Finance Friday - Nigeria’s Market Surge Meets Global Caution: Reforms, Recapitalisation & Trade Tensions in Focus

Ranora Daily - Your daily source for reliable market analysis and news.

Market Overview

Good evening and welcome to your Friday market wrap up. This week, Nigerian markets gained on insurance reforms and consumer goods strength, despite concerns over rising fuel prices. Corporate activity remained strong with expansion and recapitalization moves. Globally, markets were cautious amid U.S. trade tensions and tariff fears, prompting investors to shift to safer assets. Oil rose slightly, while China’s export growth provided some global support despite slowing factory output.

Nigerian News & Market Update

NGX gains ₦479billion as insurance, consumer goods drive rally:

On August 7, 2025, the Nigerian Stock Exchange gained ₦479 billion, driven by strong performances in the insurance and consumer goods sectors. The All-Share Index rose by 0.52% to close at 146,570.69, extending the year-to-date gain to 42.4%. Insurance stocks surged following the signing of the Nigerian Insurance Industry Reform Act 2025 by President Tinubu, boosting investor confidence. Key gainers included AXA Mansard, AIICO Insurance, and Guinness, while Chams Plc and UAC of Nigeria led the losers. Trading volume rose 16%, with insurance stocks dominating activity, reflecting strong market sentiment and renewed investor interest. - Punch

Dangote hikes petrol price, resumes sale after one-week suspension:

Dangote Refinery has resumed petrol sales after a one-week suspension, raising its ex-depot price to ₦850 per litre, a ₦30 increase, sparking concerns of pump price hikes. The price hike is linked to global crude costs, as the refinery imports about 50% of its crude. Despite this, Dangote continues to offer diesel at competitive rates. However, over 71% of Nigeria’s petrol supply still comes from imports, highlighting limited local refinery use. Depot prices across the country remain mostly stable, with only minor fluctuations, as the market reacts cautiously to the price change. - Punch

Fidson secures shareholders’ approval to raise ₦30billion for market expansion:

Fidson Healthcare Plc plans to raise ₦30 billion for expansion, following shareholder approval at its 26th AGM. The company will also increase its share capital from ₦1.2 billion to ₦1.5 billion by creating 600 million new shares. The funds will support growth across Nigeria and Africa. The AGM also marked the retirement of Founder and CEO Dr. Fidelis Ayebae after 30 years, with Mr. Abiola Adebayo named as his successor. A ₦1.00 dividend per share was approved, totaling ₦2.29 billion, based on earnings per share of ₦2.52. - Guardian

Bank recapitalisation and race towards $1trillion economy:

Nigeria's banking sector is being strengthened through a major recapitalisation drive by the Central Bank of Nigeria (CBN), aiming to support the country’s $1 trillion GDP(Gross Domestic Product) target by 2030. Eight banks have already met the new capital requirements, with others working toward the 2026 deadline. The recapitalisation will enable banks to fund larger projects, support MSMEs(Micro, Small, and Medium Enterprises), and invest in technology. Experts highlight the move as essential for financial system stability and economic growth. Mergers and acquisitions are expected as smaller banks adjust, while the CBN emphasizes stricter compliance and stronger supervision to maintain trust and resilience in the sector. - Guardian

