Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

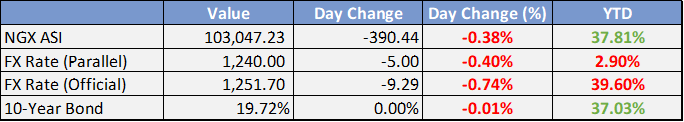

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

The US dollar index saw a modest increase of 0.2% for the day, which was somewhat surprising given the March US non-farm payrolls significantly outperforming expectations. The euro saw fluctuations, dipping from 1.0840 to 1.0791 before recovering, while USD/JPY climbed from 151.20 to 151.75. The ascent of the USD/JPY pair was tempered by concerns over potential intervention should it approach 152.

March's US non-farm payrolls were exceptionally strong, registering at +303k, far surpassing the anticipated 214k, with the previous month at 270k, and included an upward revision of +22k for the last two months. The unemployment rate dipped to 3.8% as forecasted, with participation increasing. Average hourly earnings rose by 0.3% month-over-month and 4.1% year-over-year, with a slight increase in average weekly hours from 34.3 to 34.4.

FOMC member Bowman stated it was premature to consider rate cuts, emphasizing the need for more data to ensure inflation is steadily returning to the 2% target before it becomes appropriate to gradually reduce the federal funds rate. She highlighted that we have not yet reached the juncture where lowering the policy rate is appropriate, noting several ongoing risks to inflation. Logan shared similar sentiments, indicating it was too early to consider interest rate reductions, requiring further clarity on the economic trajectory. Barkin remarked on the strength of the jobs report and the resilience of the job market.

Interest Rates:

The US 2-year treasury yield escalated from 4.64% to a peak since December of 4.75%, while the 10-year treasury yield climbed from 4.30% to 4.40%. Market expectations for the Federal Reserve's funds rate, presently at a midpoint of 5.375%, remain for it to be unchanged at the upcoming meeting on May 2nd, with a 50% probability of a rate cut by June.

The shift in focus from geopolitical concerns to payroll data was evident in credit indices. Main widened by a basis point to 54.5, CDX improved slightly by a basis point to 52.5 after a previous day’s widening, and US investment-grade cash bonds tightened by 1-2 basis points. Given the volatility and anticipation of payroll data, primary markets were predictably quiet with no new supply in either EUR or USD, resulting in US primary market volumes for the week totaling USD 24 billion.

The upcoming week is expected to see an early surge in activity, primarily due to the US CPI announcement on Wednesday and the European Central Bank meeting on Thursday. Additionally, the commencement of the US Q1 earnings season this week, particularly the financial reports from major banks on Friday, will likely influence future supply dynamics in the market.

Commodities:

Brent crude remained above $90 amidst escalating tensions in the Middle East, leading to a reevaluation of geopolitical risks. Media outlets have suggested that an Iranian response to the attack on its consulate in Damascus is imminent, while Israel has redeployed troops from Khan Younis in southern Gaza in anticipation of operations in Rafah. On Friday, the May WTI contract saw a 0.37% increase, closing at $86.91, whereas the June Brent contract ended the day 0.57% higher at $91.17, marking a 4.22% rise over the week. Following the OPEC meeting, which extended production cuts into the second quarter and addressed compensation for excess production, Saudi Arabia raised the price of its main Arab Light crude blend for Asian buyers in May to a premium of $2, up 30 cents. The May gasoline future reached a seven-month high.

In the metals market, there were indications of profit-taking following the stronger-than-expected non-farm payroll report. Copper slightly declined by 0.12% to $9,348, while aluminium increased by 0.27% to $2,451. Nevertheless, concerns over supply remain prominent. Canada's Ivanhoe Mines reported reduced output at the Kamoa-Kakula complex in the Democratic Republic of the Congo, and a drought in Zambia has raised supply issues. Goldman Sachs has predicted that these supply constraints will lead to significant deficits in the market during the second quarter.

Investment Tip of The Day

Focus on long-term financial goals rather than reacting to short-term market volatility. Making investment decisions based on short-term market movements can lead to missed opportunities or unnecessary losses. By keeping your eyes on your long-term objectives, you're more likely to make decisions that align with your overall financial plan and risk tolerance, thereby increasing your chances of achieving your investment goals.