Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

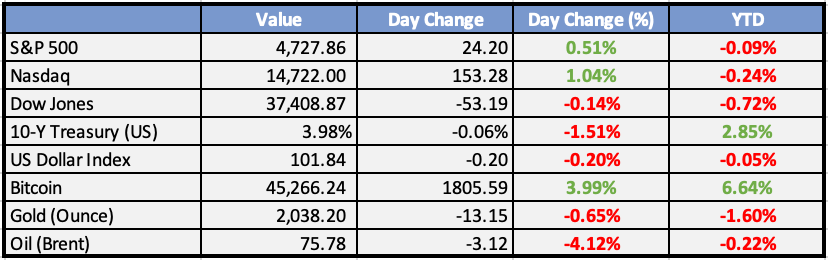

Market Data

Local

Global

x*Data as of 4pm WAT

Market News

Local

CBN pays foreign airline $61.64m through banks to settle backlog - BusinessNewsReport

Central Bank of Nigeria CBN said it has paid the sum of $61.64 million to settle some of the outstanding debts to foreign airlines

Saudis cut crude prices to all regions amid oil-price weakness - BusinessNewsReport

Saudi Aramco on Sunday said it would cut crude prices to all regions, including its largest market in Asia – a move that comes amid weaker global oil prices and increased production by producers outside the Organisation of the Petroleum Exporting Countries.

We are cooperating with EFCC’s forex investigation–Dangote Group - BusinessNewsReport

Dangote Group has said that it was cooperating with Economic and Financial Crime Commission which is investigating the possible misuse of foreign exchange from the central bank and would provide all required information.

Global

Congressional negotiators reach agreement on $1.6T government spending level for 2024 - WSJ

Congress reached a bipartisan deal on $1.6 trillion spending for 2024, but faces resistance from conservatives and tight deadlines to avoid a shutdown. The deal maintains defense spending and cancels unspent pandemic aid, but cuts $20 billion from the IRS and leaves key battles unresolved. House and Senate need to finalize 12 spending bills in weeks.

UK to invest £300 million in nuclear fuel - Reuters

Britain wants to become a major supplier of advanced nuclear fuel for next-gen reactors, investing £300M to break Russia's monopoly and aid global transition to nuclear power for climate goals. The project faces both technical and environmental challenges, but offers strategic and energy security benefits.

Market Commentary:

Asia and Australia

Indian markets may open flat, aligning with mixed and range-bound Asian markets despite higher US markets on Jan 05.

India's GDP estimated to grow by 7.3% in 2023-24, up from 7.2% in 2022-23, surpassing the RBI's revised forecast of 7.0%.

Tata Power plans to invest Rs 70,000 crore in Tamil Nadu over five to seven years for a 10 GW solar and wind project.

TVS Motor Co announces a Rs 5,000 crore investment over five years in the automobile, IT, and realty sectors, creating 500 jobs.

Encore ARC acquires IndoStar Capital's distressed loan book of Rs 292 crore, involving a senior-junior structure between the buyer and the seller.

Europe, the Middle East, and Africa:

European stocks fall on Monday due to increased geopolitical tensions and fading expectations of an early US rate cut.

Yields on the European 10-year benchmark note and the German 10-year rise for a third straight session.

Pan-European STOXX 600 down 0.2% at 475.37; German DAX marginally higher; France's CAC 40 slips 0.1%; U.K.'s FTSE 100 declines 0.4%.

Pandora reports a 12% YoY increase in organic sales; Maersk falls 1.3% due to significant changes in shipping routes.

U.K. job placements decline at the end of the year as employers remain cautious about hiring.

The Americas:

US stocks finish slightly higher on Friday, ending a nine-week winning streak, with the S&P 500 and Nasdaq Composite having their worst weekly showing in months.

Dow falls 0.6%, S&P sheds 1.5%, and Nasdaq drops 3.2% for the week, snapping nine straight weeks of gains.

ISM's survey shows a seven-month low for business conditions at service-oriented companies in December, with service sector employment dropping to the lowest level since July 2020.

U.S. employers add 216,000 new jobs in December, surpassing expectations of 170,000, leading markets to initially dial back bets on a March rate cut by the Fed.

Monthly nonfarm payrolls report prompts Treasury yields to spike higher, with the benchmark 10-year rate touching a high of 4.103%. A strong labor market could potentially delay the first of the Fed's anticipated rate cuts.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Thursday:

Core CPI m/m (US)

Unemployment Claims (US)

Friday:

GDP m/m (UK)

Core PPI m/m (US)

Investment Tip of The Day

Evaluate Supply Chain Resilience: Companies with resilient and diversified supply chains are better positioned to navigate disruptions. Assess how well companies in your portfolio manage supply chain risks.