Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

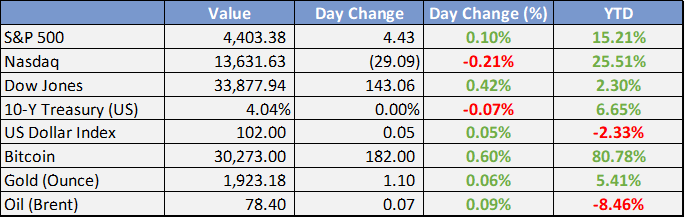

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Tinubu emerges ECOWAS chair, rallies members against coups - Punch

President Bola Tinubu emerged as the Chairman of ECOWAS and called for firm support of democracy, rejecting coups. He emphasized the need for collective action to address terrorism and coup attempts in West Africa.

Federal government reports an 18.5 million litre drop in monthly fuel consumption after deregulation – Punch

Petrol consumption in Nigeria reached 11.26 billion litres in the first half of 2023. However, after the removal of subsidy in June, daily consumption decreased by about 18.5 million litres. Prior to deregulation, the country consumed an average of 66.9 million litres of petrol daily.

Oba Otudeko returns as First Bank’s largest shareholder – Punch

Honeywell Group, owned by Oba Otudeko, has purchased the largest shares of First Bank of Nigeria Holdings in a cross deal worth N87.8 billion. This transaction has raised concerns about the validity of the trades, as no single shareholder had previously owned as many shares.

Global

US added 209k jobs in June for smallest gain in 2.5 years - Reuters

US added fewest jobs in 2.5 years in June, but strong wage growth indicates a tight labor market and ensures Federal Reserve will raise interest rates.

US remains top investment destination despite falling inflows - WSJ

In 2022, the United States remained the top choice for businesses seeking international expansion. However, global companies reduced foreign investments due to increased uncertainty and higher borrowing costs, leading to a decline in capital inflows.

Big US banks are set to report biggest jump in loan losses since Covid - Financial Times

The largest US banks are beginning their earnings season, but turbulent times lie ahead. Rising interest rates and inflation are impacting borrowers, leading banks to set aside more funds for potential bad loans. Banks with exposure to rising rates may fare better than those reliant on investment banking and wealth management.

Countries are repatriating gold in wake of Russia sanctions - Reuters

Countries are repatriating gold reserves as a safeguard against Western sanctions, according to a survey by Invesco. The study revealed concerns among central banks over the freezing of Russia's gold reserves by the West, leading to a shift in strategy. Many central banks now prefer to keep reserves at home as a safe haven asset.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Factory-gate prices fall further in China, adding to deflation concerns - PPI fell 5.4% in June (weakest since December 2015), below expectations of a 5.0% drop, following 4.6% decline in the previous month.

Japan's current account surplus misses forecasts

Asia ex-China on track to record highest FY fund inflow in eight years - overseas investors bought $25.4B in regional ex-China stocks YTD with India received most at $12.3B. A $28 billion wave of selling pressure threatens China stocks

South Korea state-run think tank says local economy appears to be on an upswing

TSMC sales beat forecasts on AI demand

Europe, Middle East, Africa

The latest Sentix survey for the Eurozone economy showed a decline in confidence for the fifth consecutive month. Came in at -22.5 versus -17.9 forecast and prior -17.0.

Politics in the Netherlands in the spotlight Monday following last week's collapse of the country's government. PM Rutte, who has been in power since 2010, set for a no-confidence vote in The Hague today after last week's coalition government infighting over migration policy.

BoE Governor Bailey rejected calls to raise the inflation goal above 2%, arguing any change could damage the bank's credibility

The Americas

Yellen's trip to China yields no breakthroughs as expected but dialogue remains open

Analysts expect second-quarter earnings to have fallen almost 9% — the biggest year-over-year decline since 2020, according to data compiled by Bloomberg Intelligence.

Bank earnings: The six lenders will set aside an estimated additional $7.6bn to cover loans that could go bad, analysts estimate.

Monetary Policy Meeting Minutes for Mexico show a “hold for longer” stance. Most directors discussed it premature to discuss rate cuts. The Committee left rates unchanged at 11.25% by unanimous decision during the Jun 22 meeting.

Investment Tip of The Day

Stay informed about global demographic trends: Changing demographics, such as aging populations or shifts in consumer preferences, can present investment opportunities in industries like healthcare, technology, or consumer goods.