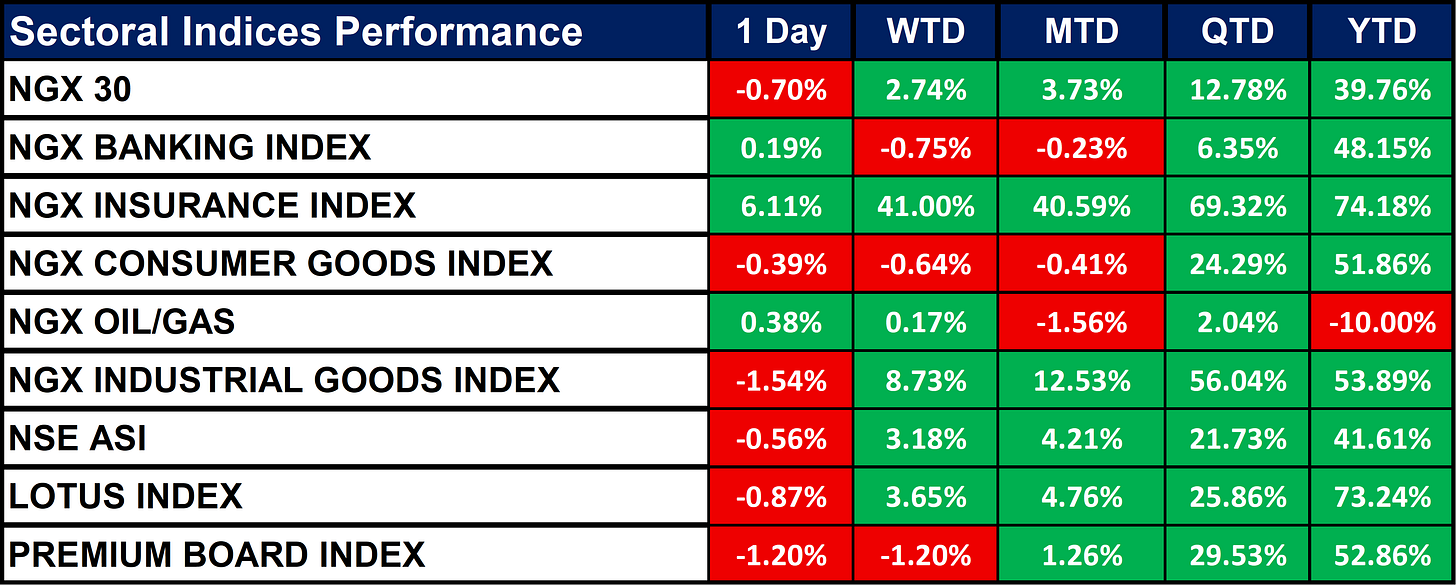

Nigeria Sectoral Indices Performance

The table below shows that the NGX sectoral indices show mixed performance. The NGX Insurance Index is the strongest performer, up 74.18% year-to-date (YTD), followed by the Lotus Index (+73.24%) and Industrial Goods Index (+53.89%). The NGX Oil/Gas Index is the only sector in decline YTD, down 10.00%. Despite a daily dip of -0.56%, the All Share Index (NSE ASI) is up 41.61% YTD, indicating overall market strength.

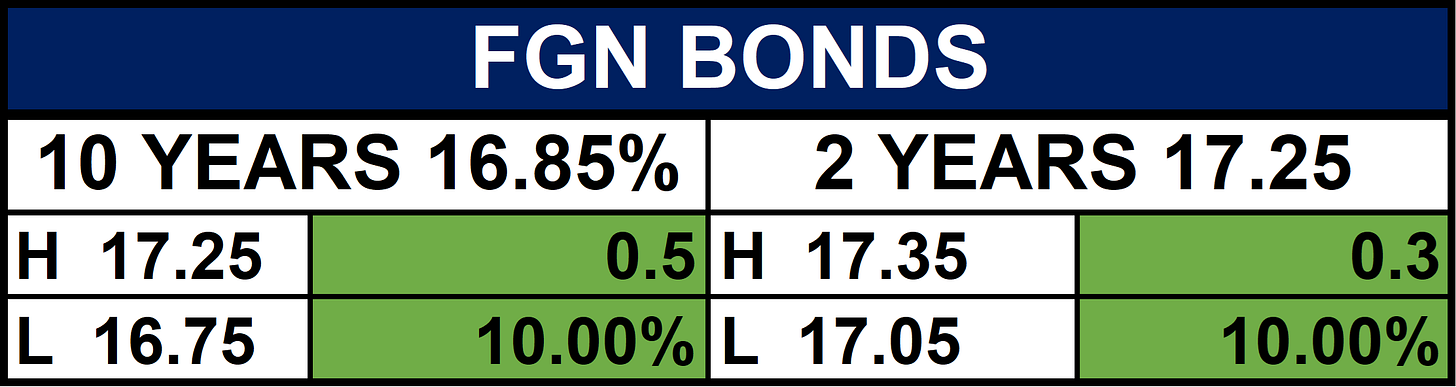

Fixed Income (FGN Bonds)

Global News & Market Update

US equity funds see sharp outflows on tariff caution, economic concerns:

In the week ending August 6, U.S. investors pulled $13.7 billion from equity funds the largest outflow since June amid concerns over Trump’s new trade tariffs and weak economic data. Instead, they moved a record $78.85 billion into safer money market funds, signaling a flight to safety. Small-cap equity funds saw the biggest losses, while communication services and industrials attracted modest inflows. Bond funds also gained traction, with $7.39 billion in inflows, led by short-to-intermediate investment-grade and government bonds, reflecting investor caution and preference for lower-risk assets. - Reuters

Oil rises after Trump eyes 100% tariff on chips:

Oil prices rose after U.S. President Donald Trump announced a 100% tariff on imported chips, excluding domestically manufactured ones. Brent Crude climbed 1% to $67.56, while West Texas Intermediate (WTI) rose 1.13% to $65.06, reflecting market concerns over trade tensions and potential economic impacts - CNBC

China’s July exports top expectations, rising over 7%; imports record biggest jump in a year:

China’s exports rose by 7.2% in July 2025, beating expectations, while imports increased 4.1%, the highest in a year. Despite a sharp 21.7% drop in exports to the U.S., China boosted trade with Southeast Asia and the EU. Key export gains included rare earths, autos, and semiconductors. The trade surplus reached $683.5 billion, up 32% from 2024. Tensions with the U.S. persist ahead of an August 12 tariff truce deadline, with potential new tariffs under discussion. Meanwhile, factory activity declined, with the manufacturing PMI falling to 49.3, indicating economic slowdown. - CNBC

Treasury yields rise as investors weigh the state of the U.S. economy:

