Money Monday

Ranora Daily - Your daily source for reliable market analysis and news.

Market Data

Local

Global

*Data as of 4pm WAT

Market News

Local

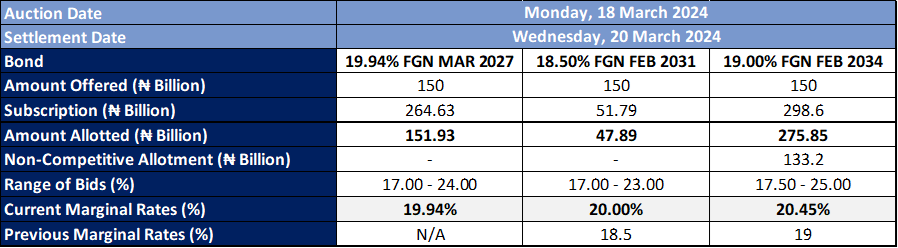

The result of the March 2024 FGN Bond auction is as follows:

MainONE partially restores service to customer from under sea cable

FG’s Sugar Master Plan phase II, requires $3.5bn investments

Global

Market Commentary:

Currencies/Macro:

The US dollar remained steady or strengthened against the currencies of the G10 group on Friday. The Euro was the standout performer, maintaining its position around 1.0890. The GBP/USD saw a slight decline to 1.2735. Meanwhile, the USD/JPY experienced a 0.5% increase, reaching 149.10, as it moved in tandem with higher Treasury yields.

In the US, February import prices aligned with expectations at a 0.3% month-over-month increase, while the figure excluding petroleum was slightly higher at 0.2%, against an anticipated -0.2%. Export prices exhibited a 0.8% monthly rise, exceeding the forecasted 0.4% increase. The industrial production index edged up by 0.1% month-over-month, surpassing the flat growth expectation, despite a downward revision for the previous month. The University of Michigan's March consumer sentiment index dropped to 76.5, slightly below the predicted 77.1, with no change in inflation expectations: the one-year outlook remains at 3.0%, and the five-year at 2.9%. Additionally, the New York Federal Reserve's Empire State manufacturing survey indicated a sharper contraction than expected, descending to -20.9 in March from a prior -2.4.

In Europe, various European Central Bank (ECB) officials, including Chief Economist Philip Lane, emphasized the necessity for additional data to inform their monetary policy decisions, suggesting that June would be a more opportune time for assessing the potential for an interest rate adjustment.

Interest Rates:

The US 2-year Treasury yield increased from 4.68% to 4.73%, and the 10-year yield rose from 4.28% to 4.31%. Market projections indicate that the Federal Reserve's funds rate, currently at 5.375%, is likely to remain constant at the upcoming meeting this week, with a 55% probability of a rate reduction by June.

In the credit market, indices weakened at the week's close, with the Main index widening by a basis point to 53.5 and the CDX index broadening by half a basis point to 50. U.S. investment-grade (IG) cash credit softened by 1-2 basis points, with a noticeable deceleration in primary market activity as the week concluded. In Europe, only three issuers, all banks, came to market, raising a total of EUR 1.55 billion. There were no new issuances in the US to finish the week, but the market has witnessed approximately USD 89 billion in issuance for March, with an additional USD 30 billion anticipated in the upcoming week.

Commodities:

Last week, crude oil markets reached nearly 5-month highs driven by a series of influential factors. Earlier in the month, OPEC+ announced the extension of its production cuts, which, alongside the International Energy Agency (IEA) revising its annual forecast from a surplus to a slight deficit and the U.S. Energy Information Administration (EIA) reporting a decrease in crude inventories for the first time since January, underpinned the price surge. Additional upward pressure came from continued drone attacks on Russian refineries and storage, notably impacting the Ryazan and Norsi refineries, which Wood Mackenzie estimated to affect approximately 40-50 thousand barrels per day (kbpd) of Russian gasoil/diesel output and around 60 kbpd of capacity at the Norsi refinery. Despite these facilities not being completely offline, the net impact was estimated to be around 50 kbpd. Wood Mackenzie also highlighted that the recent drone attacks on Russia's refinery system could have a more significant effect. In response, the April gasoline contract escalated by 7.7% last week, reaching its highest point since September. Additionally, the U.S. sanctioned another tanker involved in transporting Iranian oil, impacting global supply chains.

In the metals market, copper stood out with a notable increase of 2.1% on Friday alone, culminating in a 5.7% weekly gain and reaching a new peak since April of the previous year at $9,074. This rise occurred despite a significant surge in copper inventory levels in Shanghai, reaching their highest since February 2020. The China Nonferrous Metals Industry Association announced measures to manage capacity, including adjusted maintenance, reduced operational runs, and project delays, although it refrained from instituting direct production cuts. Rusal reported that nearly a quarter of its revenue in the previous year came from China, where aluminium prices exceeded global averages, marking a substantial increase from 8% the year before to 23% in 2023. Meanwhile, BHP made significant workforce reductions at its West Musgrave nickel and copper project in Western Australia due to financial strains, further indicating a drop in nickel prices that led to a A$2.5 billion impairment charge on its Australian nickel assets.

Investment Tip of The Day

Practice behavioral finance awareness by understanding and mitigating cognitive biases that can affect your investment decisions, such as overconfidence or herd mentality. Being aware of these biases can help you make more rational, objective decisions, reducing the likelihood of costly investment mistakes and improving your overall financial well-being.