Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

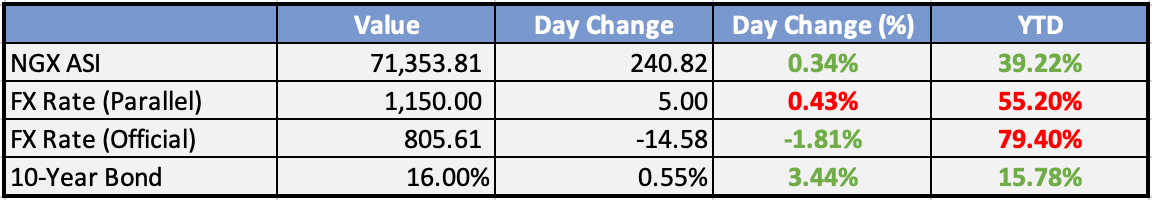

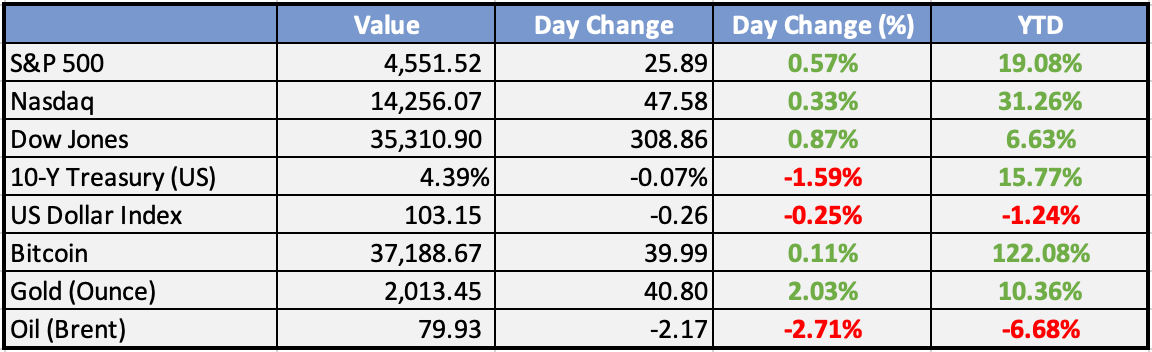

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

MPC Has Fulfilled Statutory Meeting Requirements – CBN - Leadership

The Central Bank of Nigeira (CBN) has said it has fulfilled the statutory meeting requirements of the Monetary Policy Committee (MPC) for this year, even as it said clearing of foreign exchange backlog is still ongoing with 31 banks having their backlogs cleared.

Global

Black Friday shoppers spent a record $9.8B in US online sales, up 7.5% from last year - CNBC

Black Friday e-commerce spending popped 7.5% to a record $9.8 billion in the U.S., as consumers hunted for deals online. Consumers are more price-sensitive this year, with many opting for the 'Buy Now, Pay Later' flexible payment method. The best-selling categories were electronics, toys and gaming, while home-repair tools underperformed.

Israel, Hamas look to extend truce after more hostages are freed - Bloomberg

Israel has declared that for every ten more hostages freed, the cease-fire will be extended by one day. The four-day truce, which was imposed on Friday following many weeks of indirect talks facilitated by the US, Qatar, and Egypt, has also been expressed as a goal of Hamas.

Gold price hits six-month high as investors bet on rate cuts - Financial Times

The price of gold rose to a six-month high on Monday as investors became more confident that the US Federal Reserve has finished raising interest rates. The move took the precious metal's gains since hitting a seven-month low at the start of October to just over 10 per cent. Analysts said the yellow metal could test its all-time high of just below $2,075 per ounce by the end of 2023.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asia markets ended lower almost everywhere on Monday. Greater China was led down by Shenzhen, and Hong Kong also weakened but was off its worst. Taiwan saw sharp losses due to more domestic political developments, while Australia and South Korea experienced more modest losses. Southeast Asia was lower, excluding Jakarta, and Japan closed lower despite a bright start.

Cash conditions in China’s money markets showed fresh signs of stress amid end-of-month demand and a recent liquidity squeeze. Borrowing costs remained high for funds supplying financial institutions, especially non-banks, as they approached month-end.

The HIBOR rate in Hong Kong jumped to a 16-year high on Monday due to end-year demand for cash and stockpiling for regulatory purposes. The one-month HIBOR rose to 5.53%, the highest since October 2007.

Eight Chinese government agencies and ministries, led by PBOC, issued a 25-point statement to step up financial support for the country’s private sector, seen as the latest effort by Beijing to boost business confidence amid economic headwinds.

China’s industrial profits for October rose 2.7% y/y, following an 11.9% increase in September, marking the third consecutive monthly growth. State-owned enterprises saw profits drop 9.9% in Jan-Oct, while foreign firms posted a 10.2% fall. Private enterprises recorded a 1.9% drop.

Europe, Middle East, Africa:

European equity markets were lower in the morning, pulling back on falling energy prices.

Deutsche Bank analysts cut the 2024 German GDP forecast from +0.3% to -0.2% amid a Constitutional Court ruling crisis. Chancellor Scholz’s decision to suspend the debt brake for 2023 and retroactively include at least €37 billion in new off-budget debt aims to mitigate the effects of rising electricity and gas prices.

Estonia’s central bank chief Muller stated that the ECB is unlikely to hike rates again. Governor Bailey of the Bank of England (BoE) cautioned against expecting a rapid decrease in inflation, projecting that inflation might fall to just under 4% by the end of Q1 2024.

The Americas

BoFA Flow Show for the 4-week ending Nov 21:

Stocks: Biggest 2-week inflow since Feb 2022 ($40B)

Gold: Biggest inflow since May ($0.7B)

IG Bonds: Biggest inflow to IG bonds in 15 weeks ($3.1B)

EM Debt: First inflow past 17 weeks ($20m)

Tech: Biggest inflow past 12 weeks ($2.4B)

Nasdaq listed a series of new options contracts tracking popular ETFs investing in gold, silver, natural gas, oil, and long-term Treasuries.

November S&P Global flash manufacturing PMI of 49.4 missed consensus for 50.2, down from last month’s 50.0 print and the lowest print in three months. Manufacturing output index held slightly in expansion territory.

Black Friday sales numbers:

Mastercard Spendingpulse reported a 2.5% y/y rise in nominal Black Friday sales.

Adobe Analytics reported a 7.5% rise in Black Friday ecommerce spending to a record $9.8B.

The Week Ahead:

Monday:

Tuesday:

CB Consumer Confidence (US)

Wednesday:

Prelim GDP q/q (US)

Thursday:

Core PCE Price Index m/m (US)

Unemployment Claims (US)

Friday:

ISM Manufacturing PMI (US)

Investment Tip of The Day

Review Personal Liability Risk: For high-net-worth individuals, consider personal liability risks. Asset protection strategies, such as trusts, can shield wealth from legal claims.