Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Nigeria owes foreign airlines $818m – IATA - Business News Report

Nigeria secures $8.2 billion of the required $10 billion annually for its Energy Transition Plan, aiming for decarbonization and net-zero carbon status by 2060. The government emphasizes the importance of female energy professionals in realizing this ambitious national policy.

OPEC Cuts Nigeria’s Oil Quota By 20% To 1.38m Barrels - Leadership

The Organization of Petroleum Exporting Countries (OPEC) and its allies, has agreed to cut global oil production by 1.393 million barrels per day, reducing Nigeria’s oil production quota by 20.7 per cent.CBN disburses N173bn under 100-for-100 policy – Punch

The Central Bank of Nigeria has disbursed N173.31bn to beneficiaries under its 100-for-100 Policy on Production and Productivity since the commencement of the intervention. According to the bank, the CBN Governor, Godwin Emefiele, disclosed this in Abuja after the Monetary Policy Committee meeting.Deregulation: Era of price fixing, petroleum equalization over –NMDPRA - The Sun

With deregulation of the downstream sector of the petroleum industry in full swing, the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), has said that the era of price fixing and sourcing foreign exchange for imports at the official Central Bank of Nigeria (CBN) rates is over.

NNPC to discontinue Crude Swap, targets Cash Payments for Petrol Imports - Leadership

With the removal of subsidy on petrol in the country, the Nigerian National Petroleum Company Limited (NNPC) is set to discontinue crude oil swap in favour of cash payments for petrol imports.

Global

Saudis to cut oil production by 1m barrels a day in July as OPEC+ extends output deal - Business News Report

Saudi Arabia will voluntarily cut production by 1 million barrels a day in July, alongside an agreement by the Organisation of the Petroleum Exporting Countries and its allies to stick to production targets on Sunday. Describing the voluntary cut as a “Saudi lollipop,” the country’s energy minister, Prince Abdulaziz bin Salman, said the July reduction could be extended if needed.

President Biden’s signing of the debt limit deal over the weekend brought the debt ceiling saga to a close, but it also brings forth the latest concern for markets: liquidity.

Starting today, the US Treasury will begin issuing a large number of bonds to replenish its funds.

Paying for those new bonds—and acting as a drain on liquidity—will be bank deposits.

As a result, JPMorgan expects overall liquidity to fall by some $1.1 trillion which could lead to a 5% drop in the combined performance of stocks and bonds.

According to BofA, the consequent economic impact felt from this new issuance could be equivalent to a 25bps hike in interest rates.

In the wake of March’s string of bank failures, US regulators will soon propose new rules that call for large banks to increase their overall capital requirements by ~20%.

The goal is to force banks to maintain a bigger cushion for potential losses, thereby improving the resiliency of the banking system.

The new rules are expected to apply to banks with at least $100 billion in assets.

Critics argue the proposal would raise costs for consumers, result in fewer services offered by banks, and potentially stunt economic growth.

Friday’s jobs report shows the economy unexpectedly added 339,000 jobs in May.

The figure was the most in 4 months and marked the 14th consecutive month payrolls came in above market expectations.

This puts the total number of jobs gained so far in 2023 at over 1.5 million–certainly not what the Fed wants to see.

On the other hand, the unemployment rate—which is calculated using the separate household survey—rose to 3.7% from 3.5%.

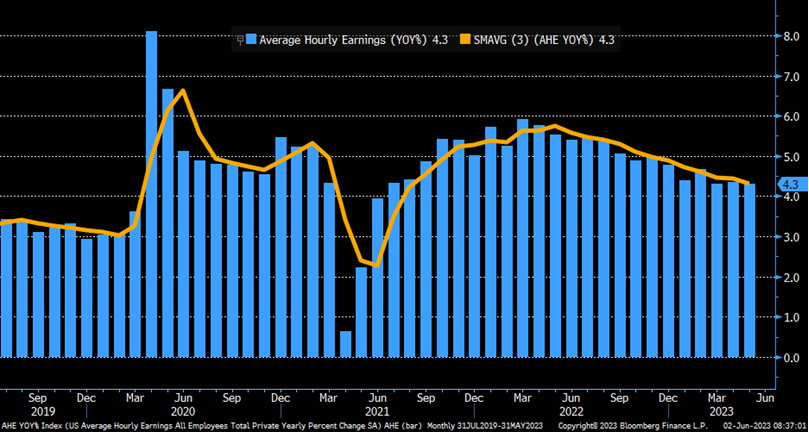

Wage growth also slowed, with average hourly earnings rising 0.3% in May and 4.3% annually, down from 0.4% MoM and 4.4% YoY in April.

Markets surged following Friday’s jobs numbers and pushed the Volatility Index (VIX) down to its lowest close in more than 3 years.

This reflects an increasingly confident outlook for stocks among investors.

Positioning, however, continues to reflect uncertainty as speculator bets against the S&P 500 remain at their most bearish since 2007.

At the same time, bullish wagers on tech stocks are approaching the highest level since late 2022.

Weekly Investment Watchlist

Market Commentary

Asia and Australia

Beijing putting together a basket of measures to support its property sector and boost the economy after previous initiatives failed to provide a hoped-for rebound. This is something to keep an eye on as it may mean liquidity entering the system providing a tailwind to stocks.

Beijing will make greater efforts to attract and utilize foreign capital. Noted China will reduce the negative list for foreign investment and relax restrictions on market access.

Economists split on whether RBA will hold or raise the cash rate by 25 bp to 4.10% at Tuesday's meeting

Negative-yielding debt bounces back to almost $2T on BOJ

South Korea forex reserves drop in May on stronger dollar; Foreigners to be allowed to invest in South Korean stock market without prior registration from Dec.

Europe, Middle East, Africa

S&P left its credit rating for France unchanged at AA despite concerns over the country's rising debt levels and after Fitch lowered its rating in April

Bank of England looks to broaden reform of deposit guarantee scheme

UK PM Sunak wants to cut National Insurance or income tax by up to 2p before next year's general election

EU gas prices retreat, but tight LNG markets are expected further into H2. Dutch TTF gas prices are down to €25/MWh from over €30/MWh just two weeks ago.

The Americas

Bearish positioning in S&P 500 highest since 2007, bullish bets on Nasdaq 100 near the highest level since late last year

CCC-rated bond underperformance highlights concerns about growth, default risks

The Week Ahead:

Monday: S&P Global Services PMI, ISM Services PMI, factory orders

Tuesday: IBD/TIPP economic optimism, API crude oil stock change

Wednesday: US trade deficit, EIA stocks change, consumer credit change

Thursday: Initial jobless claims, wholesale inventories

Friday: WASDE report

Investment Tip of The Day

Consider the impact of geopolitical events. Geopolitical events, such as political instability or trade disputes, can have a significant impact on the financial markets. Stay informed about global developments and assess their potential effects on your investments.