Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

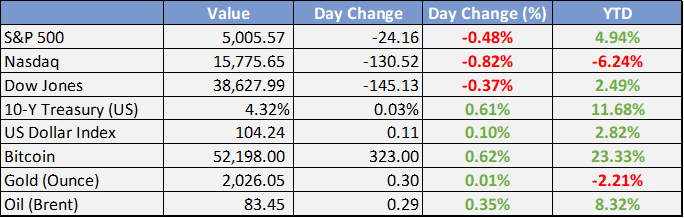

Market Data

Local

Global

*Data as of 6pm WAT

Market News

Local

Fitch Takes Rating Action on 12 Nigerian Banks Following Naira Devaluation - Proshare

Fitch Ratings has maintained the RWN on First City Monument Bank's (FCMB) and Union Bank of Nigeria PLC's (UBN) Long-Term IDRs of 'B-' and National Long-Term Ratings of 'BBB+(nga)' and 'BBB(nga)', respectively.

Fitch has simultaneously affirmed eight other Nigerian banks' and two bank holdings companies' (BHCs) Long-Term IDRs at 'B-', while also affirming the issuers' National Long-Term Ratings with Stable Outlooks.

Rising food, fuel prices could lead to civil unrest in Nigeria, AfDB warns - Sun News

As economic austerity in Nigeria reaches unbearable levels, the African Development Bank (AfDB) has expressed worries that rising prices of fuel, food and other essential commodities could precipitate social unrest. According to the regional bank, rising cost of living could also lead to social unrest in Ethiopia, Angola and Kenya respectively who are also buffeted by lingering economic hostilities.

Global

Goldman Sachs lifts 2024 S&P 500 target to 5,200 on upbeat profit outlook - Reuters

Goldman Sachs raised its year-end target for the benchmark S&P 500, opens new tab to 5,200, reflecting roughly a 4% upside from current levels, citing an improved earnings outlook for the index companies. The brokerage had previously projected the index to end 2024 at 5,100, before raising the forecast from 4,700 in December, on cooling inflation and expectations of the U.S. central bank easing rates in the year.

‘China has a lot more to lose’: U.S. considering sanctioning Chinese firms aiding Russia’s war - CNBC

The U.S. is considering slapping sanctions on Chinese companies it believes are helping Russia fuel its war in Ukraine, members of Congress told CNBC.

Lawmakers may “very soon” follow similar proposals from the EU, in what would mark the first direct penalties against Beijing over its alleged military support for Moscow.

“China has to understand that the same kinds of sanctions which are beginning to really take hold in Russia ... can also be applied to China,” Senator Gerald Connolly said.

Market Commentary:

Currencies/Macro:

The US dollar experienced minor net changes against G10 currencies on Friday, with initial gains from Producer Price Index (PPI) data later reversing across most pairs. The EUR/USD remained roughly stable at about 1.0775, dipping to a low of 1.0732. The GBP/USD stayed consistent from Friday morning at around 1.2600, with a low of 1.2551. The USD/JPY climbed to 150.65 following the data release, eventually gaining 25 pips to close at 150.20.

January's US producer price indexes came in stronger than anticipated, with a 0.3% month-over-month and 0.9% year-over-year increase (estimates were 0.1% and 0.6%, with a previous year-over-year figure of 1.0%). The core index, excluding food and energy, also rose more than expected, by 0.5% month-over-month and 2.0% year-over-year (estimates were for a 1.6% year-over-year increase, with a previous of 1.7%).

Inflation expectations measured in the University of Michigan's February consumer sentiment survey indicated a slight increase in the 1-year ahead forecast to 3.0% (from an estimate and previous of 2.9%), while the 5-10 year forecast remained steady at 2.9% (with an estimate of 2.8%). Consumer confidence improved to 79.6 from January's 79.0, maintaining the recovery from low levels that began in December.

Richmond Fed President Tom Barkin highlighted the importance of the recent firmer-than-expected inflation data, emphasizing the need for more evidence before considering interest rate cuts, aiming for greater confidence that inflation is moving sustainably towards the 2% target.

San Francisco Fed President Mary Daly stressed the need for determination to complete the inflation stabilization process, advocating for patience and readiness to adapt to economic changes.

Atlanta Fed President Raphael Bostic expressed optimism about the progress in controlling inflation and openness to adjusting the timing for rate cuts based on continued economic improvements.

Interest Rates:

The yield on the US 2-year treasury increased from 4.58% to 4.64%, reaching as high as 4.72% after the release of the Producer Price Index (PPI) data, while the 10-year yield climbed from 4.23% to 4.28%, peaking at 4.32%. Market expectations for the Federal Reserve's funds rate, currently at 5.375%, are to remain stable at the upcoming March meeting, with a 95% likelihood of a rate reduction by June.

Credit spreads showed mixed reactions in accordance with the overall regional market performance on Friday. The Main index tightened by a basis point to 56, marking its year-to-date narrowest margin, whereas the CDX index widened by a basis point to 53, still near its recent lows. Activity in the US investment-grade (IG) cash market was relatively unchanged, and primary market activity was subdued.

Commodities:

Crude oil markets reached their highest closing levels of the year amid tensions in the Middle East, with a warning from the leader of Hezbollah that their rockets could reach "anywhere" in Israel. The March West Texas Intermediate (WTI) contract saw a 1.5% increase to close at $79.19, while the April Brent contract rose by 0.74% to $83.47. Energy Aspects suggested that OPEC+ might extend its production cuts into the second quarter, citing strong physical market conditions. OPEC+ is scheduled to meet next on April 3. Bloomberg highlighted that Russia nearly met its voluntary cut targets in January, with Iraq and Kazakhstan also committing to their production targets.

US natural gas prices have dropped to near three-decade lows due to a combination of record warmth this winter reducing demand and record-high production levels. The March Henry Hub contract fell 13% last week to close at $1.61/MMBtu, marking the lowest price point for a month-ahead contract since 1995, excluding a few days in mid-2020. Goldman Sachs warned of a potential glut in the LNG market from 2025 due to a significant increase in liquefaction capacity, which could pressure prices and presents a compelling investment opportunity.

Metals markets experienced a rebound on Friday, driven by the return of China to the market and optimism for a demand recovery. Copper prices jumped 1.9% to $8,472. Guinea is considering a carbon tax on mining operations to offset emissions and vegetation removal costs, highlighting its position as a leading bauxite producer. Zinc stockpiles at the London Metal Exchange (LME) increased for the eighth consecutive day, the longest streak of gains since 2015. Australia added nickel to its Critical Mineral List, facilitating access to funding for domestic miners in response to competition from Indonesia, which now accounts for over half of the global nickel supply.

Iron ore markets also saw a positive shift with the return of China, with the Singapore Exchange (SGX) iron ore contract up 90 cents to $130.60, and the 62% Mysteel index rising $4.35 during the Lunar New Year holiday to $130.95.

Investment Tip of The Day

Consider leveraging the expertise of financial advisors for personalized wealth management strategies. These professionals can provide tailored advice based on your financial situation, goals, and risk tolerance, offering insights that DIY investing might miss. This can enhance decision-making and optimize your financial plan's effectiveness.