Finance Friday - Nigeria’s Market Resilience Strengthens on Capital Growth and Refining Output as Global Trade Tensions Pressure Equities

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to today’s market wrap up. Nigeria’s market remains upbeat as strong capital raises, the Dangote Refinery’s 20million litres daily output, and robust investor confidence boost growth momentum. Globally, sentiment is cautious amid U.S.–China trade tensions and weaker oil prices, driving demand for safe-haven assets.

Nigerian News & Market Update

Dangote refinery now delivers 20million litres daily, says NMDPRA:

Dangote Refinery now supplies 20 million litres of fuel daily, boosting Nigeria’s energy independence. The Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) plans to create a National Strategic Stock to ensure supply stability. The agency pledges transparent regulation and stronger energy reforms under the Petroleum Industry Act (PIA) 2021. - Punch

₦20billionn Sukuk: TAJBank records 185.5% oversubscription:

TAJBank’s ₦20billion Sukuk bond was oversubscribed by 185%, raising ₦57.03billion at a 20.5% profit rate. The success reflects strong investor confidence and reinforces the bank’s leadership in Nigeria’s non-interest banking sector. - Punch

Greenwich Merchant Bank achieves ₦50billion capitalisation:

Greenwich Merchant Bank met the CBN’s ₦50billion capital requirement after raising ₦22.6billion, boosting its capacity for larger deals and improved services. The bank says the milestone reflects strong investor confidence and supports future growth. - Punch

VFD Group opens ₦50.67billion rights issue for African expansion:

VFD Group launched a ₦50.67billion rights issue to expand across Africa, reduce debt, and boost investments. The move reflects investor confidence and supports the firm’s growth strategy. - Punch

Nigeria to Raise US$2.3 billion from Eurobonds in Q4:

Nigeria plans a US$2.3billion Eurobond and a US$500million Sukuk to fund its budget and manage debt. CSL expects strong investor demand, with the move likely to boost reserves but add short-term fiscal pressure. - dmarketforces

