Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

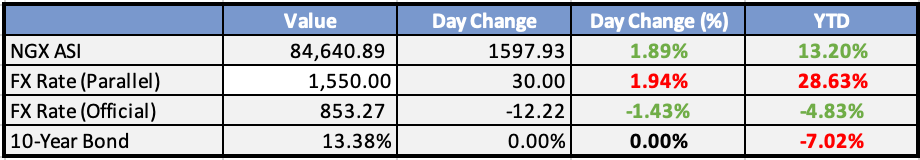

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Afreximbank, UBA disburse NNPCL over $2bn oil-for-cash loan - Punch

The African Export-Import Bank and the United Bank for Africa have disbursed $2.25bn of the $3.3bn oil-for-cash loan facility arranged by the Nigerian National Petroleum Company Limited.

EU introduces new import policy - Punch

The European Union has disclosed plans to implement a robust customs pre-arrival safety and security system targeting cargoes entering the region via sea, rail, and road.

Seven major marketers get approval to sell Dangote fuel - Punch

The seven major oil marketers in Nigeria have registered with the Dangote Petroleum Refinery for the lifting and distribution of refined petroleum products produced by the $20bn plant.

FIRS suspends implementation of VAT guidelines - TheSun

The Federal Inland Revenue Service (FIRS) has announced the postponement of the implementation guidelines for the value-added tax simplified compliance regime on the supply of low-value goods through digital means by non-resident suppliers.

DECEMBER'S INFLATION HIGHLIGHTS

Headline inflation increased to 28.92% YoY in December 2023; 0.72% higher than the 28.20% recorded in November 2023.

MoM, headline inflation increased to 2.29% in December 2023; 0.20% higher than the 2.09% recorded in November 2023.

Food inflation inched up by 33.93% YoY in December 2023; 1.09% higher than the 32.84% recorded in November 2023.

MoM, food inflation increased to 2.72% in December 2023; 0.30% higher than the 2.42% recorded in November 2023.

Core inflation printed at 23.06% YoY in December 2023; 0.68% higher than the 22.38% recorded in November 2023.

MoM, core inflation printed at 1.82% in December 2023; 0.29% higher than the 1.53% recorded in November 2023.

Global

Microsoft topples Apple to become global market cap leader - Reuters

Microsoft overtakes Apple as world's biggest company, fueled by AI boom and Apple's slumping iPhone sales. Microsoft's market cap surges over $1 trillion while Apple faces China challenges. This shift mirrors the early 2000s tech boom, with AI companies replacing traditional giants at the top.

China's military and government acquire Nvidia chips despite US ban - Reuters

Chinese military and research institutions bought banned Nvidia chips despite US export restrictions, highlighting loopholes and continued access through unknown suppliers. Universities and military entities bought chips showcasing AI focus. US aims to hinder China's AI development but complete blockades remain unlikely.

Market Commentary:

Overview:

US bond yields experienced a decline in response to weaker-than-expected US data on producer inflation on Friday. US markets are closed for Martin Luther King Jr. Day.

Currencies/Macro:

The US dollar displayed mixed movements on Friday, with only small net changes. EUR/USD fell from 1.0980 to 1.0950, while GBP/USD returned to 1.2750.

A major opinion poll over the weekend projected a massive win for the Labour Party in the election expected in H2 2024. USD/JPY fell steeply on the PPI data then trimmed losses to about -0.25% at 144.90.

US PPI inflation in December was softer than expected at -0.1%m/m and +1.0%y/y, with ex-food and energy flat m/m and +1.8%y/y.

UK production data for November was stronger than expected, with GDP, industrial production, manufacturing, and services beating estimates.

ECB chief economist Lane emphasized the inappropriateness of discussing rate cuts in the near term, cautioning against premature normalization.

Taiwan’s presidential election resulted in another victory for the independence-leaning Democratic Progressive Party.

Interest Rates:

The US 2yr treasury yield fell from 4.28% to 4.14%, while the 10yr yield fell from 3.98% to 3.94%. Markets are pricing the Fed funds rate to be unchanged at the next meeting on 1 February, with a 75% chance of a cut in March.

Credit indices remain around the lows recorded in December, with CDX at 55bp and Main at 60, despite strong primary volumes.

Commodities:

Crude markets closed with modest gains despite two rounds of strikes by the US and its allies against Houthi rebels in Yemen.

Gas markets experienced a surge in demand due to an arctic blast sweeping across North America, with the February Henry Hub contract jumping 7% on Friday.

Metals finished the week at 1-month lows, with copper down 0.7% to $8,295, aluminium down 0.9% at $2,215, and nickel falling 1% to $16,250.

Iron ore plunged on weak demand, with the February SGX contract down $3.80 to $128.55, and the 62% Mysteel index falling $4.15 to $130.75.

Day ahead:

Eurozone:

Industrial production growth will likely remain broadly weak as demand conditions soften. The trade surplus is expected to continue tracking a widening trend.

US:

US markets will be closed for Martin Luther King Jr Day.

The Week Ahead:

Monday:

Tuesday:

Empire State Manufacturing Index (US)

Wednesday:

CPI y/y (UK)

Core Retail Sales m/m (US)

Thursday:

Unemployment Claims (US)

Friday:

Retail Sales m/m (UK)

Prelim UoM Consumer Sentiment (US)

Investment Tip of The Day

Monitor Political Risk in Commodity Investments: Commodity investments can be influenced by political decisions. Assess political stability and policies in commodity-producing regions to gauge investment risks.