation Relief, Market Reforms and Global Energy Shifts Redefine Risk Sentiment

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market briefing, where Nigeria’s improving macro signals, regulatory reforms, and key corporate leadership changes take center stage. Cooling inflation, stronger market governance, and Nigeria’s exit from the European Union Anti-Money Laundering (EU AML) high-risk list point to rising investor confidence. Globally, energy supply realignments, moderating inflation in Europe, and shifting oil trade flows set the tone for risk sentiment across markets.

Nigerian News & Market Update

Standard Chartered appoints Dalu Ajene Africa CEO:

Standard Chartered appoints Dalu Ajene as Africa CEO, expanding his leadership from Nigeria to the continent. - Punch

UCIF appoints new investment committee members:

United Capital Plc appoints four new independent members to its Infrastructure Fund Investment Committee to strengthen governance and drive sustainable growth. - Punch

Nigeria’s Inflation Cools, Food Prices Finally Ease:

Nigeria’s inflation slowed to 15.15% in December 2025, with food and rural prices easing, signaling potential economic stabilization. - Channels

SEC hikes minimum capital requirements for market operators after a decade:

The SEC raises minimum capital requirements for Nigerian market operators, setting a June 2027 compliance deadline to strengthen market resilience and investor protection. - Businessday

International Breweries Plc appoints new managing director:

International Breweries Plc appoints Nicholas Kade as its new Managing Director, effective March 1, 2026, succeeding Carlos Coutino. - Premiumtimes

Nigeria exits EU high-risk money laundering list:

Nigeria is removed from the EU high-risk AML/CFT list, reflecting successful financial reforms and boosting global investor confidence. - TheSun

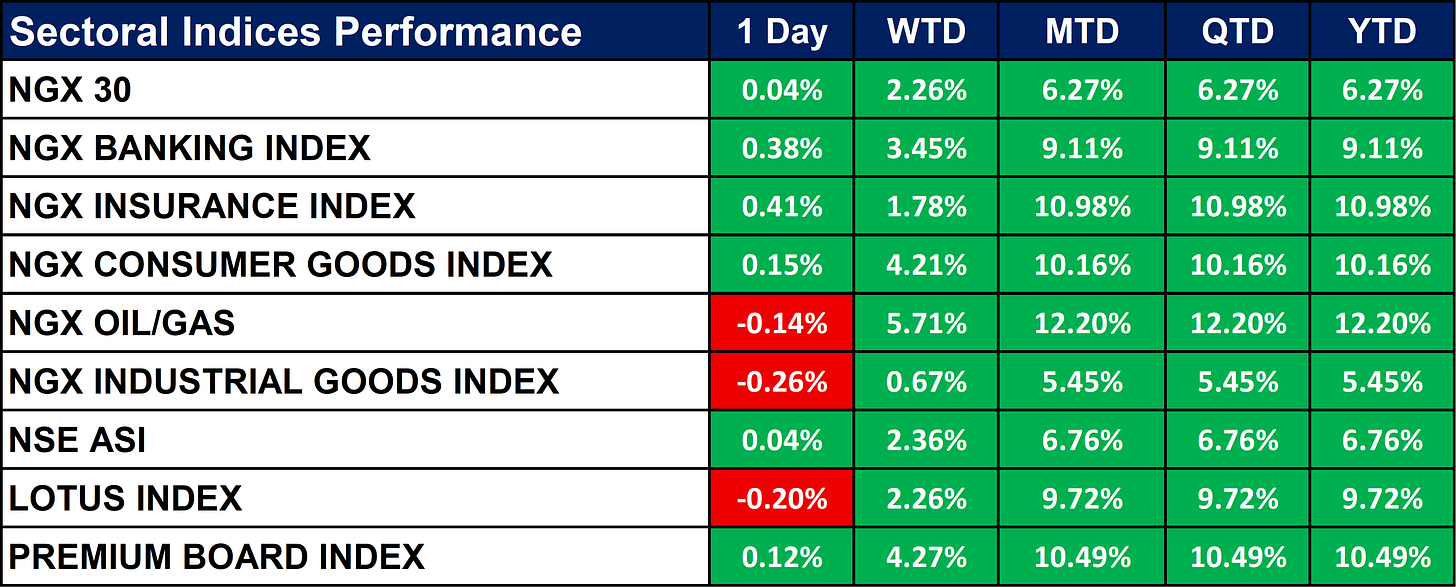

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices posted broad-based gains over the period, with Banking, Insurance, Consumer Goods and Premium Board indices all delivering strong positive returns across WTD, MTD, QTD and YTD.

Oil & Gas led medium-term performance with double-digit MTD/QTD/YTD gains, despite a slight 1-day decline, while Industrial Goods lagged with the weakest cumulative returns. Overall market sentiment remains positive, reflected in steady advances across NGX 30, NSE ASI and most sector benchmarks.

