Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

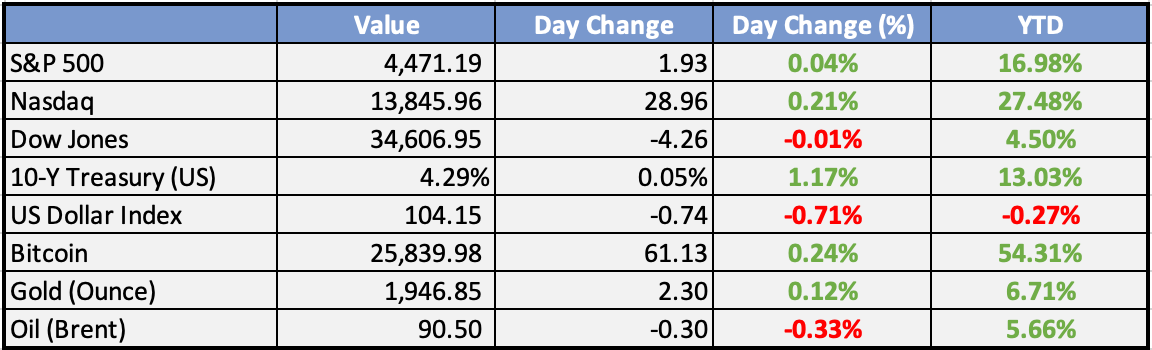

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

$13bn Trans Saharan Gas Pipeline Project Faces Headwinds Over Regional Insecurity - Leadership

The $13 billion Trans-Saharan Gas Pipeline project, aimed at transporting natural gas from Nigeria to North Africa and Europe, faces challenges due to regional insecurity. The project, which could boost energy supplies and economic development, is hindered by security concerns along the proposed pipeline route, including in regions known for instability and conflict.

Global

US, Vietnam upgrade ties as Biden visits in hedge against China - CNBC

President Biden secured agreements with Vietnam, elevating the U.S.' diplomatic status alongside China and Russia. These agreements focus on semiconductor cooperation and strengthening critical mineral supply chains, notably rare earths. Human rights concerns persist.

Yen surges on BOJ’s remarks; dollar eases ahead of US inflation - Reuters

The yen strengthened as Bank of Japan Governor Kazuo Ueda hinted at moving away from negative interest rates. The dollar slid ahead of key U.S. inflation data, with traders assessing the possibility of a "soft landing" for the U.S. economy and further Federal Reserve rate hikes. The yen rose 0.67% to 146.85 per dollar.

Oil prices ease from 10-month highs but hold above $90 a barrel - Reuters

Oil prices retreated after Saudi Arabia and Russia extended supply cuts, with Brent crude falling 0.25% to $90.42 a barrel and U.S. West Texas Intermediate crude dropping 0.53% to $87.05. Focus shifted to demand drivers, including upcoming reports from the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC).

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities closed with mixed results on Monday. China’s assets rallied on better economic news, driven by stronger-than-expected credit and inflation data. However, Hong Kong underperformed as it partially marked down losses from Chinese equities on Friday.

In China, new loans for August reached CNY 1.36 trillion, surpassing the consensus forecast of CNY 1.20 trillion and following CNY 345.9 billion in the previous month.

Bank of Japan (BoJ) Governor Ueda stated that they “can’t rule out the possibility” of having enough information by year-end to assess if wages will continue to rise. The yen strengthened, bond yields rose sharply, and the banking sector rallied largely in response to Governor Ueda’s comments.

In China, deflation pressures eased as the headline Consumer Price Index (CPI) rose by 0.1% year-on-year in August, falling below the consensus estimate of 0.3%. This marked an improvement from the 0.3% decline in the previous month, which had been the first negative print since February 2021. Core inflation remained steady at 0.8%.

Arm is reportedly close to securing enough investor support to achieve the fully diluted valuation of $54.5 billion it sought in its initial public offering (IPO) at the top of its indicated range. The company is considering asking investors to value it even higher.

Europe, Middle East, Africa:

European equity markets closed higher, although they retreated from their peak levels. The mining and banking sectors outperformed, while travel and food/beverage sectors were weaker.

The European Commission released its summer 2023 economic update, revising down the growth forecast for 2023 to 0.8% from the previous estimate of 1.1%. It also lowered the growth projection for 2024 to 1.3% from 1.6%.

Dutch TTF gas prices were on track for a third consecutive day of gains as negotiations between Chevron and the Offshore Alliance took a different path compared to Woodside.

Industry data from the UK continues to show a mixed picture for the labor market, with tomorrow’s official ONS data eagerly anticipated for further insights.

The Americas:

Meta (formerly Facebook) is reportedly planning to train a new model that it hopes will be as powerful as OpenAI’s latest GPT-4. This suggests continued interest in advancing artificial intelligence capabilities.

J.M. Smucker is nearing a deal to acquire Hostess Brands for close to $5 billion, indicating potential consolidation in the food industry.

Strategists at Oppenheimer, led by Stoltzfus, believe that US stocks are likely to dip further. This outlook could influence investment decisions in the stock market.

Earnings estimates are on the rise, further supporting expectations for a profit recovery following three consecutive quarters of year-on-year declines.

A strike by the United Auto Workers (UAW) against the Big Three US automakers (General Motors, Ford, and Stellantis) is becoming increasingly likely after the union president expressed dissatisfaction with the latest contract proposals. Such a work stoppage, even if brief, could have significant economic consequences in the US.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Manufacturing Production (YoY) (GB)

Industrial Production (MoM) (EA)

Consumer Price Index (MoM) (US)

Thursday:

Employment Change s.a (AU)

Retail Sales (MoM) (US)

Friday:

Industrial Production (YoY) (CN)

NY Empire State Manufacturing Index (US)

Industrial Production (MoM) (US)

Michigan Consumer Sentiment Index (US)

Investment Tip of The Day

Study Market Psychology for Informed Investing: Delving into market psychology is essential for investors. It involves understanding how emotions like fear and greed can influence market behavior.