Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

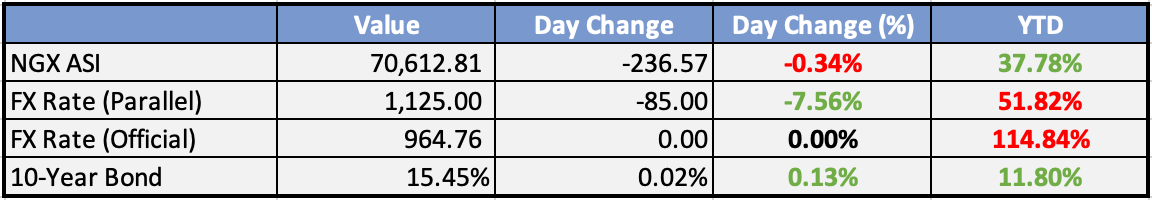

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Inflation to hit 30% by Dec – KPMG - Punch

KPMG forecasts that Nigeria’s headline inflation will rise to 30 percent by December 2023, attributing the anticipated increase to recent reforms, such as fuel subsidy removal, and the unification of the foreign exchange market.

Dangote Refinery Gets Permit To Refine Over 300,000 Barrels - Leadership

Aliko Dangote says the Dangote refinery has secured a licence to refine more than 300,000 barrels of Nigerian crude per day and will begin to process petrol “soon”.

NGX considers dual listing with Saudi Stock Exchange - The Guardian

Group Chairman of Nigerian Exchange Group, Dr Umaru Kwairanga, has hinted at the proposed plan for dual listing with the Saudi Exchange, stressing that President Bola Tinubu's economic reforms have created room for investment inflow into the country.

NNPCL resolves PENGASSAN-TotalEnergies rift, restores 275,000bpd production - Punch

The Nigerian National Petroleum Company Limited, on Sunday, said it brokered a peace deal to settle the lingering rift between the management of TotalEnergies and the Petroleum and Natural Gas Senior Staff Association/Nigeria Union of Petroleum and Natural Gas workers.

Global

Oil Slips on Lower Global Growth Expectations - WSJ

Oil prices experienced a decline amid concerns about the global economy and growth. Brent crude and WTI both dropped 1.2% to $80.44 and $76.27 per barrel, respectively. The downturn is attributed to mixed sentiments in the macro environment, with Moody's recent downgrade of the U.S. credit rating contributing to the negative trend.

A $20B week marks reopening of market for EM borrowers - Bloomberg

Emerging-market borrowers are rushing back into global bond markets, selling around $20 billion notes in a few days, capitalizing on favorable conditions amid signs that the Federal Reserve may be nearing the end of aggressive interest rate hikes. A combination of the potential end to rate hikes and cooling jobs growth in the U.S.

OPEC Raises Oil-Demand Forecast, Says Weak Sentiment Is Exaggerated - WSJ

Despite blaming speculators for recent oil price declines, OPEC stated that market fundamentals remain strong, with robust global growth trends and a healthy oil market. The group slightly increased its 2023 forecast for global oil demand growth by 20,000 barrels per day (bpd) to 2.46 million bpd.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities displayed a mixed performance in subdued Monday trade. The Hang Seng gained momentum, buoyed by the outperformance of the tech sector, despite a drag from China’s property developers. Mainland China experienced mild gains, while Japan closed little changed. The Taiex was supported by sharp gains in TSMC, offsetting minor losses in the Kospi and ASX.

Japan’s Producer Price Index (PPI) reached a two-year low, registering at 0.8% year-on-year compared to the previous month’s 2.2%. Japan’s Machine Tool Orders came in at -20.6% versus -11.2%, indicating a slowdown in industrial activity and supply chain inflation. Despite these developments, equities showed limited reaction, but the Japanese Yen traded at its weakest level of the year, with USD/JPY at 151.854.

Inflation in India continued to subside, with a reading of 4.87% year-on-year, the lowest level in four months. Food inflation inched slightly higher to 6.61% from 6.56% in the previous month. If this trend persists in the headline Consumer Price Index (CPI), the Reserve Bank of India (RBI) may consider a cut sometime next year.

China’s loan data for October was released, revealing that Chinese banks extended CNY 738.4 billion in new yuan loans, the lowest in three months but up 20% year-on-year. Household loans, including mortgages, contracted by CNY 34.6 billion, while corporate loans fell to CNY 516.3 billion from CNY 1.68 trillion.

Europe, Middle East, Africa:

European equity markets were higher, with travel/leisure, healthcare, and banks outperforming, while food/beverage and financial services underperformed.

Former UK Prime Minister Cameron returned to the government as foreign secretary in a cabinet reshuffle by Rishi Sunak. Cameron is the first former PM to return to government in 60 years. The market showed no significant reaction to the news, with UK Gilt Yields slightly lower across the curve.

A survey by CIPD indicated that pay growth remains too high to meet the Bank of England’s inflation target in the near term. Employers in both the private and public sectors planned 5% pay rises, signaling the potential for the biggest pay increase for public sector workers since surveys began in 2012. The survey was released ahead of official labor market data, expected to show a decline in employment numbers but with wage growth remaining close to record levels of around 8%.

OPEC’s latest report upgraded world oil demand by 100,000 barrels per day to 2.5 million barrels per day for 2023, while 2024 demand remained unchanged.

ECB’s Guindos foresaw a temporary rebound in inflation in the coming months as the base effects from the sharp decrease in energy and food prices in Autumn 2022 drop out of the year-on-year calculation.

The Americas:

House Speaker Johnson proposed advancing a clean stopgap funding bill over the weekend, with a vote as early as Tuesday before the current funding bill expires on November 17. Johnson’s plan would extend funding for some departments until January 19 and others until February 2, excluding some demands by House conservatives. This includes the 30% immediate cut to spending and changes to US asylum laws.

Positive news for Boeing as China is considering resuming purchases of Boeing’s 737 Max aircraft during the APEC Summit in San Francisco. Additionally, Emirates confirmed an order for 95 planes, while flyDubai is set to purchase 30 Dreamliners. Boeing shares rose by 3.2% pre-market.

Goldman Sachs stated that investors are overly concerned about the weakening outlook for US corporate earnings.

The Week Ahead:

Monday:

Tuesday:

Core CPI m/m (US)

Wednesday:

CPI y/y (UK)

Core PPI m/m (US)

Core Retail Sales m/m (US)

Empire State Manufacturing Index (US)

Thursday:

Unemployment Claims (US)

Friday:

Retail Sales m/m (UK)

Investment Tip of The Day

Monitor Portfolio Turnover: Keep an eye on portfolio turnover rates, especially in actively managed funds. High turnover can result in increased transaction costs and tax implications.