Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

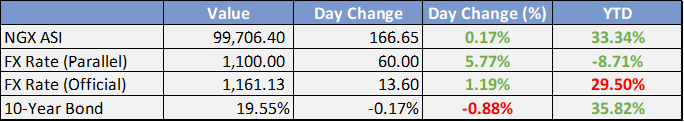

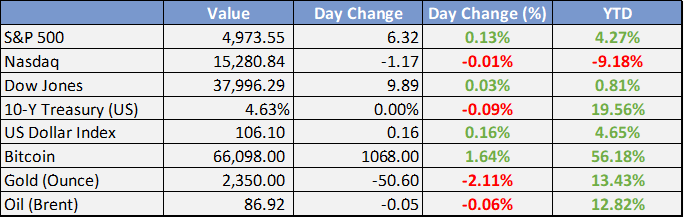

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

Global

Market Commentary:

Currencies/Macro:

During Asia-Pacific trading on Friday, reports of an Israeli strike on Iran caused US 10-year yields to drop over 10 basis points and US equity futures to decline by around 2%.

Initial market reactions were influenced by fears of an escalation in the Middle East, but as details emerged that key Iranian nuclear facilities remained intact and Iranian officials downplayed the event, markets stabilized.

The US dollar index ended the day unchanged. The EUR rose from 1.0630 to 1.0677 before settling at 1.0657, while USD/JPY increased from 154.40 to 154.65, reversing earlier safe haven flows.

FOMC member Goolsbee expressed concern that progress on inflation has stalled in 2024, noting that three months of consistent data cannot be ignored despite the noisy nature of inflation indicators.

ECB President Lagarde highlighted that risks to inflation are balanced with potential upside risks from geopolitical tensions and stronger-than-expected wage and profit growth, and downside risks from stronger-than-anticipated impacts of monetary policy and worsening global economic conditions.

Interest Rates:

The US 2-year Treasury yield increased from 4.94% to 4.99%, and the 10-year Treasury yield rose from 4.55% to 4.62%.

Markets are currently pricing a 85% chance of a Federal Reserve rate cut by September, with the Fed funds rate holding steady at 5.375% (mid) for the next meeting on May 2.

Cash bond spreads were stable, and the early market volatility prevented any new bond issuances on Friday.

The majority of last week's $31.5 billion in investment-grade supply came from the financial sector, with major contributions from Wells Fargo, Goldman Sachs, Morgan Stanley, and JPMorgan, totaling approximately $26 billion.

This week is expected to bring a more varied issuance landscape as more regional banks and corporates exit earnings blackout periods and enter the funding market.

Commodities:

Brent crude initially surged above $90 following an Israeli strike on Iran but retreated after Iranian media downplayed the incident, resulting in only modest price gains.

The May WTI contract closed up 0.5% at $83.14, and the June Brent contract ended up 0.21% at $87.29.

Iranian media reported explosions near Isfahan, close to some nuclear facilities, but also indicated that Iran had no immediate plans for retaliation.

Market sentiment was influenced by the assumption that the moderate nature of the attack and Iran's dismissive responses would prevent an escalation into full-blown conflict.

Diesel markets showed signs of weakening, with heating oil and gasoil contracts in the US, Europe, and Asia flipping into contango and reaching lows not seen since late January.

Russian diesel exports dropped significantly, with Kpler data showing a 25% decrease in shipments in the first ten days of April compared to the average of the past five years.

Chevron, Exxon, and Total are scheduled to report their Q1 earnings this week.

The World Energy Congress is set to begin in Rotterdam on Monday.

Investment Tip of The Day

Consider incorporating hedging strategies, such as options or futures, to protect your investments against adverse movements in the market. These financial instruments can help manage risk by setting a floor for potential losses while still allowing participation in potential gains. Hedging can be particularly useful in uncertain or volatile markets, providing a measure of security and helping to preserve capital.