U.S. Treasury yields rose as markets reacted to new tariffs and leadership changes at the Federal Reserve. President Trump imposed steep duties on several countries, including 50% tariffs on Brazil and India, and nominated Stephen Miran to the Fed Board, raising concerns about political influence. Investors are now focused on upcoming inflation data. - CNBC

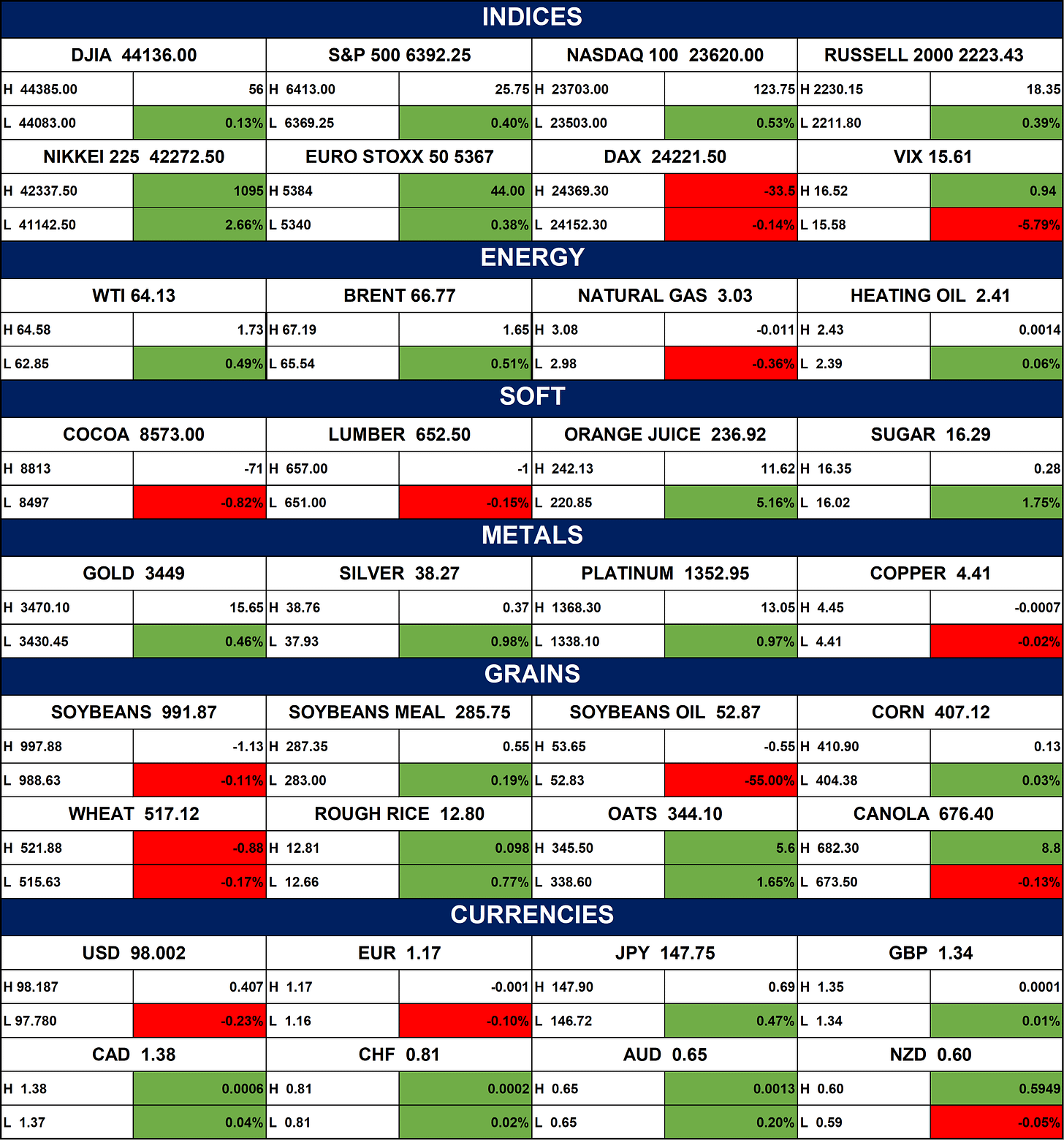

Indices, Commodities & Currencies

The table below Depicts the Markets showed moderate gains overall. Major stock indices like the Nikkei 225, S&P 500, and NASDAQ rose, while volatility (VIX) dropped sharply. Energy prices edged up, and precious metals gained. Soft commodities were mixed, with orange juice rising sharply. Grains showed minor moves in both directions. In currencies, the U.S. dollar dipped slightly, while others like the yen and Aussie dollar strengthened.

Fixed Income (USA Bonds)

Conclusion

The Nigerian market is likely to maintain momentum, driven by insurance reforms and banking recapitalization, though rising petrol prices and global trade tensions pose risks. Globally, market volatility may continue amid tariff concerns and economic data releases, with investors favoring safer assets and selective opportunities in commodities and emerging markets.

Thanks for reading Ranora Consulting! Subscribe for free to receive new posts and support my work.