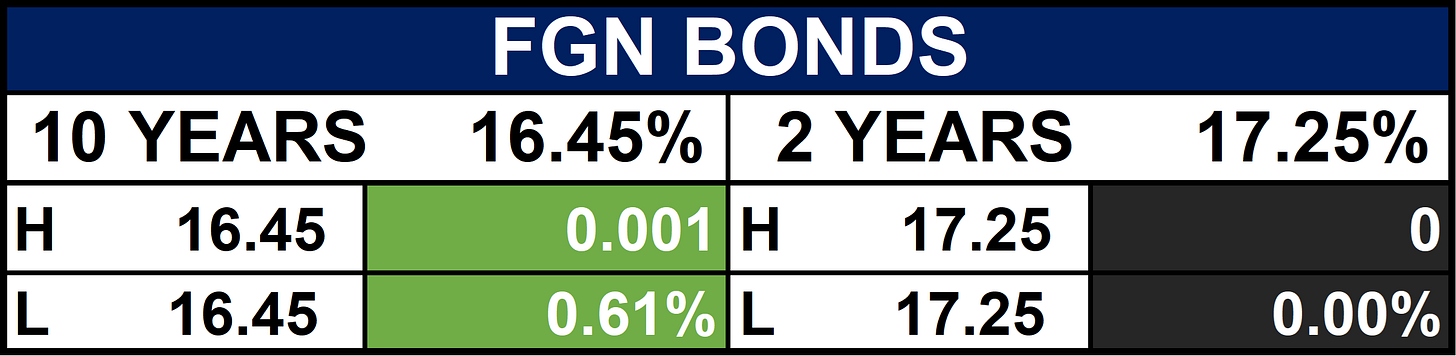

Fixed Income (FGN Bonds)

Global News & Market Update

Azerbaijan starts natural gas supplies to Germany and Austria:

Azerbaijan’s SOCAR begins supplying natural gas to Germany and Austria, expanding its European market amid reduced Russian exports. - Reuters

U.S. lifts import ban on Malaysian palm oil firm FGV Holdings:

The U.S. lifts its import ban on Malaysian palm oil producer FGV Holdings after the company addressed forced labour concerns and implemented reforms. - Reuters

OPEC regains share in India as Russian oil imports slump in December:

India’s imports of Russian oil fell to a two-year low in December 2025, boosting OPEC’s share of the country’s crude supply to an 11-month high. - Reuters

German inflation confirmed at 2.0% in December:

German inflation slowed to 2.0% in December 2025, down from 2.6% in November, confirming preliminary data. The statistics reflect harmonised consumer prices, allowing comparisons across European Union countries. - Reuters

Mitsubishi to buy Texas, Louisiana shale gas assets for $7.53 billion:

Mitsubishi Corp plans to acquire U.S. shale gas assets from Aethon Energy for $7.53 billion, marking its largest deal to strengthen its gas supply chain. - Reuters

