Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

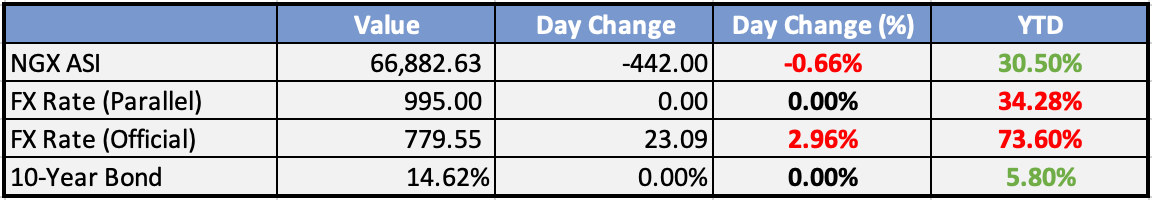

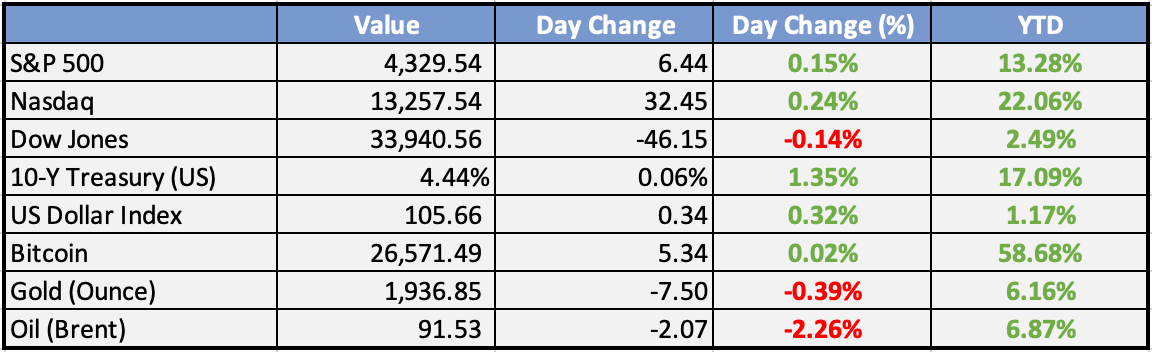

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Nigeria at risk of debt overhang as exchange rate nears N1000/$1 - The Sun

Nigeria faces a growing risk of debt overhang as the exchange rate inches closer to ₦1000 to $1, raising concerns about the country's ability to service its foreign debt and maintain fiscal stability.

PIA: Nigeria’s oil rig count rises to 41 - The Sun

Nigeria's oil rig count has increased to 41, signaling growth in the country's oil and gas sector following the implementation of the Petroleum Industry Act (PIA), which has attracted more investments and exploration activities in the industry.

FG to improve fintechs’ access to funds via regulations, digital infrastructure - Guardian

The Nigerian government is planning to enhance fintech companies' access to funds by introducing regulatory measures and improving digital infrastructure, aiming to promote financial technology innovation and inclusion in the country's financial sector.

Global

Airbnb and Blackstone joined the S&P 500 - WSJ

Blackstone and Airbnb stocks surged following the announcement by S&P Dow Jones Indices that both companies would be included in the S&P 500 (.SPX) index. Blackstone saw a 4.1% increase, while Airbnb's stock price rose by 5%. This change will take effect on September 18th, with Blackstone and Airbnb replacing Lincoln National Corp and Newell Brands Inc (NWL.O).

Credit card losses are rising at the fastest pace since the great financial crisis - CNBC

Goldman Sachs warns of credit card companies facing their highest losses in almost 30 years, excluding the 2008 crisis. Losses began rising in Q1 2022, hitting 3.63%, possibly reaching 4.93%. Record U.S. credit card debt amplifies concerns.

Bond yield surge casts dark quarter-end shadow - Reuters

Asia begins the week after a turbulent market spell driven by surging U.S. bond yields following the Federal Reserve's hawkish stance. Markets hope for stability, but rising Treasury yields and a strong dollar pose challenges. Emerging markets face tight financial conditions due to high U.S. debt costs and dollar strength.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities showed mixed results on Friday. Japan’s Nikkei and Topix both ended lower but rebounded from intraday lows following the Bank of Japan (BOJ) meeting. Greater China stocks rebounded and outperformed the region, while South Korea saw declines and Taiwan experienced gains. The Australian ASX index closed relatively flat.

In Japan, inflation remained broadly steady, with service prices consolidating at 2% for the first time in three decades. Core CPI rose 3.1% year-on-year in August, slightly surpassing the consensus estimate of 3.0% and matching the previous month’s 3.1%.

Japan’s Flash manufacturing PMI for September was 48.6, down from 49.6 in the previous month. This marks the fourth consecutive month of contraction and the weakest level in seven months.

Qualcomm is reducing its workforce in China and Taiwan, signaling a longer-than-expected industry downturn and a slow recovery.

In China, yields on shorter-term Chinese government bonds are rising despite two recent LPR (Loan Prime Rate) cuts this year. Tightening capital supply is undermining the easing efforts of the People’s Bank of China (PBOC). While long-term yields have fallen, yields on five-year and shorter maturities have risen, causing a flattening of the yield curve.

Europe, Middle East, Africa:

European equity markets mostly experienced declines. The Basic Resources and Oil & Gas sectors outperformed, boosted by higher commodity prices and rising hopes of additional stimulus measures from China.

Despite the policy statement leaving the door open to further tightening if necessary, the probability of a November Bank of England (BoE) rate hike is perceived to be less than 50% by the markets.

UK retail sales remained subdued in August, with a 0.4% increase compared to the consensus estimate of 0.5% and a 1.1% drop in the previous month. Food sales and clothing had strong months, but internet sales declined, and fuel sales dropped due to increased prices affecting demand.

UK GfK consumer confidence reached a 20-month high in September at -21, compared to the previous reading of -25. This was the strongest level since January 2022, just before Russia’s invasion of Ukraine.

The Americas:

Flow dynamics are in focus as the higher-for-longer theme exerts upward pressure on rates and weighs on risk sentiment. A recent report from Bank of America noted that global equity funds saw outflows of $16.9 billion in the week ending September 20, the most significant outflows since December 2022. US equity funds also experienced outflows of $17.9 billion, the most significant outflows since last December.

Morgan Stanley indicated that absent a rebound in the spot market, CTA (Commodity Trading Advisor) models are likely to turn sellers over the next few days. Nomura recently estimated that a drop below 4,409 on the S&P 500 would trigger selling by CTAs, with an estimated $12.3 billion worth of equity futures to be sold in aggregate.

The United Auto Workers (UAW) targeted work stoppages against major Detroit automakers are expected to expand today due to few signs of progress in wage and benefit negotiations.

The Week Ahead:

Monday:

Tuesday:

CB Consumer Confidence (US)

Wednesday:

Thursday:

Final GDP q/q (US)

Unemployment Claims (US)

Friday:

Core PCE Price Index m/m (US)

Revised UoM Consumer Sentiment (US)

Investment Tip of The Day

Evaluate Geopolitical Risks: Assess geopolitical risks, such as trade tensions, conflicts, or policy changes in regions relevant to your investments. These factors can affect global markets and specific sectors.