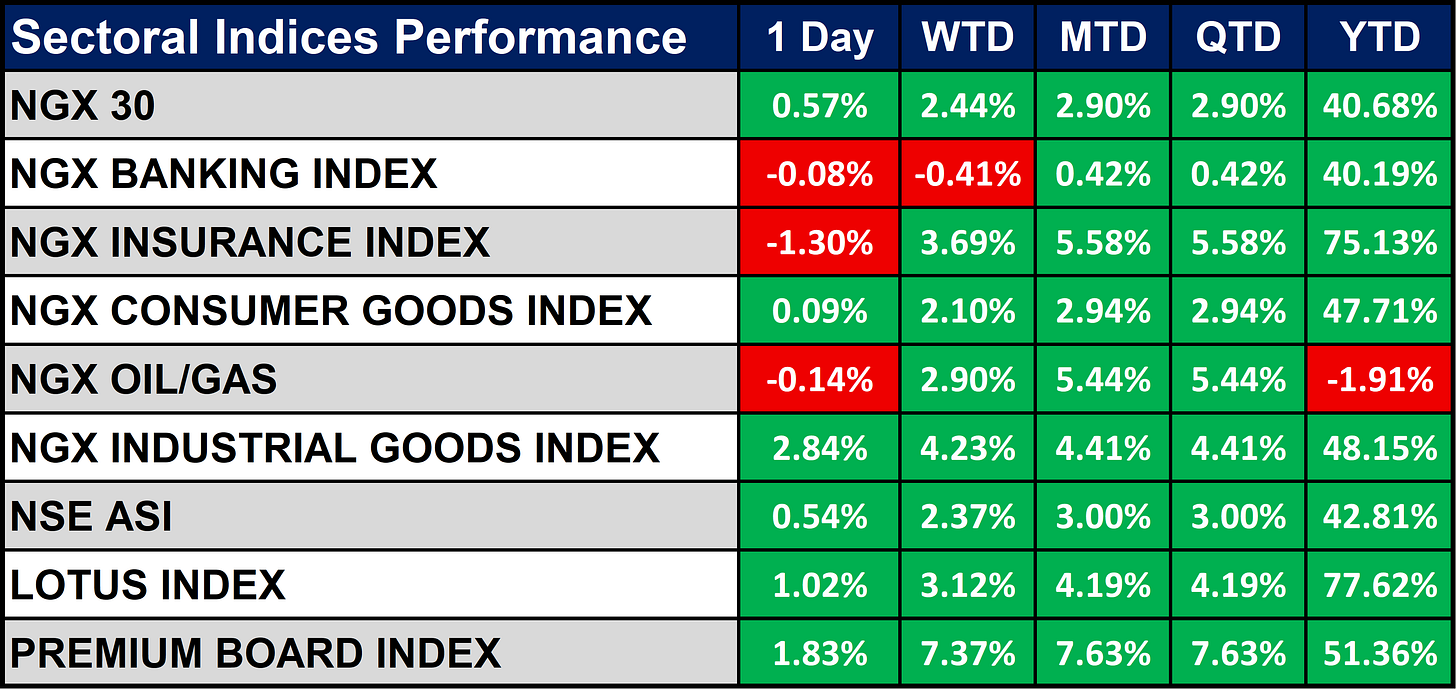

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices show strong overall performance, with most sectors posting gains across all timeframes. The LOTUS Index and NGX Insurance Index lead year-to-date, up 77.62% and 75.13% respectively, while the Oil/Gas Index remains the only laggard at -1.91% YTD. Short-term momentum is strong across the board, especially in the Premium Board Index, which posted the highest gains over the past day (1.83%) and week (7.37%).

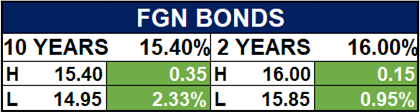

Fixed Income (FGN Bonds)

Global News & Market Update

China hits back at US ships with additional port fees:

China and the U.S. will impose reciprocal port fees on each other’s ships starting October 14, escalating trade tensions. Both sides call the measures discriminatory, with analysts warning they could disrupt global shipping and increase trade costs. - Reuters

Brazil’s trading firm Timbro enters coffee export market as it sees room to grow:

Brazil’s Timbro has entered the coffee market, expanding its export portfolio after strong growth in sugar. The firm posted 18billion reais in 2023 revenue and is expanding globally with new offices in the U.S. and Dubai. - Reuters

US tariffs a drag on EU confidence, jobs, ECB study finds:

ECB researchers say few eurozone workers fear U.S. tariffs, but the concern could still hurt confidence and slow growth. The new tariffs, raised to 13.1%, pose risks mainly to export-heavy sectors in countries like Ireland and the Netherlands. - Reuters

Trump boosts Argentina’s Milei with $20 billion lifeline as US buys pesos:

The U.S. Treasury set up a $20billion currency swap with Argentina to stabilize its economy and support President Milei’s reforms. Treasury Secretary Bessent said it’s not a bailout but a strategic move to boost U.S.–Argentina ties, though it drew criticism from U.S. lawmakers. - Reuters

Chinese wind turbine maker to invest up to $2 billion in Scottish factory:

China’s Ming Yang Smart Energy will invest £1.5billion in a wind turbine plant in Scotland, creating up to 1,500 jobs. The three-phase project starts production by 2028, supporting the UK’s renewable energy goals. - Reuters

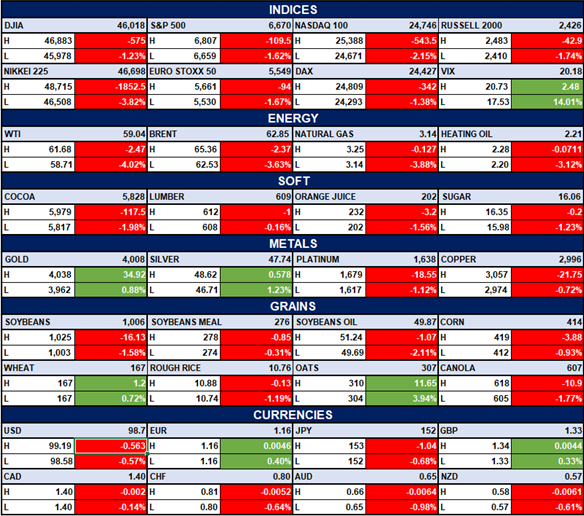

Indices, Commodities & Currencies

The table below depicts that the Global markets mostly declined, with major indices like the S&P 500, NASDAQ, and DAX all down over 1%. Energy prices fell sharply WTI and Brent dropped. The U.S. dollar weakened slightly, while gold and silver rose amid broad market losses.

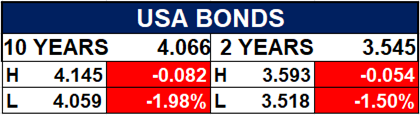

Fixed Income (USA Bonds)

Conclusion

Nigeria’s market remains positive, driven by strong capital inflows and refinery output, though upcoming Eurobond sales may spark short-term volatility. Globally, trade tensions and lower oil prices could pressure markets, while gold demand stays strong. Investors should expect mild consolidation locally, with value opportunities in banking and industrial stocks.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.