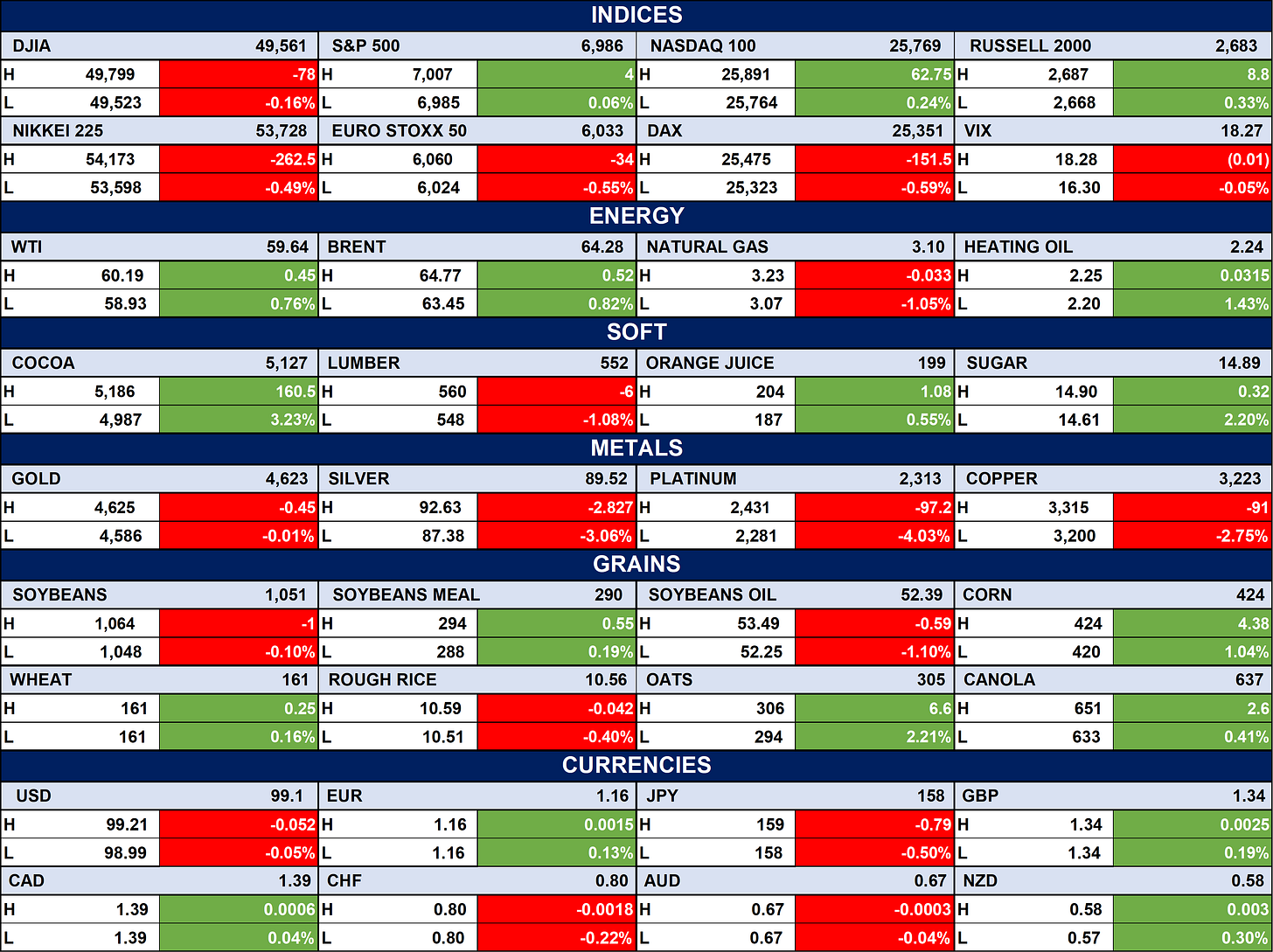

Indices, Commodities & Currencies

The table below shows that the Global equities were mixed, with U.S. indices (S&P 500, Nasdaq, Russell 2000) edging higher, while European markets (DAX, Euro Stoxx 50) and Japan’s Nikkei closed lower, reflecting cautious risk sentiment.

Energy prices were broadly firmer as WTI and Brent crude gained, while natural gas dipped; soft commodities showed strength in cocoa and sugar, offset by weakness in lumber. Metals and grains were mixed, with gold flat and industrial metals lower, while currencies were relatively stable, marked by a slightly softer dollar and mild gains in the euro and pound.

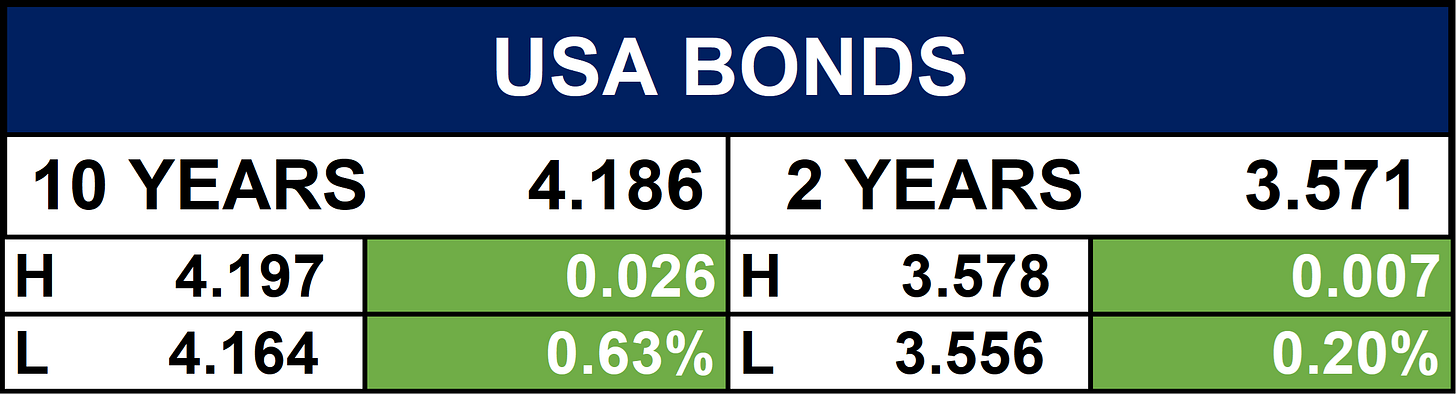

Fixed Income (USA Bonds)

Conclusion

Looking ahead, investors may see improved sentiment in Nigerian equities and fixed income as inflation eases and regulatory reforms deepen market resilience. Banking, infrastructure, and consumer sectors could benefit from stronger governance and policy stability, while global energy developments may continue to influence commodity prices. Overall, markets are likely to remain selective, with opportunities driven by reform momentum at home and macro stabilization trends abroad.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.