Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

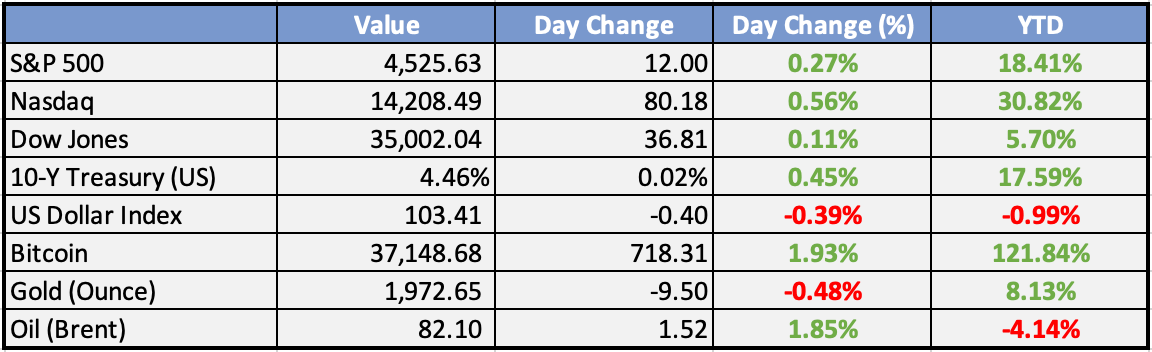

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

NSIA unveils $500m renewable energy investment platform - Punch

The Nigeria Sovereign Investment Authority has launched a $500 million Renewables Investment Platform for Limitless Energy dedicated for the development of renewable energy projects across the entire value chain.

FG seals $2.2bn Solar PV deal with Sun Africa - BusinessDay

The federal government through the ministry of power has sealed a $2.2 billion solar PV deal with Sun Africa. Bayo Adelabu, the minister made this known on his official Twitter account on Sunday

AfDB Targets $1bn Financing to Expand Agro-industrial Processing in Nigeria - Thisday

The President of the African Development Bank Group, (AfDB) Dr Akinwumi Adesina, has stated that the bank and its partners were targeting $1 billion in financing to expand the Special Agro-Industrial Processing Zones (SAPZ) programme in Nigeria.

OPEC moves to cut additional 1m bpd - TheSun

JP Morgan’s head of energy strategy, Christyan Malek, has warned that amid the recent plunge in oil prices, driven as much by shorting CTAs (who today are in full-blown short squeeze panic mode) as the Biden admin, the oil market was underestimating the chances of deeper supply cuts during this month’s Nov 26 OPEC+ meeting.

Global

OpenAI appoints new boss as Altman joins Microsoft - Reuters

Emmett Shear, former CEO of Twitch, has been named interim CEO of OpenAI following the abrupt departure of Sam Altman. Altman is set to join Microsoft, a major backer of OpenAI, as CEO of a new research group. Speculation arose about Altman's departure due to safety concerns regarding powerful AI models, but Shear dismissed this in a statement.

Dollar slides to over two-month low as Fed cut bets take charge - Reuters

The U.S. dollar slid to a more than two-month low as traders bet on a peak in U.S. rates and shifted focus to potential rate cuts by the Federal Reserve. The dollar index hit its weakest level since September, with the euro reaching its highest since August. Markets discounted the likelihood of further rate hikes after weak U.S. economic indicators, including lower-than-expected inflation.

Oil rises on expectations of further OPEC+ supply cuts - CNBC

Oil futures rose on Monday as OPEC+ considers deeper supply cuts to bolster prices that have fallen in recent weeks. Brent crude and West Texas Intermediate futures both gained over 1%, settling at $81.80 and $77.01, respectively. Investors are also watching Russian crude oil trade after U.S. sanctions and the possibility of a deal to free Gaza hostages.

Weekly Investment Watchlist

Market Commentary:

Asia and Australia:

Asian equities ended Monday with a mixed performance. Hong Kong saw strong gains led by property stocks, and mainland shares were modestly higher. Seoul experienced sharp gains, while Taipei remained flat due to domestic political developments. Australia closed slightly higher, Southeast Asia had a mixed performance with SingTel dragging Singapore lower, and India held opening losses. Japan ended lower after touching a 33-year high earlier in the day.

China maintained its 1-year and 5-year Loan Prime Rate steady. Chinese regulators are reportedly drafting a list of 50 private and state-owned developers eligible for a range of financing measures to support the property market. This potential stimulus is welcomed, and attention is on whether they follow through with such actions.

India is expected to extend the ban on certain rice exports into 2024 due to concerns about tightening supplies amid El Niño conditions, potentially keeping global prices elevated after reaching a 15-year high in August.

Thailand’s Q3 GDP grew 1.5% year-on-year, below expectations of 2.4%, with a sharp fall in exports offsetting gains in imports and the service sector from tourism. Government spending contracted by -4.9% year-on-year as Covid measures were being unwound.

Bond giant Pimco has started buying yen to prepare for a tighter Bank of Japan (BOJ) monetary policy.

Europe, Middle East, Africa:

European equity markets were mostly higher, following strong gains in the previous week.

German officials and lawmakers are preparing for painful budget cuts after the constitutional court ruled last week that the country’s €60 billion off-budget was unlawful.

The ECB, in its latest Financial Stability Review article, noted that low valuations for Eurozone bank stocks appear to reflect concerns about credit risk and shareholder payouts, likely weighing on future credit growth.

EU equity markets posted a substantial rally over the past three weeks, supported by a ~30bp decline in the US 10-year real bond yield. The global equity risk premium remains close to a 15-year low, and 12-month forward consensus EPS expectations are near historical peak levels.

Germany’s Bayer has abandoned a large late-stage trial testing a new anti-clotting drug due to a lack of efficacy, causing its shares to slide over 16%.

The Americas:

Argentina has a new right-wing libertarian president, Javier Milei. His strong win is seen as a move by the people to bring an outsider with radical views to fix an economy facing triple-digit inflation, a looming recession, and rising poverty. This decision is expected to weigh on the Peso while lifting Bond Yields when markets open.

October housing starts in the US increased by 1.9% month-on-month to a pace of 1.372 million, beating consensus expectations. Single-family starts rose 0.2% to 970,000, the highest since July, while multi-unit starts increased 4.9% month-on-month to a pace of 382,000.

Over the weekend, the significant news was the firing of OpenAI’s founder and CEO, Sam Altman. Reports suggest that he and his team are joining Microsoft to lead a new AI research initiative.

The Week Ahead:

Monday:

Tuesday:

Wednesday:

Unemployment Claims (US)

Revised UoM Consumer Sentiment (US)

Thursday:

Flash Manufacturing PMI (UK)

Flash Services PMI (UK)

Friday:

Flash Services PMI (US)

Flash Manufacturing PMI (UK)

Investment Tip of The Day

Evaluate Company Governance Structures: Different governance structures can impact decision-making. Assess how a company's governance aligns with shareholder interests for better risk management.